Description

List of 3 real estate investors in France

To give you a better idea of our list, we briefly introduce three companies that are included in our address database of the largest French real estate buyers. Our team deals intensively with the respective markets and analyses the most important players in detail before we prepare our lists. In this way we ensure that the most relevant companies are really included in our overviews and that you don’t acquire outdated data.

1. Amundi Real Estate (Paris) – largest asset manager in Europe

The French real estate investor Amundi Real Estate is the largest asset manager in Europe and one of the largest in the world, with approximately €1.653 billion in assets under management (2019). The internationally active real estate investor has its headquarters in Paris and offices in 37 countries. The real estate giant is engaged in a wide range of investment areas and is therefore active in the segments of residential real estate, office real estate, retail/shopping centres, light industrial and hotels/tourism.

Update 2023: Continued good business at Amundi, which recently sold the Cube 10 office complex in Hamburg to French asset manager Ofi Invest Real Estate for approximately EUR 60 million. This is roughly equivalent to 22 times the annual net rent.

2. La Française (Paris) – diversified portfolio

The real estate investor La Française states that it has 50 billion euros in assets under management. The business model is dual and the group offers financial and real estate investments. About 31% of the investor’s real estate business is international; the French headquarters is in Paris. La Française has a broad investment portfolio: in addition to residential and office properties, the investor is also interested in infrastructure and logistics investments as well as in hotel properties.

Update 2024: The real estate investor is still present on the market, albeit via secret deals. Most recently, La Français only officially communicated the purchase of the Frankfurt office building Campus 53.

3. Groupe LFPI (Paris) – regional focus in Europe

The Paris-based Groupe LFPI is internationally positioned and has offices in New York, Geneva, Vienna, Frankfurt, Milan and Luxembourg. With a clear focus on office properties, hotels and business premises, the real estate investor is very successful. Founded in 2005, the company now has over 200 buildings in its portfolio, spread across four countries: France, Germany, Austria and Italy.

Picture source: Lomig via Unsplash (22.08.2023)

These investor types are included in the list:

- Investment managers

- Real estate companies

- Project developers with portfolio acquisition

- Private equity investors

- REITs

- Pension funds

- Foundations

These property types are purchased:

- Residential real estate

- Office properties

- Retail real estate

- Logistics real estate

- Light industrial real estate

- Hotel real estate

- Data center

- Parking garages

- Nursing homes

Investors in the list are interested in:

- Core Real Estate

- Value add real estate

- Sales-and-Leaseback

- Trophy real estate

- Distressed Assets

- Project developments and forward deals

- Debt investments

Included columns in our directory

- Company data (name, legal form, country of origin)

- Contact details (address, URL, e-mail, telephone number, management)

- Form of address of the management suitable for serial letters (e.g. “Dear Dr. Müller”)

- Investor type (investment manager, REIT, pension fund, private equity, etc.)

- Investment focus (asset classes, ranking from A to E, (global) investment volume / assets under management, detailed geographical focus)

- Special investment focus (debt, parking, forward deals, etc.)

- Link to the acquisition profile of the companies and contact details of an acquisition manager (if indicated on the investors’ website)

Where are France’s investors from?

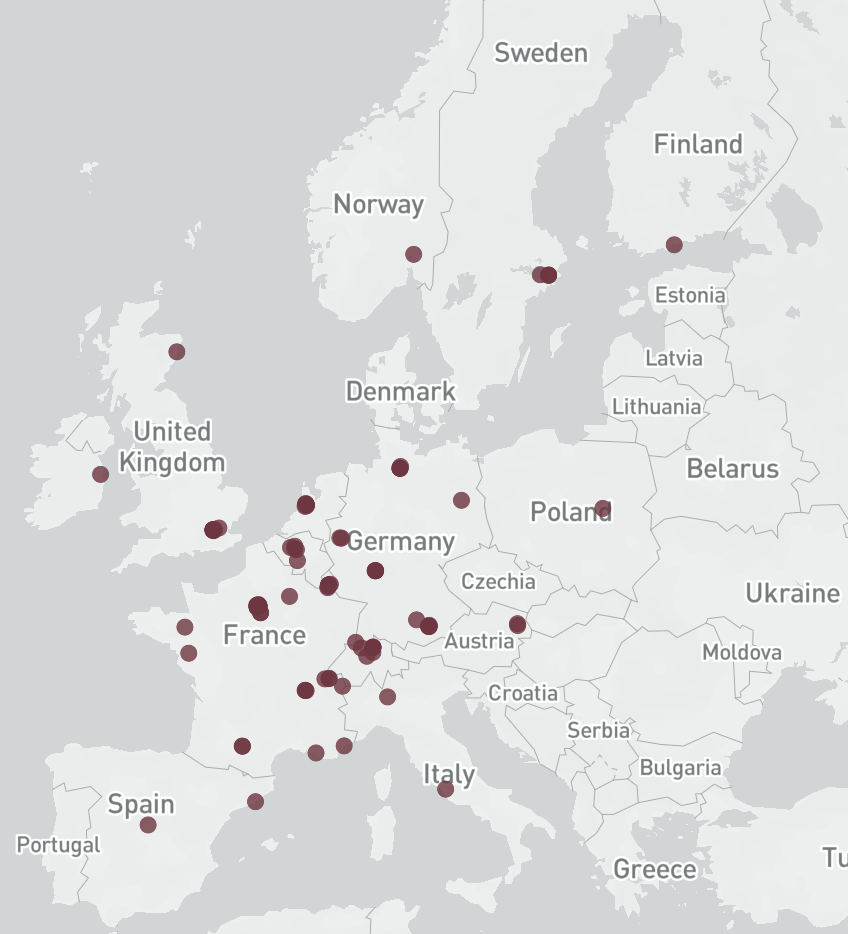

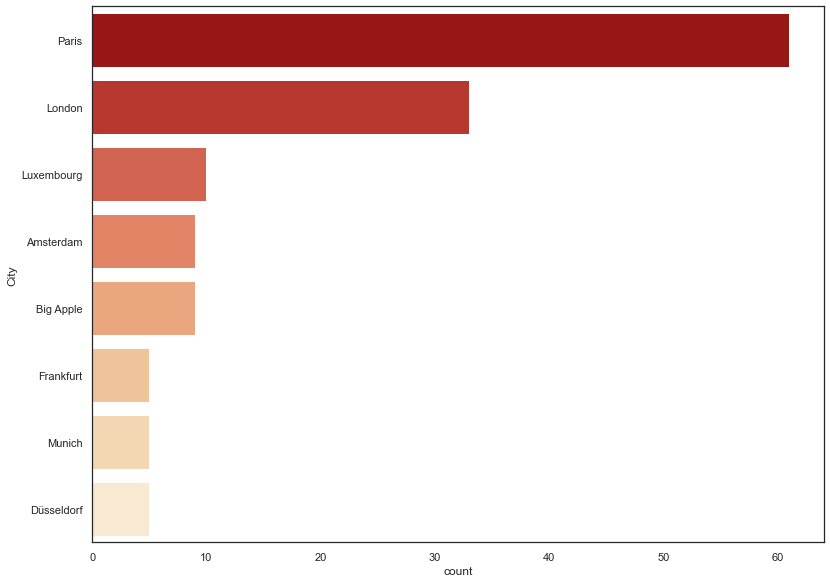

It should come as no surprise that most of France’s real estate investors are located in Île-de-France and more specifically Paris. Besides the capital many real estate investors have their headquarter in other large french cities like Marseille, Lyon and Nice. In France’s real estate market there are also foreign investors from other Countries like Germany, UK, Switzerland, and the USA.

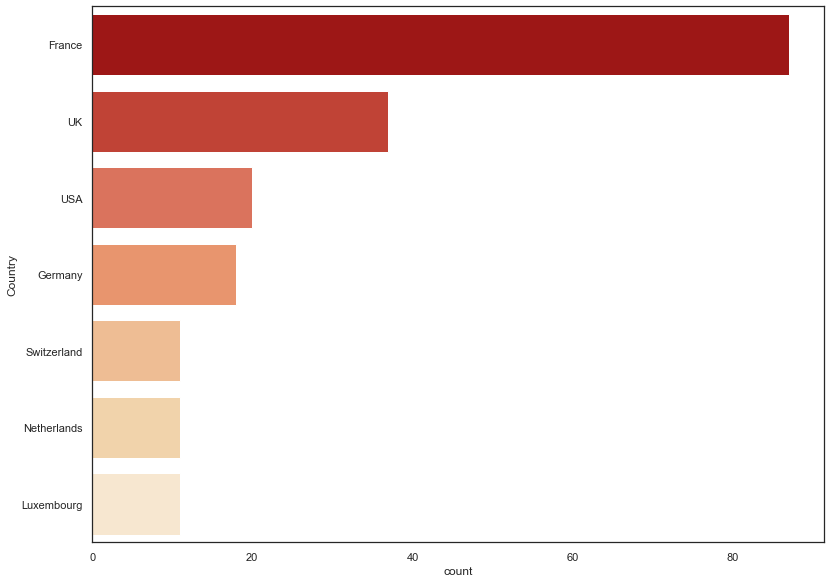

Countries of origin

Most real estate investors in France come – as expected – from France. However, numerous international investors are also active in France, for example from the United Kingdom, Switzerland, or the USA.

The largest buyers from Europe, USA and the whole world

France’s real estate market is one of the most important in Europe – especially in conurbations such as Paris, Lyon, Bordeaux or Strasbourg, the market is booming. Île-de-France is also increasingly establishing itself as the largest office property market in Europe. This market leadership naturally attracts international investors to France, so in addition to investors from the metropolis of Paris, our database also includes, for example, real estate investors from London, Frankfurt, Munich, Düsseldorf or even New York. The list includes the respective investment focus of the investors – a large part of these are mainly interested in office properties, retail & shopping centres or residential properties, but also the hotel industry, investors for light industrial or infrastructure & logistics as well as care, health & social services and also investors interested in government investments are present in sufficient numbers.

Covered asset classes in our list: residential, office, retail, logistics, care, hospitality etc.

The real estate market can be divided into different asset classes, which are characterised by very different structures and characteristics. The team of Research Germany knows that specialized investors operate in the individual segments. To help you easily identify the right real estate buyer for your project, our overview contains several columns that show all relevant asset classes. With just one click you can filter by investment companies that invest in residential real estate, office real estate, retail and shopping centers, logistics or light industrial real estate, hotels and vacation properties or care properties. The largest companies are often active in several segments, while smaller companies often focus on individual areas.

Picture sources: Unsplash(Diogo Nunes), Unsplash(Kugnharski), Unsplash(Loizeau), Unsplash(TOWNER)

Any questions? Get in touch!

Leo Semmelmann, Founder

contact [at] researchgermany.com

+49 (0) 89 92927741

We are looking forward to help you in case of any questions, remarks and individual requests. Feel free to get in touch via email, live chat or phone. We can also offer you package prices and can create individual lists.

Includes institutional investors, investment managers, project developers, real estate companies, REITs and pension funds that actively acquire real estate in France. This list is based on our

Includes institutional investors, investment managers, project developers, real estate companies, REITs and pension funds that actively acquire real estate in France. This list is based on our

Markus Keller (verified owner) –

The list contains the top investors from France. I am very happy with the product.