Research Germany Sector Reports (Part 3)

The chemical industry in Germany: turnover, statistics, background

With sales of around € 203 billion in 2018, the German chemical industry is the fourth largest in the world after the USA, China and Japan and the largest in Europe. German chemical companies such as BASF and Bayer are among the world’s most important players [1]. As a producer of intermediate goods, the chemical industry is indispensable for the German industrial landscape and also globally, because Germany is the country with the strongest exports in the chemical sector. In addition to this high significance, the industry is also one of the most research-intensive sectors in Germany – over 10 billion euros are spent on research and development every year [2]. With over 300,000 employees (2016), the chemical industry is also the fifth largest employer in Germany [3]. The following sector report provides detailed insights into areas of activity and innovations in the chemical industry, the most important locations, key financial figures and insights into the gender ratio and efforts in the area of sustainability.

1) Fields of activity of the German chemical industry: What is produced?

The chemical industry is very broad and diverse. For this reason, it is not possible to distinguish exactly between segments within the chemical industry. Nevertheless, the following areas can be identified, under which most of the products manufactured fall [4]. In the following we will introduce you to the 6 largest segments:

- Fine and speciality chemicals (~26% of total production)

- Pharmaceutical industry (~22% of total production)

- Polymers (~19% of total production)

- Petrochemicals and derivatives (~16% of total production)

- Inorganic basic chemicals (~8% of total production)

- Laundry and personal care products (~7% of total production)

- Refinement (~2%)

In order to provide a more detailed overview of the chemical industry, these segments are presented and examined in more detail below. A detailed directory of German chemical companies and their segments is provided by our List of the 600 largest chemical companies in Germany.

Fine and speciality chemicals

The specialty chemicals segment is characterised by – as the name suggests – the production of special chemical substances. This segment is subject to high research and innovation pressure, as this is the only way they can survive in the market. In addition to active pharmaceutical ingredients, specialty chemical products also include so-called fine chemicals. Fine chemicals are pure chemical substances – there is no clearly defined definition, but fine chemicals can usually only be produced by complex syntheses. Accordingly, only small quantities are usually produced. Quality, not quantity, is particularly important: fine chemicals must have a guaranteed degree of purity. Examples of fine chemicals are food additives such as minerals or vitamins, but also raw materials for pharmaceutical products. The production of speciality chemicals is very costly and complicated because mass production is not possible – but the selling prices are correspondingly high [5]. The German market leader in speciality chemicals is the Lanxess Deutschland GmbH, which develops, manufactures and distributes chemical intermediates, additives, speciality chemicals and plastics.

Image Source: Merck KGaA

Pharmaceutical industry

The pharmaceutical industry in Germany is highly diversified and has a wide range of products in human and veterinary medicine. In 2019, the pharmaceutical industry in Germany generated almost €50 billion [6]. A distinction is made between research-based and non-research-based pharmaceutical companies, with the (larger) research-based companies being represented by the VFA. The majority of its members are based in North Rhine-Westphalia, although in terms of the number of employees (with over 20,000 employees) the sector is largest in Baden-Württemberg [7]. The segment is also characterised by medium-sized companies – over 75% of the companies have fewer than 250 employees [8]. The top-selling pharmaceutical company in Germany is the McKesson Europe AG with sales of over €20 million in 2018.

Image Source: McKesson Europe AG

Polymers

Polymers

Another segment of the chemical industry is the polymer sector. As described above, the chemical industry is mainly a pre-producer. The polymers produced are then used in the plastics industry mainly for packaging or in the construction, automotive and electronics industries [9]. One of the best-known German chemical companies, the BASF SE is one of the leading manufacturers of polymers and additives. In addition to polyamide, SE also produces a wide range of intermediates. The Covestro AG is the market leader in Germany for polymers and offers solutions for a wide range of areas: automotive, construction, electronics, foams, healthcare and plastics. Covestro AG is among the top 10 German chemical companies and had a turnover of around 15 million euros in 2018.

Image Source: BASF SE

Petrochemicals and derivatives

Petrochemicals and derivatives

Petrochemistry describes the chemistry of rock and stone oils – actually petrochemistry. The segment deals with the synthesis of hydrocarbon compounds from components of crude oil and natural gas. These processes are then used to produce fuels or (intermediate) products for the manufacture of plastics, for example [10]. The best-known German manufacturer is the BP Europa SE, which mainly processes raw materials at refineries in Gelsenkirchen. According to its own information, SE is one of the largest producers in Europe with the production of its two main products ethylene and propylene in Gelsenkirchen. There, crude oil-based raw materials are processed into basic materials that are used on a daily basis – in addition to products for plastics production, for example, components for detergents and cleaning agents or intermediate products for pharmaceuticals. BP Europa SE produces a total of ~3 million tonnes of petrochemicals such as ethylene, propylene or benzene.

Image Source: BP Europa SE

Inorganic basic chemicals

Inorganic chemistry deals with the structure and properties of carbon-free compounds – with the exception of some simple carbon compounds. These include chemicals such as acids and bases, metals, salts and minerals. The most important/most commonly produced inorganic basic chemicals in Germany are chlorine, hydrogen, oxygen, hydrochloric acid, sulphuric acid and sodium hydroxide [12]. The Linde AG is one of the world’s leading producers of industrial gases and, overall, is among the top 30 chemical companies in Germany as a whole (measured by sales figures). In 2019 the company, which is based in Munich, will have annual sales of around €2 billion.

Image Source: Linde plc

Innovations, trends and growth drivers in the industry

The German chemical industry has a unique value due to its special status as a producer and supplier of raw materials for other industries. This value is also reflected in the German invention of chemical parks, where production can be made highly efficient through synergy and compound effects. Production is not only efficient, but also qualitative – chemical products “Made in Germany” enjoy a high international reputation. In addition, the industry is highly innovative – every fifth patent comes from the chemical industry. With regard to the development of the German chemical industry, it is clear that the highest growth potential lies in the pharmaceutical sector – the ageing society, an increase in civilisation diseases (diabetes, high blood pressure, etc.) and cancer and heart disease are leading to an ever-increasing demand. It is also interesting to look at the industry’s energy consumption – it is very high: about 1/5 of the energy demand of the processed industry is accounted for by the chemical industry. Over the last few years, the production value has increased by 1.5%, while energy consumption has actually decreased – the industry is therefore becoming more and more energy efficient. In a few decades the chemical industry will be facing a major upheaval: one of the three raw material bases, fossil raw materials, account for ~15% of the raw material total. By 2030, this share will increase to about 20%; instead, more and more renewable raw materials will be used. The petrochemical industry in particular is facing a challenge in this respect. A good example of a positive change is the Finnish mineral oil and Biofuel oil producer Neste. The company offers various renewable solutions, including the patented Neste MY Renewable product Diesel™, a diesel fuel made from 100% renewable resources [13].

The German chemical industry has a unique value due to its special status as a producer and supplier of raw materials for other industries. This value is also reflected in the German invention of chemical parks, where production can be made highly efficient through synergy and compound effects. Production is not only efficient, but also qualitative – chemical products “Made in Germany” enjoy a high international reputation. In addition, the industry is highly innovative – every fifth patent comes from the chemical industry. With regard to the development of the German chemical industry, it is clear that the highest growth potential lies in the pharmaceutical sector – the ageing society, an increase in civilisation diseases (diabetes, high blood pressure, etc.) and cancer and heart disease are leading to an ever-increasing demand. It is also interesting to look at the industry’s energy consumption – it is very high: about 1/5 of the energy demand of the processed industry is accounted for by the chemical industry. Over the last few years, the production value has increased by 1.5%, while energy consumption has actually decreased – the industry is therefore becoming more and more energy efficient. In a few decades the chemical industry will be facing a major upheaval: one of the three raw material bases, fossil raw materials, account for ~15% of the raw material total. By 2030, this share will increase to about 20%; instead, more and more renewable raw materials will be used. The petrochemical industry in particular is facing a challenge in this respect. A good example of a positive change is the Finnish mineral oil and Biofuel oil producer Neste. The company offers various renewable solutions, including the patented Neste MY Renewable product Diesel™, a diesel fuel made from 100% renewable resources [13].

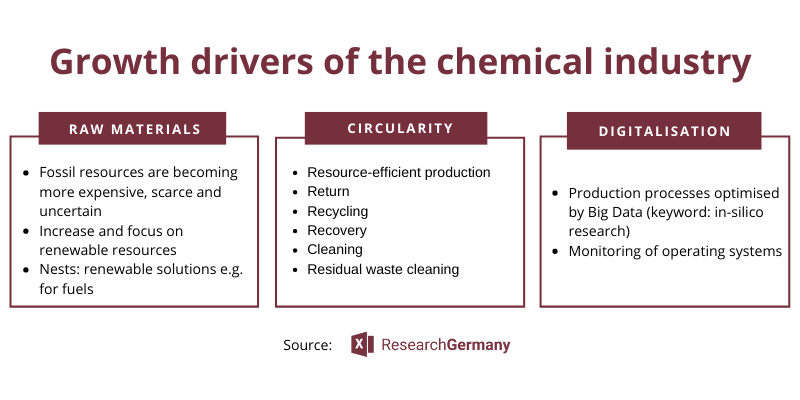

Image Source: [14]

A buzzword that is used more often in connection with innovations in the chemical industry is “Chemistry 4.0”. Chemistry 4.0 describes an industry characterised by topics of digitalisation, circular economy and sustainability. One interesting topic is the circular economy of the chemical industry – a circular economy includes not only resource-efficient and climate-friendly production but also, and above all, the return, recycling and recovery of energy and cleaning and disposal of residual materials. Safechem,a chemical company based in Düsseldorf, relies on circular economy as a business model and offers a leasing model for solvents, which has reduced the solvent content in wastewater by up to 80%. The digitalisation of the chemical industry – and thus the second important component of “Chemistry 4.0” – can be divided into three sectors: Transparency & digital processes, Data-based operating models and Digital business models. For example, through “in-silico” research, data-based operating models offer the possibility to simulate larger chemical processes or operating systems can be monitored to prevent production downtimes [14].

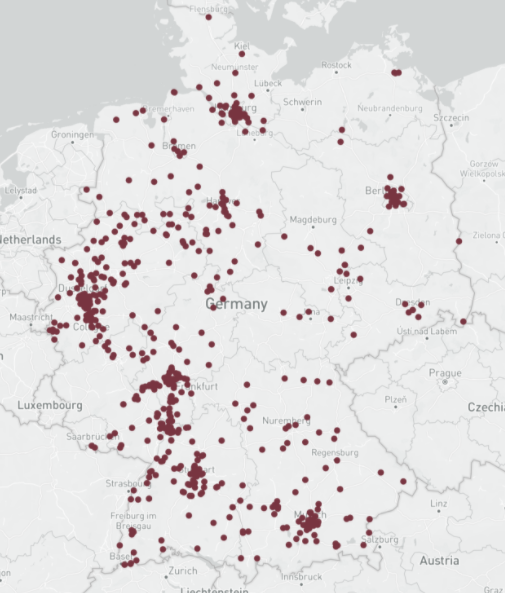

2) Map of chemical companies: Where is production?

Chemical parks in Germany and industrial location Baden-Württemberg

Chemical parks in Germany and industrial location Baden-Württemberg

The German chemical industry is characterised by medium-sized companies – over 90% of the 2,000 chemical companies have fewer than 500 employees. And these medium-sized companies are extraordinarily powerful: they generate around one third of the turnover. This is mainly due to the flexibility of medium-sized companies to implement the individual wishes and requirements for special chemicals. As a result, market leaders of niche products or hidden champions exist in many areas.

There are a total of 37 chemical parks in Germany – most of them are located in North Rhine-Westphalia or the Ruhr region where 13 of them are located. The CHEMPARK chemical park in Leverkusen shows why such chemical parks are more than useful: With more than 31,500 employees on approx. 480 hectares, more than 5,000 different chemicals can be produced within the plant. As Germany’s third largest industry, the chemicals sector generates around 11% of total industrial turnover. The chemical-pharmaceutical industry is also an indispensable employer – over 450,000 people work here [14].

The chemicals sector is also very strong in Baden-Württemberg: over 470 companies create ~107,000 jobs and generate a turnover of almost €40 billion. In the field of education in particular, the state offers a wide range of opportunities for study, training or further education [15]. The McKensson Europe AG is the largest player in the region with its headquarters in Stuttgart – and among the top 5 in the chemical-pharmaceutical sector: The Pharma AG generates an annual turnover of ~21 € billion (2018) and employs over 26,000 people.

Lists matching this industry report

-

Rated 4.50 out of 5€1.499,99 Incl. VAT

-

Rated 5.00 out of 5€199,99 Incl. VAT

-

Rated 4.50 out of 5€199,99 Incl. VAT

-

Rated 5.00 out of 5€349,99 Incl. VAT

-

Rated 5.00 out of 5€2.499,99 Incl. VAT

3) Key financial figures of the chemical industry: What is the market volume?

Market volume

Companies with turnover below €1 billion (2018)

Sales development of the top 5

The figures are based on our database and can be found in the list of the top 600 chemical companies in Germany. The classification of the Top 5 companies is based on this same database and the list of the the German Chemical Industry Association.

Market volume and total sales in the German chemical industry: 2015-2018

In an international comparison, Germany ranks fourth in the global chemical-pharmaceutical industry. One of the reasons for this is its reputation as a driving force: the chemical industry is in third place in terms of (percentage) research spending in Germany, and research and development spending has been rising constantly since 2005 [16]. As shown in the graph, growth has remained more or less stable in recent years. A large proportion of turnover is generated by exports, because Germany is the most important power in the sector and is ahead of the USA and China in terms of exports (calculated in billions of euros). In 2019, the German chemical industry exported products worth 193 billion euros. The most important customer here is Europe, almost 70% of exports in 2019 were exported to European countries [17].

The graphs are based on our list of the top 600 chemical companies in Germany. Our database contains the total turnover of the companies, therefore there may be deviations from the turnover figures only in the chemical sector. As some sales figures from 2018 are not yet available, in some cases averages from 2015-2017 have been taken as provisional sales in order to prevent a distorted sales decline in the sector.

Competition analysis: What is the market structure in the chemical industry?

As already mentioned, the chemical industry in Germany is characterised by medium-sized companies – 71% of the top 600 companies in Germany have fewer than 500 employees. However, the sales distribution is relatively balanced: 67% of the companies earn less than €1 billion per year (basis: 2018), but the top 5 (BASF SE, Henkel AG & Co. KGaA, Boehringer Ingelheim GmbH, Merck KGaA and Bayer AG) earn only ~20% of total turnover – so the SME sector of the chemical-pharmaceutical industry in Germany is very strong.

Development of the German market leaders in the chemical industry

The BASF SE has a long history – the pioneer of today’s group was founded as early as 1865. In the meantime, the group has over 117,000 employees in 6 Verbund sites and 361 production sites spread all over the world – BASF is active in more than 90 countries. The BASF Group has consolidated its portfolio into six segments: Agricultural Solutions, Nutrition & Care, Surface Technologies, Industrial Solutions, Materials and Chemicals. The Chemicals segment is broadly diversified, enabling the Ludwigshafen-based SE to offer chemical products in the fields of petrochemicals, intermediates, monomers and catalysts. With an annual turnover of ~€63 billion, BASF is one of the leading companies worldwide.

The Henkel AG & Co. KGaA based in Düsseldorf is also a company with a long history – as early as 1876, the beginnig of today’s company was founded, at that time mainly a universal detergent was produced. In the meantime, the company has split into three brands: Laundry & Home Care, Beauty Care and Adhesive Technologies. Under the respective brands a wide variety of markets are served – from consumers to professionals and industry. With over 50,000 employees, Henkel is represented in more than 120 countries and has achieved international recognition.

Like the top 2 German chemical and pharmaceutical companies, Merck KGaA has a long history. Merck is even considered to be the oldest pharmaceutical company in the world, as its beginnings date back to 1668. In America and Canada, Merck operates under the name EMD (Emanuel Merck, Darmstadt), as the rights to the name belong to the US pharmaceutical group Merck & Co, Inc. which also goes back to its founder Emanuel Merck. With over 57,000 employees, Merck is active in 66 countries in the healthcare, life science and performance materials sectors. The sales figures of the Darmstadt based company have remained relatively constant at ~15 billion € over the last years.

The Bayer AG is a divisional company consisting of a total of 392 companies (as at the end of 2019). The 420 companies are spread across 87 countries, with the main site in Leverkusen. The core of the AG is the chemical-pharmaceutical industry and the following three segments: Pharmaceuticals, Consumer Health and Crop Science. Within these segments, Bayer AG is in some cases the market leader, for example in the case of non-prescription pharmaceutical products within the Pharmaceuticals division. Bayer AG has relatively few employees compared to the other top 5, around 17,000, but has a comparatively strong turnover, which has developed to almost €15 billion by 2018.

The Boehringer Ingelheim GmbH is a pharmaceutical company with – as the name suggests – headquarters in Ingelheim am Rhein. The GmbH has a research focus and conducts research at 12 research centres distributed around the world. The GmbH spends ~20% of its turnover on research and development each year. In total, Boehringer Ingelheim is distributed in 29 countries and locations, which are also divided into animal or human pharmaceuticals. In recent years, the company has steadily increased its sales – sales in 2017 were over €18 billion (for the 2018 value, the average value for 2015-2017 was taken). The GmbH employs ~50,000 people worldwide.

4) Gender balance and sustainability

Share of women on management boards

Gender distribution in the chemical industry

Compared to other industries in Germany, the proportion of women on board of directors in the chemical industry is relatively high, at 15% – in the top 5 companies (BASF SE, Henkel AG & Co. KGaA, Boehringer Ingelheim GmbH, Merck KGaA and Bayer AG) there is always exactly one woman on the board – this makes 4 female board members to 27 male ones.

The data for the graphics and text are taken from our database and refer exclusively to the (managing) directors.

Sustainability in the German chemical industry:

There is no getting around chemistry3 if you want to find out about sustainability in the German chemical industry. The 12 Chemical Industry Guidelines3 were formulated in 2013 and are now closely linked to the UN’s Sustainable Development Goals (SDGs). Basically, general requirements are formulated within these guidelines, such as integrating sustainability into corporate strategy (Goal 1), making contributions to sustainable development through innovation (Goal 4) or protecting people, the environment and biological diversity (Goal 8).

A good example of the integration of sustainability into corporate strategy, the first objective of the chemical industry3 , is the Umicore AG & Co. KG. The Umicore AG & Co. KG is based in Hanau and is a specialist in the above-mentioned recycling management. The company is a globally active materials and recycling group. Umicore offers tailor-made products made from production waste, residual or used materials – at Umicore, this cycle is not a by-product but its core business. In addition to its focus on recycling, the company is also committed to clean mobility and supplies automotive catalytic converters which can be recycled after use. The third division that demonstrates how strongly the company’s strategy is interwoven with sustainability is its recycling approach.

As already mentioned in the report, the chemical industry is generally very research-intensive and is striving to use this innovative power in the area of sustainability, especially with regard to Chemistry 4.0. An interesting and promising example of sustainable innovation is presented by Carbios: with the so-called “biorecycling” process involves the de-polymerisation of individual polymers (such as those found in PET bottles) by adding enzymes, which results in monomers that are purified and are now ready for polymerisation. This innovative process makes complete recycling possible for the first time and thus the endless use of plastic.

As already mentioned in the report, the chemical industry is generally very research-intensive and is striving to use this innovative power in the area of sustainability, especially with regard to Chemistry 4.0. An interesting and promising example of sustainable innovation is presented by Carbios: with the so-called “biorecycling” process involves the de-polymerisation of individual polymers (such as those found in PET bottles) by adding enzymes, which results in monomers that are purified and are now ready for polymerisation. This innovative process makes complete recycling possible for the first time and thus the endless use of plastic.

The goal of protecting people, the environment and biological diversity is a major task – especially as there are many different approaches to this. Ecover, a company whose German site is in Hamburg, starts with cleaning products. Their concept is all-encompassing – starting with the fact that Ecover uses less and less palm oil in their products, with the aim of doing without it completely in order to prevent deforestation. The concept around the detergents is also about sustainability and protection of our environment: the plastic packaging is 100% recycled, the factories use innovative methods to save waste water, local resources save CO2 in the delivery routes and the fragrances are biodegradable and therefore do not cause any damage when the products reach the sewers.

The goal of protecting people, the environment and biological diversity is a major task – especially as there are many different approaches to this. Ecover, a company whose German site is in Hamburg, starts with cleaning products. Their concept is all-encompassing – starting with the fact that Ecover uses less and less palm oil in their products, with the aim of doing without it completely in order to prevent deforestation. The concept around the detergents is also about sustainability and protection of our environment: the plastic packaging is 100% recycled, the factories use innovative methods to save waste water, local resources save CO2 in the delivery routes and the fragrances are biodegradable and therefore do not cause any damage when the products reach the sewers.

5) Statistics and facts in the chemical industry

- The chemical industry is a preliminary service provider and broadly diversified

- The three largest segments are fine and speciality chemicals, pharmaceuticals and polymers

- Germany is a driving force for innovation, also thanks to chemical parks

- Chemistry 4.0 describes an industry characterised by digitalisation, circular economy and sustainability

- North Rhine-Westphalia and Baden-Württemberg are the most important German locations for the chemical industry

- Germany is an international export leader

- The chemical industry is characterised by medium-sized companies which are very strong

- There are 15% women on the boards of directors

- Chemistry3 is a guideline for sustainability in the chemical industry

Industry reports that might also interest you:

Sources (last accessed on 30.10.2020)

Picture of the article: BASF SE

[1] https://de.statista.com/themen/1092/chemieindustrie/

[2] https://www.bmwi.de/Redaktion/DE/Artikel/Branchenfokus/Industrie/branchenfokus-chemie-pharmazie.html

[3] https://www.boeckler.de/pdf/p_study_hbs_395.pdf

[5] https://www.chemie.de/lexikon/Spezialchemie.html

[6] https://de.statista.com/themen/1415/pharmaindustrie-in-deutschland/

[8] https://www.gesundheitsindustrie-bw.de/standort/pharma

[9] https://de.statista.com/themen/3094/kunststoffindustrie-in-deutschland/

[10] https://www.chemie.de/lexikon/Petrochemie.html

[11] https://www.marquard-bahls.com/de/news-info/glossar/detail/term/anorganische-chemikalien.html#:~:text=Zu den anorganischen Chemikalien zählen,%2C Metalle%2C Salze und Mineralien.

[12] https://www.vci.de/vci/downloads-vci/publikation/chemiewirtschaft-in-zahlen-print.pdf

[16] https://www.vci.de/ergaenzende-downloads/forschung-und-entwicklung-chemie-kurz.pdf

[17] https://www.vci.de/ergaenzende-downloads/chemiemaerkte-weltweit-folien-teil-1.pdf

Iconsources (last accessed on 30.10.2020):

- Recycling https://www.flaticon.com/de/autoren/freepik

- Innovation https://www.flaticon.com/authors/freepik

- Environment https://www.flaticon.com/authors/darius-dan