Description

List of 3 large real estate investors in Germany

Our research expertise goes far beyond the creation and maintenance of our databases. We deal intensively with the relevant markets and analyse the most important players in detail. To give you an impression of what kind of investors are included in the list, we present three listed companies with different sizes and with a different focus.

1. Deka Immobilien: office, retail, hotel, logistics

In our internal ranking with an A rating and over 36.3bn EUR in assets under management, Deka is one of the largest domestic property investors. More than 500 properties worldwide are managed from the headquarter in Frankfurt. Last year, the transaction volume from the property arm of the Sparkassengruppe amounted to 4.5bn EUR. The company invests in properties from 30m EUR. Office properties, retail properties, hotels and logistics properties are purchased. It is also important to Deka that the properties are energy efficient and sustainable.

Update 2022: Deka assets under management now exceed 51 billion euros. The German real estate investor continues to be an active buyer in Germany and abroad: for example, the Google Campus in Seatte was acquired in February 2022 for 718 million euros.

Update 2023: German real estate investor Deka underscored its global activity last year. Thus, at the end of 2022, numerous properties of Booking.com, including the company headquarters in Amsterdam, were acquired for over 566 million euros.

2. Quantum: residential, office, retail, parking, logistics

Hamburg-based Quantum is another active real estate investor and project developer on the German market.Its portfolio includes, for example, the Ludwigspalais in Munich with over 19,900sqm of rental space. Another property is the Adlerwerke in Frankfurt am Main, which was acquired in a club deal in 2016 and has over 78,000sqm of space.The assets under management in the investment management exceed 10 billion euros.

Update 2022: Quantum remains an extremely active investor: for example, the JAZZ urban quarter in Hamburg’s Hafencity was acquired from Patrizia with over 200 residential units.

Update 2023: Earlier this year, Quantum released its figures for the past year. Real estate assets under management rose above 11 billion euros. Most of the acquisitions took place in the residential and healthcare asset classes. For example, the “Jazz” urban quarter in Hamburg was acquired. In September 2023 Quantum also became active in Denmark for the first time, acquiring a residential property in Copenhagen.

3. aam2core Holding AG: residential, office, logistics, light-industrial

The Frankfurt-based investor aam2core is an extremely active investor in the German real estate market. Thus, numerous properties have been acquired since 2017, such as the office building “Duke” in Herzogenaurach, the ensemble “Franky” or the office property “Iris” in Frankfurt. Residential buildings, office buildings, logistics and light industrial properties, as well as micro and student living properties are actively acquired.

Update 2023: In October 2023, aam2core acquired a residential complex in Wiesbasen with over 6,500sqm of space.

Update 2024: Frankfurt-based Aam2core acquired 90 residential units in the north of Cologne at the end of last year. The residential quarter is to undergo energy-efficient refurbishment and has a total rental area of around 5,500 square meters. The purchase price was treated confidentially.

Picture source: Jason Dent via Unsplash (03.08.2023)

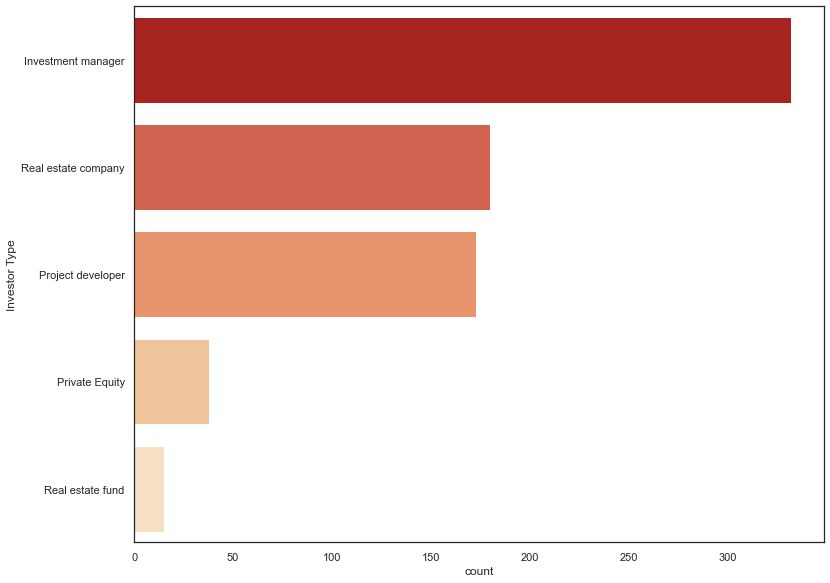

These investor types are included in the list:

- Investment managers

- Real estate companies

- Project developers with portfolio acquisition

- Private equity investors

- REITs

- Pension funds

- Foundations

These property types are purchased:

- Residential real estate

- Office properties

- Retail real estate

- Logistics real estate

- Light industrial real estate

- Hotel real estate

- Data center

- Parking garages

- Nursing homes

Investors in the list are interested in:

- Core Real Estate

- Value add real estate

- Sales-and-Leaseback

- Trophy real estate

- Distressed Assets

- Project developments and forward deals

- Debt investments

Included columns in our directory

- Company data (name, legal form, country of origin)

- Contact details (address, URL, e-mail, telephone number, management)

- Form of address of the management suitable for serial letters (e.g. “Dear Dr. Müller”)

- Investor type (investment manager, REIT, pension fund, private equity, etc.)

- Investment focus (asset classes, ranking from A to E, (global) investment volume / assets under management, detailed geographical focus)

- Special investment focus (debt, parking, forward deals, etc.)

- Link to the acquisition profile of the companies and contact details of an acquisition manager (if indicated on the investors’ website)

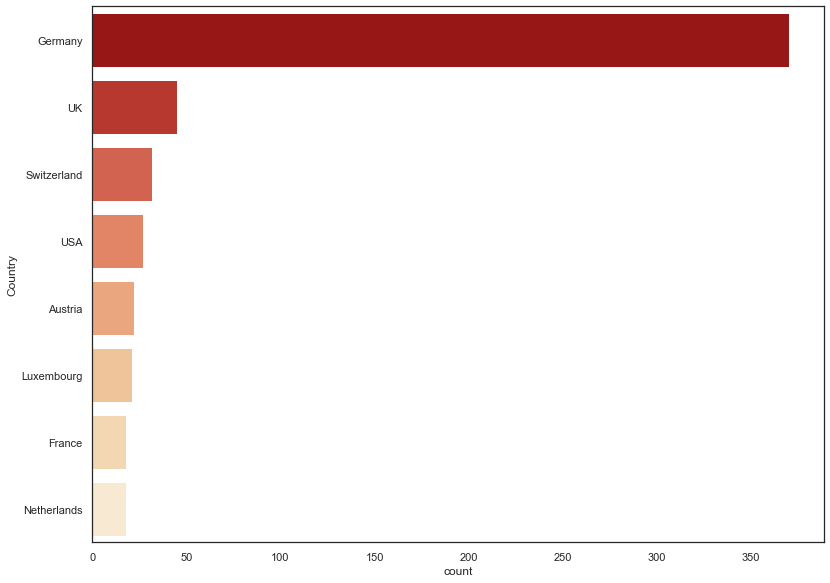

Countries of origin

Most real estate investors in Germany come – as expected – from Germany. However, numerous international investors are also active in Germany. Especially investors from Switzerland, the United Kingdom or the USA.

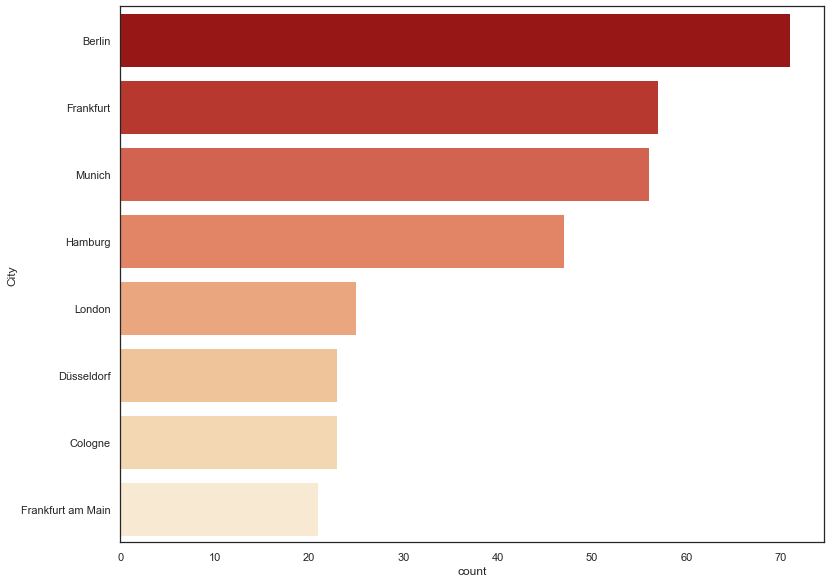

Headquarters in Germany

Most real estate investors in Germany are headquartered in Berlin, followed by Frankfurt and Munich. Some investors also come from Hamburg and Cologne. International real estate investors in Germany come from e.g. London, Amsterdam or Zurich.

Investor types of property buyers

Over 300 real estate investors active in Germany are categorized by us as “investment managers”. Over 150 of the real estate investors are categorized as project developers or real estate companies. In addition, numerous private equity real estate investors are active in Germany.

Database of the largest investors in Germany

With our list of real estate investors we support Germany’s leading real estate agents, project developers, construction companies, consultancies and property owners. The list helps our clients to identify and approach real estate buyers, acquire new customers, sell products and services and analyse the German real estate market. The list, available as an Excel file, can be downloaded and used directly with just a few clicks. The overview of the most important real estate investors in Germany is much more than just an address database. Due to detailed information on the investment focus and purchase profile, you can start addressing them directly.

Directory of investment companies from Germany, Europe and the rest of the world

Our list includes investors from a wide range of countries, including other European countries, the USA, Asia and the Middle East. The listed investors have one thing in common: they buy German real estate in a wide range of sizes and asset classes. Some Northern European investors buy investment properties in Berlin en masse, while others specialise in office buildings in B and C locations. With our unique list, we can help you to approach just about every national and international investor in Germany.

Detailed information in our list: purchase profile, assets under management etc.

The investor database, which can be downloaded as an Excel file, contains a large number of data points, allowing you to sort the list according to your requirements. Thus, the most important information of the investor purchase profiles is located in different columns. We provide a subjective ranking from A to E, assets under management, detailed geographic focus, contact details, asset classes, CEOs and more. Due to the clear Excel design the data points can be sorted in a short time. An example request could look like this: show me all major investors (Ranking A and B) investing in Germany with focus on office and logistics properties.

Finding suitable investors for property sales or lead generation

Our product is perfect for finding buyers for your properties or those of your clients. It differs from investor to investor from what property value the investor starts looking after investments. The biggest investors are looking for properties from 50M€ upwards, while smaller investors are already buying properties with a value from one million euros upwards. Furthermore, our list is very suitable for lead generation in the real estate industry. The largest investors are usually also active as asset managers and therefore responsible for the important decisions in property management. We support you in finding the right investor by providing a link to the purchase profile on the website, if it is provided in the investment strategy presented online. In addition, our database contains the name and e-mail address of a contact person for the purchase, if this person is mentioned on the website of the companies. You can thus avoid hours of research.

All asset classes included: Residential properties, retail, logistics, light industrial, healthcare

Our German Real Estate Investors list contains investors with a focus on all possible asset classes and can be sorted by those. The most popular asset classes here are residential and office properties. Some investors here focus on the top 7 cities such as Berlin, Hamburg and Munich, while others deliberately concentrate on buying properties in B and C locations, where the selling factors are even lower and might lead to higher returns. There is also a high level of investment in asset classes such as retail. Here the focus is on food markets or large shopping centres. A relatively young asset class, but one that is rising due to e-commerce and globalisation, is logistics and light industrial. Many investors are also focusing on healthcare properties such as nursing homes or facilities for senior citizens.

Are you only interested in investors for specific asset classes?

Our list of the 400 largest real estate investors active in Germany contains investors with different focuses. Some only buy residential properties, some only office properties, others properties of all asset classes. If you are only interested in investors with a focus on a specific area just write us via contact [at] researchgermany.com.

If you are interested in a special cutout we are looking forward to your request via live chat, phone or mail. Examples of possible individual excerpts:

- All real estate investors based in Southern Germany

- All real estate investors with focus on residential, office and retail properties

- All real estate investors based in Germany and focusing on healthcare and hotel properties

Picture Sources: Unsplash( Adrian Trinkaus, 30.11.21; Leon Seibert, 30.11.21; William Krause, 30.11.21)

Any questions? Get in touch!

Leo Semmelmann, Founder

contact [at] researchgermany.com

+49 (0) 89 92927741

We are looking forward to help you in case of any questions, remarks and individual requests. Feel free to get in touch via email, live chat or phone. We can also offer you package prices and can create individual lists.

Includes institutional investors, investment managers, project developers, real estate companies, REITs and pension funds that actively acquire real estate in Germany. This list is based on our

Includes institutional investors, investment managers, project developers, real estate companies, REITs and pension funds that actively acquire real estate in Germany. This list is based on our

Andrea Gargalis –

The Top 400 Real Estate Investors in Germany list greatly improved our company’s CRM structure. We were able to establish many close business relationships with contacts from this data base.

The ResearchGermany team work is done diligently and with high quality. They respond very quickly to any of a personal requests, both via phone or e-mail.

Lasse Rasmussen (verified owner) –

As Danish investment manager we are looking for a co-investor in Germany. We came across ResearchGermany and tried the list. Of course we already knew the big investors, but especially medium-sized and regionally active companies are very valuable to us. We can recommend the database without any restrictions.

Julian Long (verified owner) –

I received very swift response to my initial enquiries about the products and since purchase have found the lists to be extremely useful. As we work extensively across Germany (and Europe) having detailed lists of companies that we can then target as possible clients is really important. ResearchGermany have been able to provide this detail and we are very happy to recommend them to others.