Description

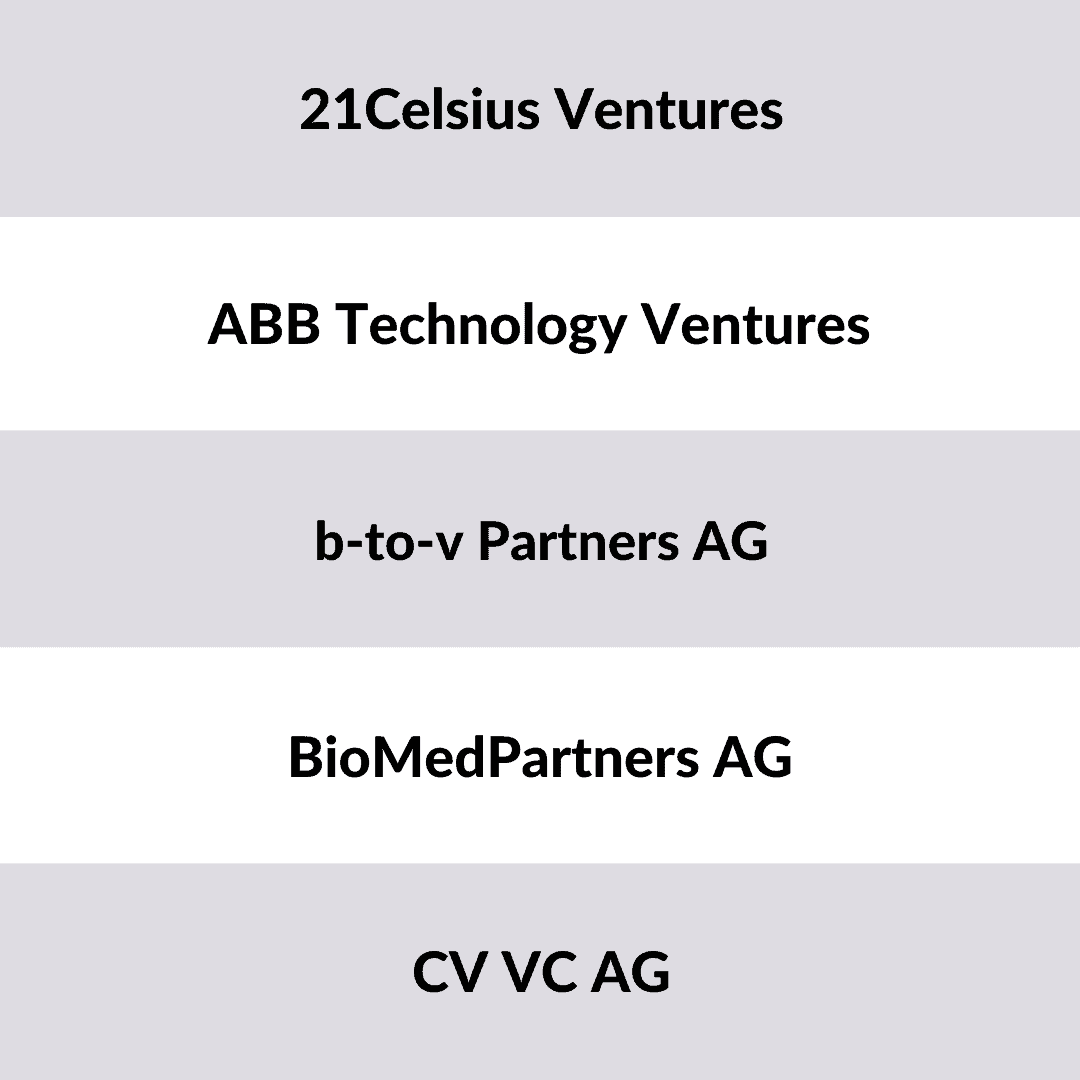

List of 5 venture capital investors in Switzerland

The venture capital market in Switzerland is booming. Between 2012 and 2017, new venture capital invested annually rose from just over CHF 300 million to more than CHF 900 million, tripling within five years. Last year alone, 175 financing rounds were successfully completed. With our list of the largest Swiss venture capital funds, we cover all major Swiss venture capitalists. Below we present 3 funds that are part of the list.

Just under half of the investments were in startups in the ICT sector and biotechnology companies. Fintechs developed particularly stormily and now reach a share of almost ten percent of the invested venture capital. Regionally, start-up financing is concentrated primarily in the cantons of Zurich, St. Gallen and Fribourg. Sufficient start-up capital is provided by various venture capital funds, among others. We present the largest funds active in Switzerland here.

1. CREATHOR VENTURES

CREATHOR VENTURE Management GmbH has been supporting young companies with start-up capital since 1984. From its two locations in Bad Homburg and Zurich, the company is involved in venture financing with a focus on Germany, Switzerland, Austria and Scandinavia. To date, the company has invested in around 220 start-ups. The investments are always made for a limited period of time. The investments realized in Switzerland include, among others, a participation in the German-Swiss property-tech company Allthings Technologies AG last year. Together with private investors, CHF 2.5 million was made available here.

2. Index Ventures

Index Ventures was founded in Geneva in 1996 and is an internationally oriented venture capital fund with a diverse mix of industries. In addition to its Geneva headquarters, the fund has offices in London and San Francisco. The investment focus here is also on early-stage and growth financing. The investment portfolio currently includes around 160 companies in a good two dozen countries around the globe. One of Index Ventures’ most recent investments is the Berlin-based start-up FactoryMarket, which aims to compete with established chains with one-euro stores. Index Ventures has invested around EUR 10 million in this company.

Update 2024: In December 2023, Index Ventures invested in Tacto, a company that uses artificial intelligence to achieve supply chain optimization. In addition to Index, Sequoia also invested in Tacto. This investment shows where the VC journey can take us in 2024. AI and machine learning are megatrends that will shape the coming months and years.

3. Novartis Venture Fund

The Novartis Venture Fund is the venture capital fund of the Swiss biotechnology and pharmaceutical group Novartis, headquartered in Basel.The fund invests worldwide in innovative start-ups with business models in the biotech, biopharma and life science sectors.Currently, there are more than 40 companies in the investment portfolio.The invested capital in the portfolio amounts to approximately CHF 800 million.The investment focus is on early-stage financing through to growth-stage financin

4. Onelife Advisors SA

Onelife SA is a venture capital investor that, in addition to providing venture capital, also sees itself as a consulting and services company. The investment focus of the company, which operates from Lugano in Ticino, is in the pharmaceutical, biotechnology and high-tech sectors. In this sense, Onelife Advisors works with financial institutions and family offices preferably in Switzerland. The investments carried out and accompanied by Onelife Advisors are generally in the low million range.

5. Redalpine Venture Partners

Redalpine Venture Partners AG is a venture capital provider primarily active in the ICT and health tech sectors.The company is based in Zurich and in Munsbach, Luxembourg, and is primarily active as an early-stage and start-up investor.The investment portfolio currently comprises around three dozen companies.The investment activities are currently bundled in three funds. Recent engagements include an investment in the health tech start-up Aktiia in Neuchatel, Switzerland.

Update 2023: Venture capital is becoming more interesting and accessible as an asset class for more and more investors. This is also demonstrated by the latest cooperation between asset manager Maerki Baumann & Co. and Swiss VC Redalpine Venture Partners. Since 2023, clients of the asset manager can invest in this alternative asset class for as little as CHF 100,000, provided they are classified as institutional investors.

Picture source: eberhard grossgasteiger via Unsplash (17.07.2023)

Risk investors in life sciences, biotech, technology and Co.

Switzerland is home to numerous renowned start-ups. Young Swiss companies are particularly outstanding in research-intensive segments such as life sciences, robotics or artificial intelligence. Numerous international venture capital funds have been active in Switzerland for years and support start-ups with venture capital. But also within the country, more and more investment companies are being founded to support local young entrepreneurs with capital and business know-how. However, an overview of the largest Swiss venture capital companies is not yet available, so that the search for the right investor is often a greater challenge for founders and co-investors. With our list of the venture capital funds in Switzerland we can help.

This information is included in the list

- Names of the Swiss venture capital companies

- Information on the investment focus (by sector) and information on whether Series A and B rounds are accompanied

- Exemplary investments from the past

- Highlighting corporate venture capital funds

- Contact details (address, e-mail address, telephone number, URL)

- Names of the executives/management

- Serial letter suitable for addressing the management (e.g. “Dear Dr. Müller”)

VC´s: Partners for start-ups throughout Europe and the world

Not only the start-up scene in Switzerland benefits from the country’s experienced venture capitalists. Swiss VCs are also in great demand beyond the country’s borders. The largest venture capital funds in Switzerland are not only active in the Swiss Confederation, but also in the entire DACH region, Europe and the whole world. Some Swiss VCs even have a presence in the USA, UK or Germany in order to demonstrate a local presence. The experienced employees of the most important venture capital firms in Switzerland can often look back on a successful career in the Swiss financial sector and have been able to build up a significant international network. The VCs benefit from the long-term partnerships by being able to accompany relevant deals abroad. For the reasons mentioned above, the list of Switzerland’s top venture capital funds is also ideally suited for start-ups and co-investors from abroad.

Lead generation: Swiss venture capitalists

Lead generation in the environment of venture capital funds in Switzerland has never been as easy as with our clearly structured address database. Thanks to our up-to-date contact details, you can start approaching potential partners immediately and do not have to spend hours researching suitable VCs. By specifying the investment focus by industry, it is possible to filter the list according to your needs. The exemplary start-up investments also help to identify venture capitalists that fit the search profile. All relevant cities and cantons in Switzerland are covered. With our database, you can find investors in Zurich, Zug, Schwyz, St. Gallen, Vaud, etc. You no longer have to click through countless overviews and compile relevant venture capital funds by hand, but can get started immediately. We wish you every success in contacting us, whether by post, e-mail or telephone.

Picture source: Mike Dennler, Claudio Schwarz

Any questions? Get in touch!

Leo Semmelmann, Founder

contact [at] researchgermany.com

+49 (0) 89 92927741

We are looking forward to help you in case of any questions, remarks and individual requests. Feel free to get in touch via email, live chat or phone. We can also offer you package prices and can create individual lists.

Contains Swiss venture capital funds that actively invest in startups. These invest in startups from the tech, consumer goods, medtech, biotech, food, etc. sectors.

Contains Swiss venture capital funds that actively invest in startups. These invest in startups from the tech, consumer goods, medtech, biotech, food, etc. sectors.

Reviews

There are no reviews yet.