Description

List of 4 large venture capital investors in Germany

In order to get a better understanding of the entries in the list, some of the VCs are presented in detail, focusing on investment focus and exemplary investments.

1. ASTUTIA Ventures GmbH

ASTUTIA Ventures is an owner-managed venture capital company based in Munich, which has been in existence since 2006. The company provides young innovative start-ups with above-average growth prospects with capital to enable them to “really take off”. Market entry, growth and internationalisation strategies are financed. The goal is a temporary investment with a profitable exit after about three to five years. Beyond financing, ASTUTIA Ventures also supports its start-ups with know-how and expertise. The company sees itself as a mixture of venture capital company and business angel.

Benedict Rodenstock founded ASTUTIA Ventures more than ten years ago. The Rodenstock Family Office forms the financial background of the company. The investment focus is on digital start-ups with a transaction-oriented BtC business model, which are still in an early phase and have long-term sales prospects of up to EUR 100 million. The ASTUTIA Ventures investments themselves range from 100,000 to 500,000 Euros. There are currently ten investments, and just as many exits have already been realised – among others with now well-known online brands such as Mister Spex (glasses), Dreamlines (cruises) or Joblift (meta job search engine).

Update 2023: Benedict Rodenstock has now launched a new fund, Arviq Capital Partners, which operates primarily in the early-stage sector. Relevant target industries and targeted startups ideally have their know-how in the Smart Cities, Smart Mobility, Blockchain and Health Tech segment.

2. Atlantic Internet GmbH

The Berlin-based venture capital company Atlantic Internet GmbH operates under the “Atlantic Labs” brand. Atlantic Labs was founded in 2013 by entrepreneur Christophe Maire, who had already gained many years of experience in the founding and development of digital and technology-driven start-ups. Atlantic Labs is involved in venture capital at an early stage of the company’s development and accompanies start-ups on their way to dynamic growth. The current focus is on e-health, mobility, industrial applications, “intelligent” machines, mobility and distributed networks. However, the company is also fundamentally open to new areas if these offer special opportunities.

Three examples illustrate the orientation of Atlantic Labs:

- together with the Munich-based venture capital financier Earlybird, four million euros were made available for the Kreatize digital platform. Via the platform, medium-sized mechanical engineering companies can place orders for plastic and metal components;

- Atlantic Labs took a stake in Styla, a content platform for the fully automated creation of websites and online magazines, in one of the first financing rounds;

- Another commitment is the investment in Lano – a work management platform that aims to enable companies to work efficiently with external employees.

3. CHECK24 Ventures GmbH

As the company name suggests, CHECK24 Ventures is part of the CHECK24 Group, which is one of the best-known German comparison portals on the internet. The venture capital company specialises in early stage financing and wants to offer more than just the provision of capital. Founders can also make use of CHECK24’s infrastructure and experience in IT, organisation and management – an important aid in the start-up phase. of a start-up.

The start-ups financed by CHECK24 Ventures often operate in the fields covered by CHECK24. But this is not mandatory. Here are three examples of CHECK24 Ventures participations

- Moebel24 is a comparison portal which was founded in 2015 and enables online comparisons of over 3.5 million pieces of furniture and furnishings;

- Zizoo was founded in 2014 and is a platform for boat rentals. Via Zizoo, charter companies can easily “sell” their boats to the man or woman;

- Teachers’ Marketplace is a virtual market created in 2016 where teachers can buy or sell teaching materials easily and inexpensively.

4. Earlybird VC Management GmbH & Co. KG

Munich-based Earlybird VC Management has been around since 1997, making the company almost an “oldie” in the field of VC companies with a focus on digital start-ups. Not many competitors can boast more than twenty years of experience. Early stage and growth financing is the Earlybird business. They also provide strategic and operational support and accompany the young companies to the capital market. Earlybird is thus a fixed component of our database of the most important venture capital funds in Germany.

The investment volume is currently more than one billion euros. The minimum investment is 250,000 euros, the upper limit for a single investment is 10 million euros. Earlybird VC Management is thus one of the largest and most successful VC companies in Europe. The venture capital business is divided into three divisions, each of which is managed by a separate team:

- Digital West: Early stage investments in technology start-ups. Regional focus: Germany, Austria, Switzerland, Scandinavia, Benelux, UK, France and Southern Europe;

- Digital East: early-stage financing in the information and communication technology sectors. Regional focus: Eastern Europe and Turkey;

- Health-Tech: early-stage and growth financing in the healthcare sector with a digital focus. Focus areas: Digital Health – digital health applications, innovative medical equipment, modern diagnostics, support for medical treatment.

Update 2024: After Earlybird made a total of 52 investments in 2023 and was fundamentally satisfied with the challenging year, the German VC expects an upswing in 2024. This is due to the expected fall in interest rates, an upswing on the capital markets and a great need for financing in the tech scene.

Picture source: Dylan Gillis

Investors: Active in the German-speaking region, Europe and worldwide

The venture capital scene has been dominated for years by American VCs in particular, who often lead large financing rounds. But also in Europe, more and more funds have emerged that accompany important Series A and Series B rounds. These include some of the largest venture capital companies from Germany, which are increasingly active beyond national borders. Outside the DACH region, the markets in France, UK and the USA are particularly exciting. But also in Eastern Europe and the Baltic States, Portugal, Spain, Israel and other countries, start-up hubs are emerging, which are closely watched by German investors. With our list of the most important German VCs, you have the opportunity to have all the relevant equity investors in the startup scene at a glance.

Included information: Investment focus, contact details, exemplary investments

The data contained in the Excel list helps our clients to find the right German venture capital funds for their objectives. Thus, the listed VCs can be sorted according to their investment focus. One column lists as precisely as possible the areas in which investments are made. The VCs are active in almost all possible areas, from software to food and fintechs. For an even better picture of the VCs, exemplary investments are listed. To find out how long the venture capitalists have been on the market, a column with the year of foundation (if available) is provided. To contact the VCs, the list contains the postal address, e-mail, telephone and URL. The names of the managing directors are also included.

- Name of the VC

- Investment data (investment focus, excerpt of the top investments, year of foundation)

- Highlighting corporate venture capital companies

- Contact details (address, telephone, URL, e-mail address)

- Names of the executives/management

- Serial letter suitable for addressing the management (e.g. “Dear Dr. Müller”)

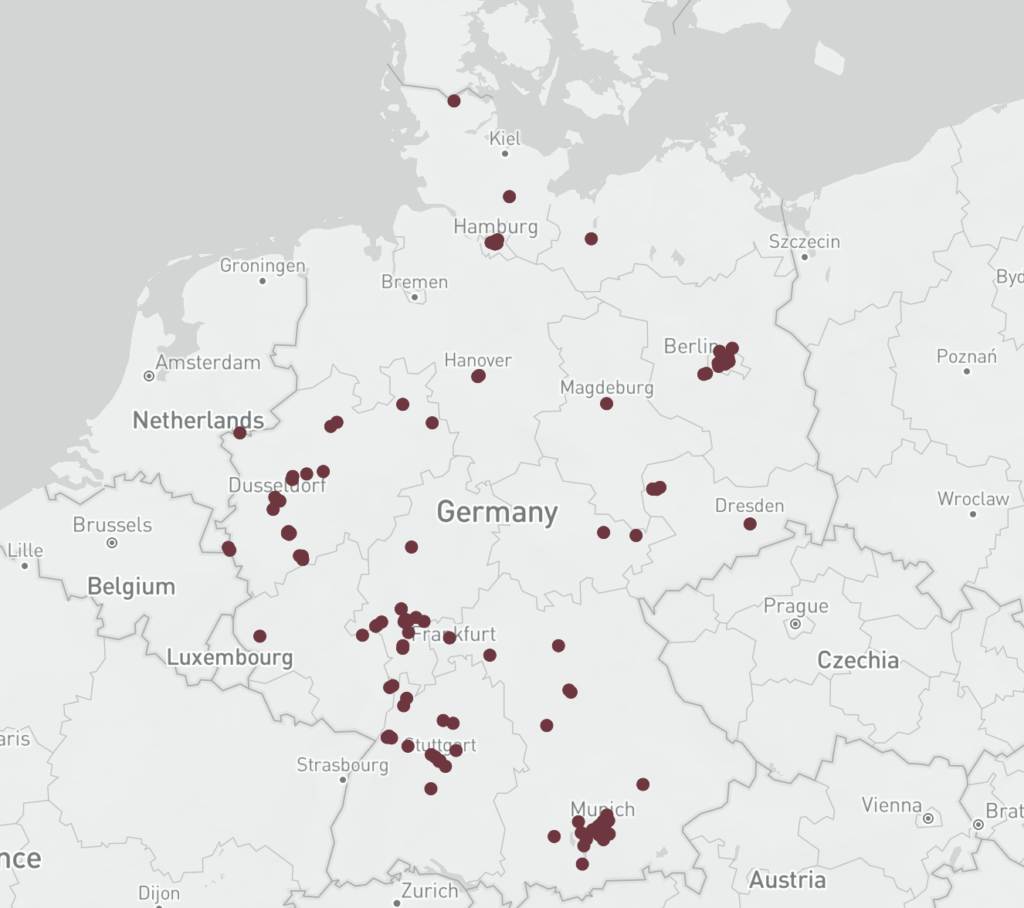

Map of German Venture Capital Funds

Below, you will find a map of all German venture capital funds from our list. There is a strong focus on Germany’s startup hubs: Berlin, Munich and Hamburg. But also many German venture capital investors are located in and around Frankfurt.

Corporate VC´s are also included in the list

The list includes not only regular VCs, but also corporate venture capital funds. These are the venture capital arms of the largest German companies. They invest in the business area of the parent company and try to give it new innovative power and sales growth. The motives for corporate VC investments are different: to build up cooperations with potential new competitors, to buy innovations or to recruit employees. The best example is Allianz X, the venture capital division of Allianz: the fund has already (as of April 2019) invested over 430 million in FinTechs and InsurTechs in top startups such as American Well, Auto1, N26 or Lemonade. This offers start-ups the opportunity to identify venture capital funds from Germany that score points not only with capital but also with strategically important access to German groups.

Picture source: Bethany Legg

Any questions? Get in touch!

Leo Semmelmann, Founder

contact [at] researchgermany.com

+49 (0) 89 92927741

We are looking forward to help you in case of any questions, remarks and individual requests. Feel free to get in touch via email, live chat or phone. We can also offer you package prices and can create individual lists.

Contains German venture capital funds that actively invest in startups from the tech, consumer goods, medtech, biotech, food, etc. sectors.

Contains German venture capital funds that actively invest in startups from the tech, consumer goods, medtech, biotech, food, etc. sectors.

L. Rahn –

This list saved us many hours of research. Recommended!