automotive

Continue reading

List of the 3 Largest German Automotive Suppliers for Metal Vehicle Parts – Including Revenues

Continue reading

List of the 3 Largest German Automotive Suppliers for Metal Vehicle Parts – Including Revenues

Continue reading

Continue reading

Almost every vehicle is assembled with modular design principles. The bodywork forms the skeleton, in which a large number of...

Continue reading

List of the 3 Largest German Automotive Seat Suppliers – Including Revenues

Continue reading

List of the 3 Largest German Automotive Seat Suppliers – Including Revenues

Continue reading

Continue reading

No car can go without seats. Car seats must meet special requirements. They should be ergonomic and contribute to driving...

Continue reading

List of the 3 Largest Chemical Companies in Baden-Württemberg

Continue reading

List of the 3 Largest Chemical Companies in Baden-Württemberg

Continue reading

Continue reading

Baden-Württemberg is home to around 500 chemical and pharmaceutical companies. In terms of sales, they account for 10 percent of...

Continue reading

List of the 3 Largest German Automotive Suppliers for Air Conditioning Systems – Including Revenues

Continue reading

List of the 3 Largest German Automotive Suppliers for Air Conditioning Systems – Including Revenues

Continue reading

Continue reading

Air-conditioning systems are now almost taken for granted as part of the car's equipment and are no longer limited to...

Continue reading

List of the Top 3 Automotive Suppliers in Lower Saxony

Continue reading

List of the Top 3 Automotive Suppliers in Lower Saxony

Continue reading

Continue reading

Lower Saxony is VW state. With its main plant in Wolfsburg and further plants in Braunschweig, Salzgitter and Hanover, Volkswagen...

Continue reading

List of the Top 3 Automotive Suppliers in North Rhine-Westphalia (NRW)

Continue reading

List of the Top 3 Automotive Suppliers in North Rhine-Westphalia (NRW)

Continue reading

Continue reading

North Rhine-Westphalia has always been an important location for car manufacturers and automotive suppliers. Ford in Cologne and Daimler in...

Continue reading

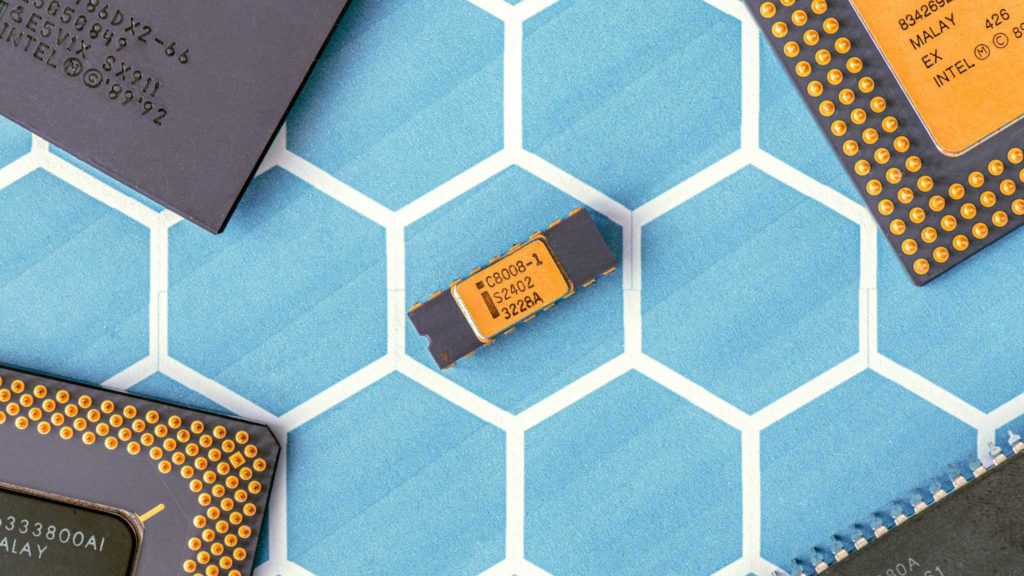

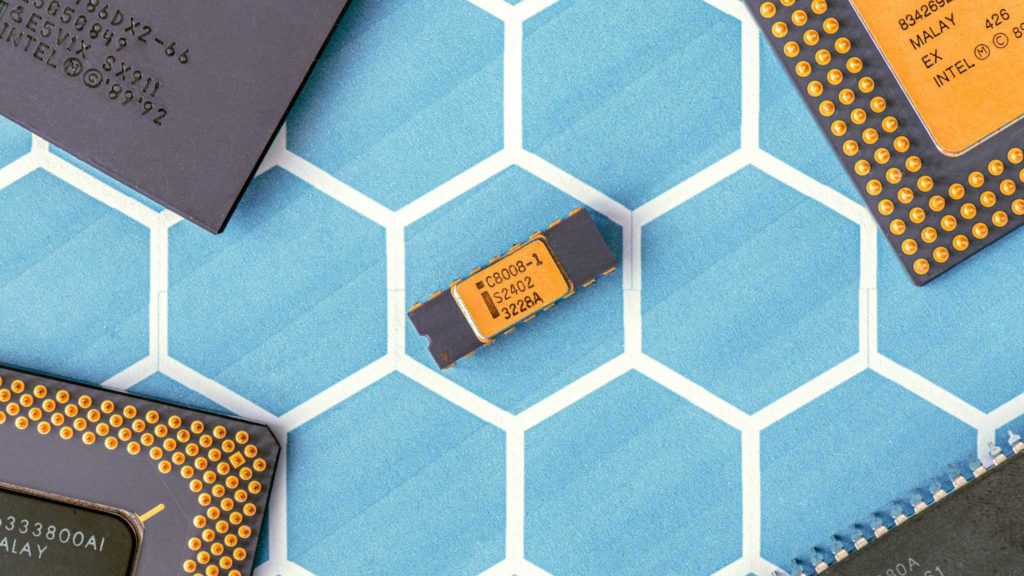

List of the Top 5 German Automotive Electronics Suppliers – Including Revenues

Continue reading

List of the Top 5 German Automotive Electronics Suppliers – Including Revenues

Continue reading

Continue reading

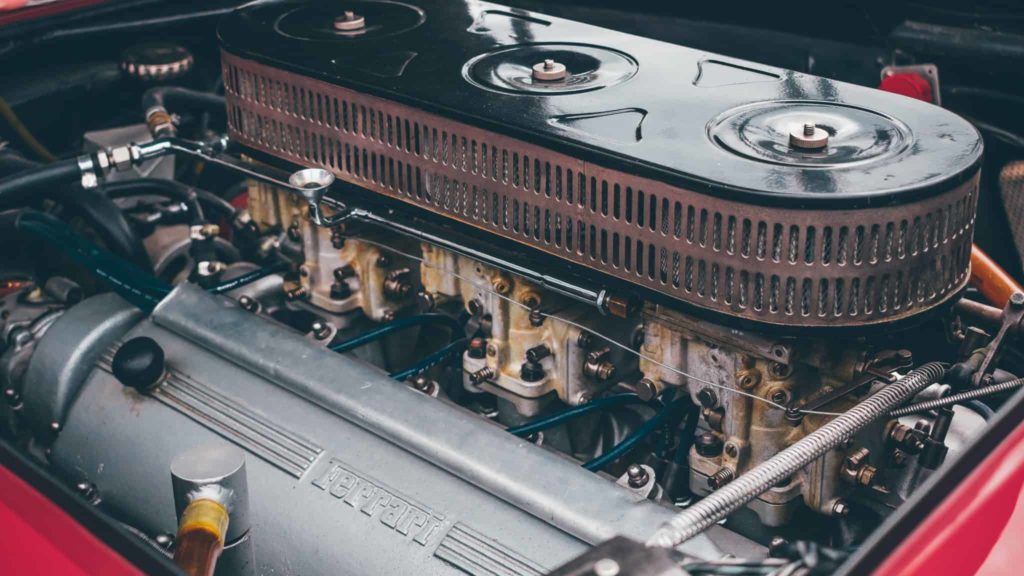

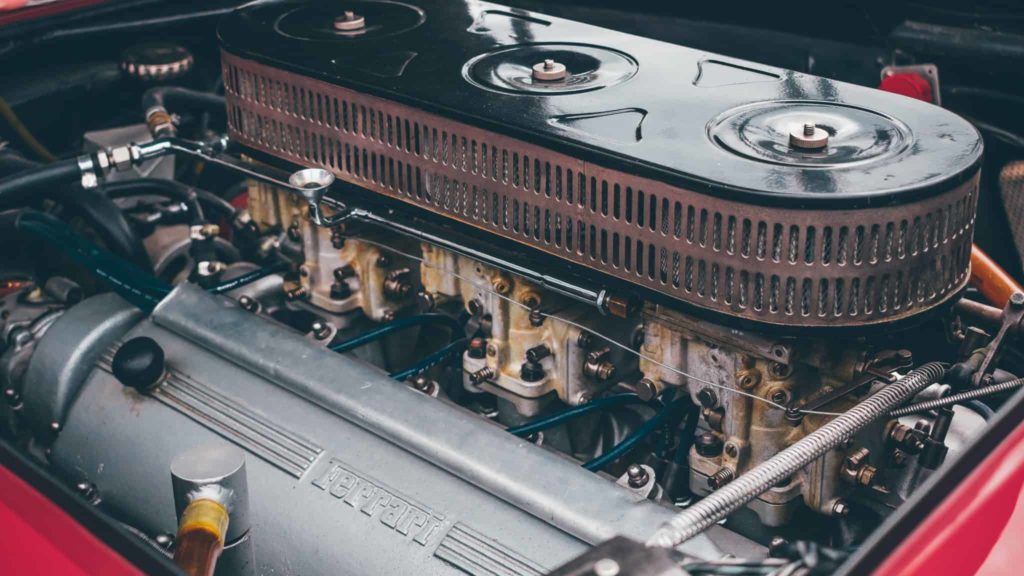

Today, electronics play an important a role in car mechanics. It is indispensable for modern vehicles. Efficient driving, driving safety,...

Continue reading

List of the Top 5 Largest Automotive Suppliers in Bavaria

Continue reading

List of the Top 5 Largest Automotive Suppliers in Bavaria

The automotive sector is very important in Bavaria. Some 500,000 people are employed in the State by the automobile manufacturing...