Description

List of 5 real estate investors in Switzerland

To give you a better view of our list, we briefly introduce three companies that are included in our address database of the largest Swiss real estate buyers.

1. Swiss Prime Site Immobilien AG (Geneva)

One of the most active Swiss real estate investors is Swiss Prime Site Immobilien. The focus of the Geneva-based investor is on investments in primarily commercially used properties. The portfolio value of Swiss Prime Site is around CHF 12 billion. The investment focus is on commercial buildings and mixed-use properties with appreciation potential. In addition, building land and sites are acquired. Investments are made from a minimum size of CHF 10 million. Portfolio properties of SPS are spread all over Switzerland. An exemplary property is the Prime Tower in Zurich with a height of over 126 meters.

Update 2022: Swiss real estate investor SPS achieved good leasing successes in the first half of 2022. Thus, more than 90,000 sqm were newly leased or re-leased.

2. Swiss Life Asset Management AG (Zurich)

Swiss Life is the largest Swiss life insurer and emerged from Schweizerische Lebensversicherungs- und Rentenanstalt. It has its own fund company, Swiss Life Asset Management AG, which also invests in real estate through its Swiss Life Asset Management Real Estate division. In this sense, the fund company is active in Switzerland, Germany, Luxembourg, France and the UK. Money is invested in office and commercial real estate as well as residential properties. The value of the real estate portfolio amounts to around CHF 54 billion. The company is also active in real estate management. Here, the assets under management amount to around 29 billion euros.

Update 2023: With its transactions in 2022, Swiss Life Asset Management underscored its weighty role as a real estate investor in Switzerland and Europe. For example, the Volt Air property in Berlin and the prestigious 86 Boulevard Haussman in Paris were acquired in cooperation with Norges Bank.

3. UBS Real Estate Switzerland (Basel, Zurich, Lausanne)

UBS is another major Swiss bank and one of the largest asset managers in the world. The bank’s fund business takes place under the umbrella of UBS Asset Management. This also includes UBS Real Estate Switzerland. In keeping with its name, it invests exclusively in properties in Switzerland, with a focus on German-speaking Switzerland. The business area has a long tradition and can look back on a 75-year history. The real estate portfolio consists of residential, office and commercial properties and comprises around 1,100 properties with a market value of approximately CHF 25 billion.

Update 2024: The UBS fund Euroinvest is focusing on a greater mix of locations and is also buying new RE asset classes as part of this. Residential and logistics in particular are moving into focus here.

4. Pensionskasse des Bundes PUBLICA (Berne)

PUBLICA is a public-law pension fund based in Berne. PUBLICA is currently organized in 19 pension funds and serves 66,000 insured persons and 42,000 pensioners. With total assets of CHF 42.5 million, the pension fund is one of the largest Swiss pension funds. PUBLICA currently owns 75 properties in the residential, office and retail sectors, all located in Switzerland. The focus is on city centres and easily accessible agglomeration communities.

5. Swiss Estates AG (Freienbach)

Swiss Estates AG, based in Freienbach, invests in high quality real estate in several cantons in Switzerland. The company is focused on residential real estate with long-term growth prospects. Swiss Estates invests in properties with at least 20 residential units, which are held and developed for the long term according to the “buy and develop” strategy. The company buys properties in urban areas in Switzerland with a value of CHF 10 million or more. An exemplary investment is L’Orée du Parc in the canton of Vaud with a value of approximately CHF 29 million.

These investor types are included in the list:

- Investment managers

- Real estate companies

- Project developers with portfolio acquisition

- Private equity investors

- REITs

- Pension funds

- Foundations

These property types are purchased:

- Residential real estate

- Office properties

- Retail real estate

- Logistics real estate

- Light industrial real estate

- Hotel real estate

- Data center

- Parking garages

- Nursing homes

Investors in the list are interested in:

- Core Real Estate

- Value add real estate

- Sales-and-Leaseback

- Trophy real estate

- Distressed Assets

- Project developments and forward deals

- Debt investments

Included columns in our directory

- Company data (name, legal form, country of origin)

- Contact details (address, URL, e-mail, telephone number, management)

- Form of address of the management suitable for serial letters (e.g. “Dear Dr. Müller”)

- Investor type (investment manager, REIT, pension fund, private equity, etc.)

- Investment focus (asset classes, ranking from A to E, (global) investment volume / assets under management, detailed geographical focus)

- Special investment focus (debt, parking, forward deals, etc.)

- Link to the acquisition profile of the companies and contact details of an acquisition manager (if indicated on the investors’ website)

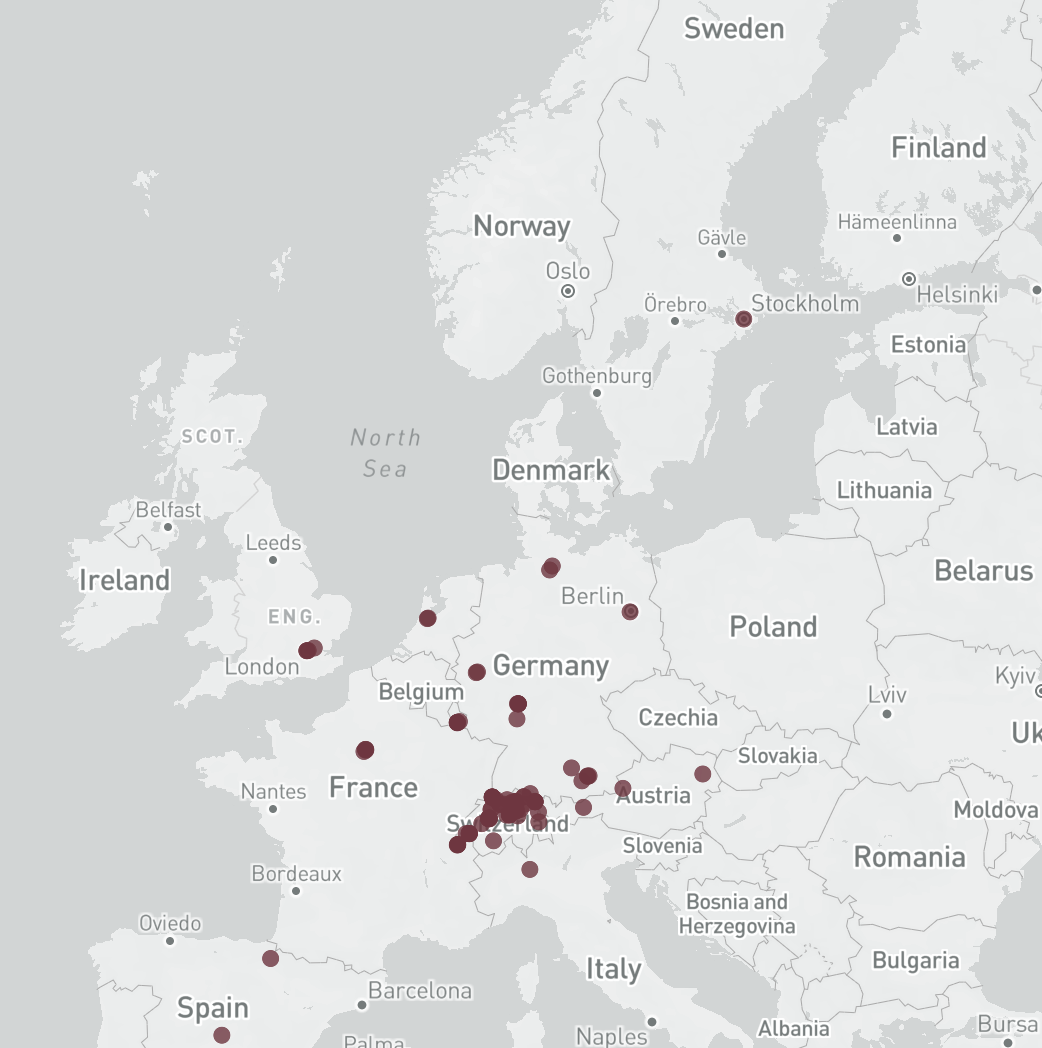

Where are the investors located?

Many of the real estate investors in our list of the largest real estate buyers in Switzerland are domestic. Important locations for Swiss real estate investors are major cities like Zurich, Geneva, Zug or Bern. In addition numerous foreign property investors from countries like France, UK, and Germany invest heavily in Swiss real estate.

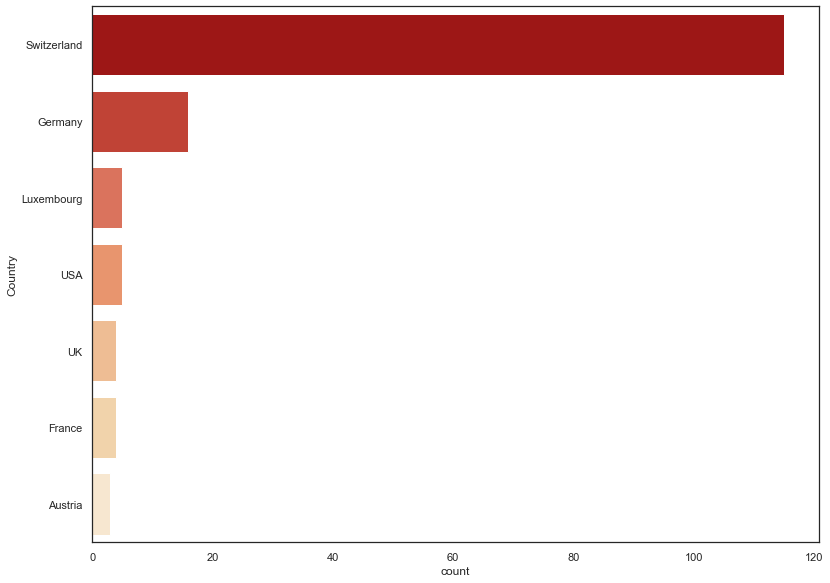

Countries of origin

Most real estate investors in Switzerland come – as expected – from Switzerland. However, numerous international investors are also active in Switzerland, for example from Germany, Luxembourg and the USA.

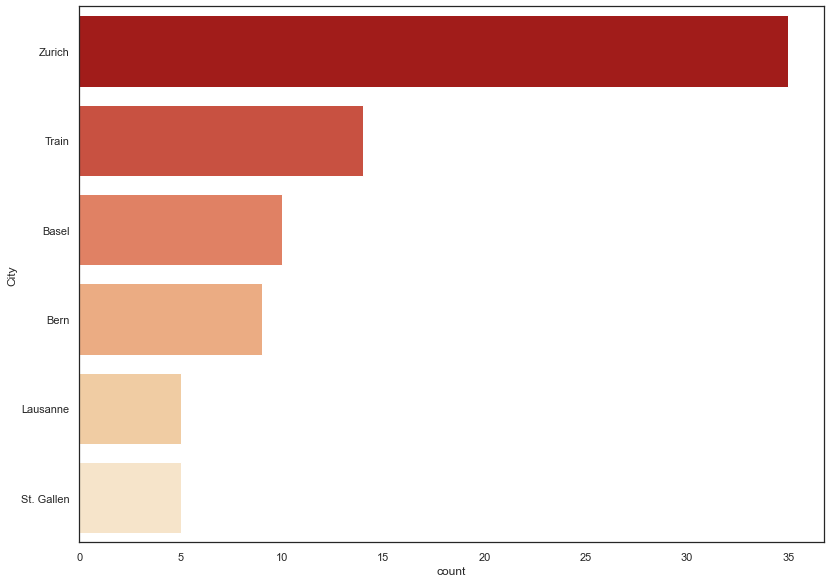

Headquarters

Most real estate investors in Switzerland are headquartered in Zurich, followed by Zug, Basel, and Bern. Some investors also come from St. Gallen and Lausanne.

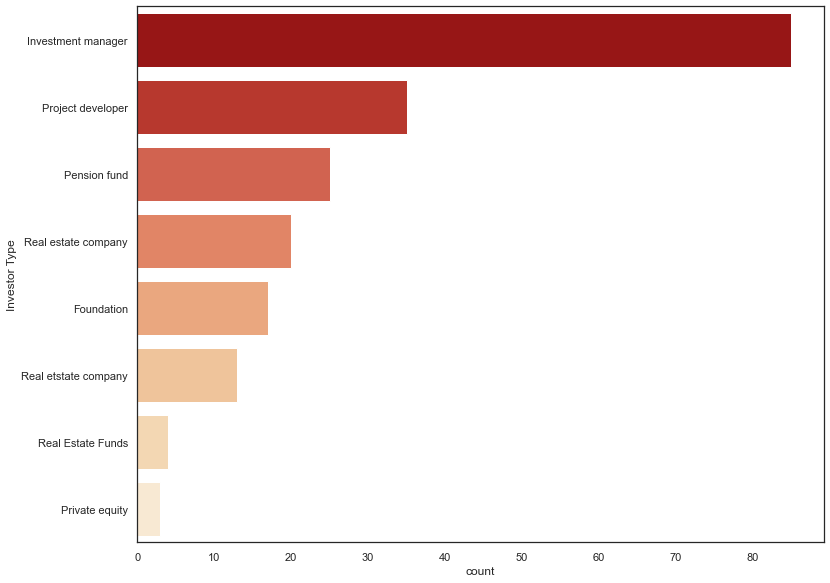

Investor types in Switzerland

Over 80 of the real estate investors active in Switzerland are categorized by us as “investment managers”. Over 30 of the real estate investors are categorized as project developers or real estate companies. In addition, numerous private equity players are active in Switzerland.

The Swiss real estate market is booming. As in other countries, low interest rates, a lack of investment alternatives and steadily rising demand are leading to a dynamic increase in real estate prices. It is becoming increasingly difficult for private individuals – even high earners – to afford a home in neighbouring Germany. Switzerland’s attractive real estate market also attracts the attention of real estate investors, who play a significant role. With our exclusive list of the top 100 Real Estate Investors in Switzerland, we offer you a comprehensive overview of the largest investors, co-investors and buyers in the Swiss real estate industry.

Players in Switzerland: from Aargau to Geneva to Zurich

Through our intensive market observation for many years we are able to offer a comprehensive overview of the largest and most important real estate investors. They come from the various cantons, other European countries and the rest of the world. Many pension funds are active in the Swiss market while institutional investors, such as funds from other countries, are particularly interested in large projects. The listed real estate investors come from Zurich, Bern, Aargau, Geneva, etc.

Perfect list to identify buyers and to generate leads

As already mentioned, our investor lists focus on two major topics: support in finding suitable property buyers and lead generation. The large number of relevant Swiss real estate investors and the many data points help to identify potential interested parties quickly and easily. Many companies also use our lists to find suitable customers in the real estate sector. Thousands of employees work for the largest investors active in Switzerland, the total assets-under-management range up to several trillion Swiss Francs.

Asset classes in Switzerland: residential, office, retail, logistics, care, light industrial, debt

The investors in our database are active in the entire spectrum of possible asset classes in the real estate sector. The most common investments are residential and office properties. The investment focus of the various companies differs greatly. Some specialize in luxury residential portfolios in Zurich’s A-locations, while others are interested in apartment buildings in B- and C-locations in more rural cantons. There are also big differences in office investments: while some investors are only interested in top buildings in large cities, others are interested in business parks and office buildings in smaller towns. Retail real estate – from supermarkets to shopping centres – is also relevant. Other asset classes shown in the list are logistics and light-industrial real estate as well as healthcare real estate such as medical centres and nursing homes.

Any questions? Get in touch!

Leo Semmelmann, Founder

contact [at] researchgermany.com

+49 (0) 89 92927741

We are looking forward to help you in case of any questions, remarks and individual requests. Feel free to get in touch via email, live chat or phone. We can also offer you package prices and can create individual lists.

Includes institutional investors, investment managers, project developers, real estate companies, REITs and pension funds that actively acquire real estate in Switzerland. This list is based on our

Includes institutional investors, investment managers, project developers, real estate companies, REITs and pension funds that actively acquire real estate in Switzerland. This list is based on our

Reviews

There are no reviews yet.