Description

List of 3 large real estate investors in Europe

Our list of European real estate investors includes the major investors in European real estate markets. Below we present three exciting investors from the list.

1. Deka Immobilien (Frankfurt, Germany)

One of the leading pan-European and also globally active real estate investors is Deka Immobilien, which is part of the investment arm of the German savings banks. The German investor focuses on office, retail, logistics and hotel properties. The investments also focus on a sustainability effect: for example, attention is paid to “green building” certifications. The owned building “The Edge” is certified by BREEAM with Outstanding and is even energy positive due to solar panels & Co. Overall, the company is one of the most relevant real estate investors in Europe.

Update 2022: In 2022, assets under management stand at over 50 billion euros; there are more than 580 properties in the portfolio.

2. Amundi Real Estate (Paris, France)

Amundi is a French asset manager that manages over 40 billion euros in client assets through its Real Estate division and owns more than 1100 properties. The Real Estate subsidiary was founded in 1979 and is one of the top players in the European office real estate market. The asset manager owns hundreds of properties in Paris alone. In addition to office properties, the portfolio also includes retail properties and residential buildings. These include landmark properties such as Avenue de l’Opera, which with its 6900sqm was added to the portfolio in 2016 – in the direct vicinity of the Louvre.

Update 2023: The investor recently established ACREL II, a new €600 million loan fund for commercial real estate. The fund will specifically target real estate-backed debt instruments with core or core-plus quality risk profiles and invest in the eurozone.

3. Aroundtown (Luxembourg)

Another exciting real estate investor in Europe is Aroundtown SA, which invests in commercial and residential properties. The residential portfolio is managed through its subsidiary Grand City Properties. The portfolio includes properties with an area of more than 10 million sqm; the annual rent is more than one billion euros. Aroundtown invests primarily in Germany and the Netherlands and has become a cornerstone for real estate investors in Europe over the years.

Update 2024: Aroundtown continues to be an active and successful player on the real estate market. An office building in Frankfurt am Main with around 4,000 m² of space was recently let on a long-term lease to a renowned institution. The leased building meets high environmental standards and has been awarded the BREEAM certificate.

These investor types are included in the list:

- Investment managers

- Real estate companies

- Project developers with portfolio acquisition

- Private equity investors

- REITs

- Pension funds

- Foundations

These property types are purchased:

- Residential real estate

- Office properties

- Retail real estate

- Logistics real estate

- Light industrial real estate

- Hotel real estate

- Data center

- Parking garages

- Nursing homes

Investors in the list are interested in:

- Core Real Estate

- Value add real estate

- Sales-and-Leaseback

- Trophy real estate

- Distressed Assets

- Project developments and forward deals

- Debt investments

Included columns in our directory

- Company data (name, legal form, country of origin)

- Contact details (address, URL, e-mail, telephone number, management)

- Form of address of the management suitable for serial letters (e.g. “Dear Dr. Müller”)

- Investor type (investment manager, REIT, pension fund, private equity, etc.)

- Investment focus (asset classes, ranking from A to E, (global) investment volume / assets under management, detailed geographical focus)

- Special investment focus (debt, parking, forward deals, etc.)

- Link to the acquisition profile of the companies and contact details of an acquisition manager (if indicated on the investors’ website)

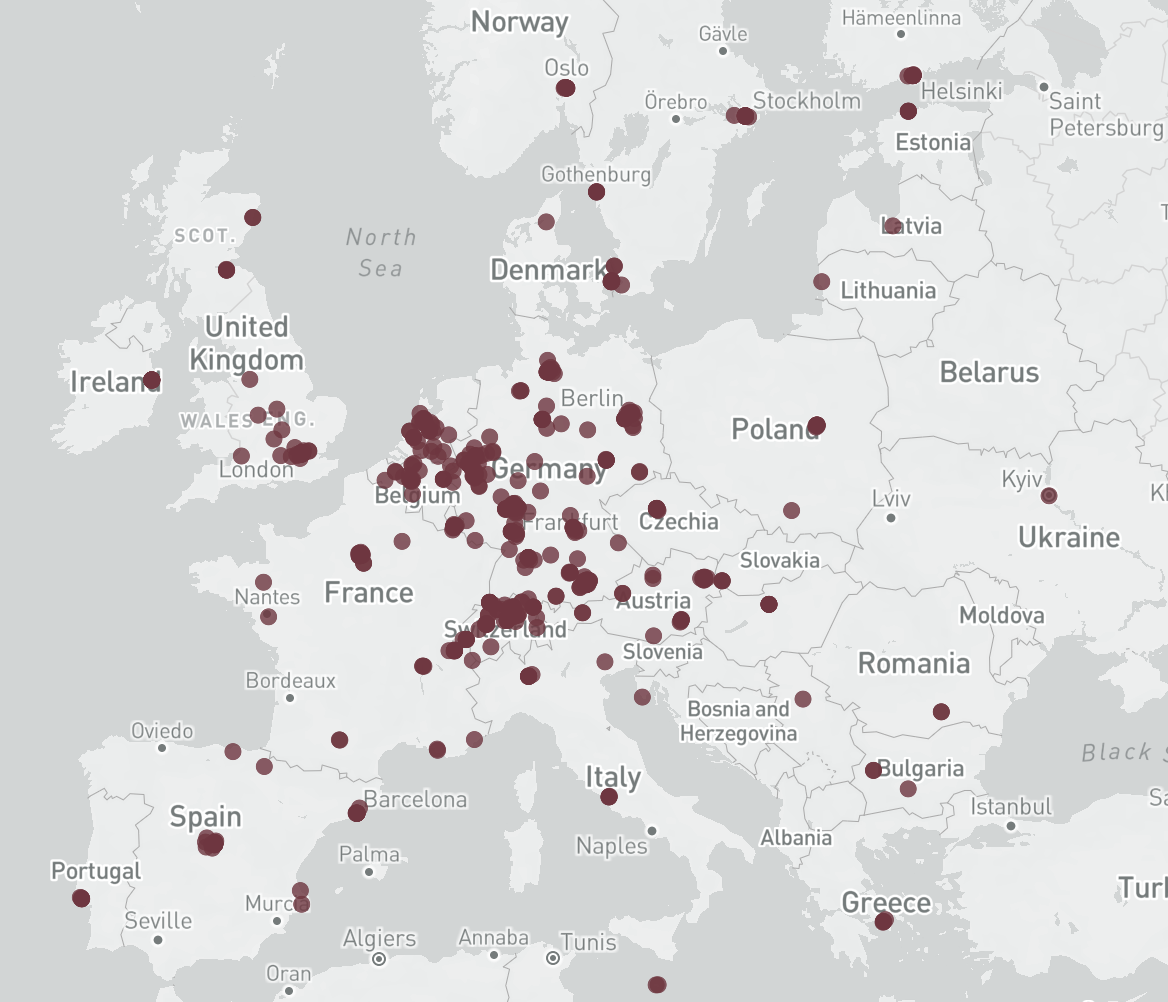

Headquarters in Europe

The map to the left shows the majority of property investors that invest in European real estate. From the map it can be concluded that a large portion of the real estate investors that have a European office are based in Germany, Switzerland, and the UK. France, Spain, Austria, Denmark, and Sweden also have a bunch of real estate investors. Furthermore other European countries like Italy and Czechia also have dozens of real estate investors. In addition to the property investors based in Europe, there are also investors located in North America, Asia and other parts of the world.

Database of European property investment firms

Our team observes and analyses the European real estate market to offer this unique product: a database of the top 1200 real estate investors in the European market. Our overview is downloadable as an Excel file and helps our clients to sell properties and attract new customers. By purchasing this list you will get a unique and comprehensive list of the most important real estate buyers.

Players from Germany, Europe and the rest of the world

As part of the research for the list, we analyse all real estate transactions in Europe: who buys which properties in which asset classes? Where are these investors still active? Thus, our list contains mainly investors from Germany and neighbouring countries, but also, for example, real estate buyers from Asia, the Middle East or the USA. American investors, for example, are particularly active in Spain and the UK. Investors from Northern Europe often have their focus on the Scandinavian region. Interestingly, many South African investors specialise in the Eastern European market (Serbia, Poland, Croatia, etc.). The listed investors come from all over the world, but have one thing in common: they actively buy real estate in Europe.

The list contains the most important data points

Once you have downloaded our list as an Excel file, a treasure trove of data opens up to you, helping you to find the right buyers for your properties or suitable new customers in Europe. Basically, each entry contains the company name, the website URL and contact details such as the corresponding e-mail and postal address. The additional data helps to identify the right investors. Therefore, the asset classes in which investments are made are listed. Further columns help to define the exact geographical focus (which countries, which regions).

Identification: Property buyers, New customers, Analyse markets

Our customers use our lists for three major areas: finding suitable prospects, acquiring new customers and detailed market analysis and research. Through a lot of data points, we enable our clients to identify and approach the optimal potential buyers for properties throughout Europe. In addition, our list is ideally suited for identifying and approaching potential new customers: the listed companies are Europe’s largest real estate owners and therefore exciting “leads”. In addition, our list helps to identify the most important players in the respective markets and to conduct a sound market research.

Where are they located?

Real estate investment firms from Europe can be found in several countries. Many investors have their headquarters in the UK, Northern Europe, Germany, Switzerland, Austria, Benelux, France and Spain. But, of course, every country in Europe has its own national real estate investors. Our extensive list covers more than 1200 investors that are active in Europe. Besides the investors from the map below, also many investors from the United States, Asia, the Middle East and Canada are active in Europe – and thereby part of our list.

Different asset classes

The more than 1,200 real estate investors buy properties from all available asset classes. The most popular asset classes are residential and office properties. The properties purchased range from residential portfolios to individual apartment buildings and from skyscrapers to small office buildings in B locations. Another popular asset class is hotels (we also have our own product for this, see: Largest Hotel Investors Europe). Here again, the investment spectrum ranges from 5-star hotels in prime locations to small boutique hotels. Other up-coming asset classes in the focus of European investors are healthcare properties such as nursing homes and medical centres, logistics properties and light industrial properties.

Any questions? Get in touch!

Leo Semmelmann, Founder

contact [at] researchgermany.com

+49 (0) 89 92927741

We are looking forward to help you in case of any questions, remarks and individual requests. Feel free to get in touch via email, live chat or phone. We can also offer you package prices and can create individual lists.

Includes institutional investors, investment managers, project developers, real estate companies, REITs and pension funds that actively acquire real estate in Europe.

Includes institutional investors, investment managers, project developers, real estate companies, REITs and pension funds that actively acquire real estate in Europe.

Julian Long (verified owner) –

I received very swift response to my initial enquiries about the products and since purchase have found the lists to be extremely useful. As we work extensively across Spain (and Europe) having detailed lists of companies that we can then target as possible clients is really important. ResearchGermany have been able to provide this detail and we are very happy to recommend them to others.

Farid Alkhaldi (verified owner) –

Fast and efficient and the customer service amazing!