Description

List of the 25 largest companies in Germany

To gain an insight into our list of the largest German companies, we present the 25 companies with the highest turnover in Germany in detail. We go into detail about the field of activity and the current situation of the companies. You quickly get an overview of the German economy: the focus is on technology, the automotive industry and mechanical engineering.

1. Volkswagen AG, Wolfsburg

The VW Group is undisputedly Germany’s largest car manufacturer and is in a constant battle with Toyota and General Motors for the top global position. In addition to the Volkswagen brand, the Audi, Bentley, Bugatti, Ducati, Lamborghini, Porsche, Seat and Skoda brands belong to the group via corresponding subsidiaries. A separate division is Volkswagen Commercial Vehicles – including the MAN and Scania brands. VW operates worldwide and has over 650,000 employees.

Update 2021: Volkswagen sales fell by 12 percent in 2020 due to Corona. With its future programme “TOGETHER – Strategy 2025”, Germany’s largest carmaker wants to transform itself into a leading global provider of sustainable mobility. Goals include: 33 e-models by 2025, expansion of battery technology and autonomous driving.

Update 2022: In 2022, Volkswagen AG is primarily concerned with the IPO of the Porsche shareholding and the switch to electric vehicles. The development of the Cariad software division also plays a special role. In 2021, Group-wide turnover was over 250 billion euros. Oliver Blume took over the leadership of the group in September 2022.

Update 2023: In order to strengthen its own position in the world’s largest automotive market (China), the group recently launched a joint venture. In this context, VW’s software unit Cariad has announced the establishment of a corporate cooperation with Chinese software provider Thundersoft.

2. Mercedes-Benz Group AG, Stuttgart

Mercedes-Benz stands for premium vehicles all over the world and was Daimler AG’s best-known brand. In addition, the car group was involved in the production of trucks and buses. This business was transferred to Daimler Truck AG at the end of 2021 as part of a split-up of the group. Since then, the Mercedes-Benz Group AG has existed, which focuses on passenger cars and vans.

Update 2021: The Corona pandemic caused an 11 percent drop in revenue at Daimler 2020. Essential for the future development of the Group is the planned split of the Group into two companies: Mercedes-Benz Cars & Vans for car manufacturing and Daimler Trucks & Buses for truck and bus manufacturing.

Update 2022: Daimler AG is also concerned with the conversion to an electric vehicle group. Thus, the company’s last combustion engine is to be launched on the market in 2023. The 2021 turnover was 169 billion euros.

3. Deutsche Telekom AG, Bonn

Deutsche Telekom was created in 1995 from the former telecommunications division of Deutsche Bundespost. Today, the company is the market-leading telecommunications provider and also the largest telecoms company in Europe. The business is based on two pillars: Telekom Deutschland bundles services for private and business customers. T-Systems International takes care of key accounts.

Update 2021: In 2020, Deutsche Telekom achieved record revenues and revenue growth of over 25 percent. The US business was largely responsible for this, with revenue growth of over 50 percent. In 2021, the company wants to surpass this result. The strategic focus is on the following topics: fibre optics, 5G and digitalisation.

4. BMW AG, Munich

The BMW Group, headquartered in Munich, is the number 3 car manufacturer in this country. In addition to the BMW brand, the group owns the British brands Mini and Rolls Royce. In addition to cars in the premium segment and sports cars, BMW manufactures motorbikes and engines. BMW employs around 135,000 people.

Update 2021: With a drop in sales of “only” 5 per cent, BMW has come through the Corona year 2020 quite lightly compared to other carmakers. In 2021, things are expected to pick up again. The highlight of the year will be the market launch of the new BMW iX series. BMW wants to set standards in terms of e-mobility.

5. Siemens AG, Munich

Siemens AG is one of the most important companies in the German economy. In Germany alone, Siemens has 125 locations and is represented in 190 countries. The Munich-based company is active in many different business areas, including automotive supply, mechanical engineering, software, railway technology and the electrical industry. Siemens AG currently employs 293,000 people.

Update 2023: At the beginning of March 2023, Siemens announced that the company’s large gearboxes and motors subsidiary would be spun off and listed on the stock exchange under the name Innomotics. From October 2023, the division is to be independent and placed on the stock exchange with around 14,000 employees and sales of around three billion euros.

6. Allianz SE, Munich

Allianz SE is the market leader in insurance in Germany and one of the largest insurance groups in the world. Founded in 1890, the group developed into a global player after the Second World War. The Allianz Group covers the entire insurance business and has a large fund company, Allianz Global Investors. Dresdner Bank, which was part of the group for a time, was sold to Commerzbank in 2008/2009.

Update 2021: The Allianz Group has survived the Corona year 2020 quite unscathed – not least thanks to a good property and liability insurance business. In 2021, it hopes to benefit from the general economic recovery after Corona. For the coming years, growth is expected through increased offers for sustainable provision.

7. Robert Bosch GmbH, Stuttgart

The Bosch story began in 1886 as a backyard workshop in Stuttgart. Today, Bosch is one of the world’s largest automotive suppliers and at the same time a conglomerate with various business sectors. Automotive Technology is a focal point, accounting for 60 percent of sales. Other Bosch divisions are Industrial Technology, Consumer Goods Technology and Building Technology. Bosch has around 400,000 associates worldwide.

Update 2021: At Bosch, the Corona crisis was reflected in a 6.4 percent decline in sales in 2020. Only in the consumer goods sector was there an increase in sales. Nevertheless, the company sees itself well positioned for the future. The internet of things, solutions for artificial intelligence, and electromobility will shape the future Bosch strategy.

8. REWE-ZENTRALFINANZ EG, Cologne

REWE-Zentralfinanz EG, headquartered in Cologne, is the parent company of REWE Group.REWE is the largest food retailer in Germany. The supermarket chain specialises primarily as a retailer and grocer. Among others, Billa, Penny and DER Touristik Deutschland belong to REWE.

9. Deutsche Post AG, Bonn

Deutsche Post was created in 1995 from the former Deutsche Bundespost – Postdienst and has developed into an internationally active group in the express, parcel and freight business (DHL brand). Nationally, Deutsche Post maintains its monopoly position in the letter business (Deutsche Post brand). In recent years, the parcel business has benefited from the e-commerce boom, while the letter business has declined.

Update 2021: Deutsche Post is one of the clear Corona winners. Revenue rose by 5.5 percent in 2020, while the operating result improved by more than 17 percent to 4.8 billion euros. The main success driver was the parcel and express business (DHL), which benefited from the e-commerce boom in Corona times.

10. EDEKA ZENTRALE AG & Co. KG, Hamburg

EDEKA is one of the big players in German food retailing and at the same time a complex organisation in which cooperative and corporate structures coexist. EDEKA ZENTRALE AG & Co. KG in Hamburg bundles important holdings of the group and is a partner of the EDEKA regional companies, which in turn stand alongside the EDEKA shops. EDEKA ZENTRALE represents about two thirds of the group’s sales.

Update 2021: 2020 was a successful year for the EDEKA Group. Turnover grew by 9.5 percent, especially strong in the independent food retail trade with 14.2 percent. The EDEKA stores benefited from the fact that they remained open despite lockdowns. 2021 also promises good business.

11. E.ON SE, Essen

E.ON SE was created in 2000 from the two conglomerates VEBA and VIAG. E.ON is the holding company of an electricity provider from Essen and the largest energy company in Germany. In 2016, it sold its conventional energy business to the independent Juniper SE and focused on energy networks, renewable energies and the dismantling of German nuclear power plants. E.ON employed 78,126 people in 2020. 12.

12. BASF SE, Ludwigshafen

BASF’s origins date back to 1865. Today, BASF is the world’s largest chemical company in terms of sales. The group employs about 115,000 people and has sites in more than 80 countries. Its main business areas are chemicals, plastics, performance products, system solutions, crop protection/nutrition and oil/gas. The main plant in Ludwigshafen is considered the largest chemical site in the world.

Update 2021: BASF was able to close the 2020 financial year with almost unchanged sales, while earnings fell by 23 percent – partly due to the pandemic. BASF wants to grow CO2-neutral by 2030 and keep its greenhouse gas emissions at 2018 levels despite increasing production. The sales target for 2021 is 61 to 64 billion euros.

13. Münchener Rückversicherungs-Gesellschaft AG, Munich

Munich Re is the world’s largest reinsurer and was founded back in 1880. For a long time, the company was closely intertwined with the Allianz Group. Today it goes its own separate ways. With its subsidiary Ergo Group, Munich Re is also active in the primary insurance business. Ergo is one of the leading insurance companies for private and business clients in Germany.

Update 2021: 2020 led to high losses at Munich Re in connection with Covid-19. Profit fell to 1.2 billion euros. In reinsurance alone, pandemic losses accounted for 3.4 billion euros. In 2021, the aim is to return to the pre-Corona profit level of €2.8bn.

14. Uniper SE, Düsseldorf

Uniper is a spin-off from the energy group E.ON that took place in 2016. In a complex restructuring, conventional power generation, global energy trading and other E.ON businesses were bundled under the umbrella of the new company Uniper. In the meantime, the Finnish energy group Fortum has acquired almost half of the Uniper shares, and a takeover is intended.

Update 2021: 2020 was successful for the Uniper energy group. The previous year’s result was exceeded, thanks above all to a successful gas business. Uniper wants to make its European electricity generation CO2-neutral by 2035. It plans to have one gigawatt of solar and wind energy production by 2025.

15. AUDI AG, Ingolstadt

AUDI has existed as a car brand for over 100 years. In the 1960s AUDI was bought by VW. Since then AUDI AG has been a sub-group within the VW Group, but operates independently. The two main plants in Ingolstadt and Neckarsulm are of central importance. However, production also takes place abroad. AUDI has over 90,000 employees.

Update 2021: The Corona year 2020 also left its mark on the VW subgroup AUDI. Sales fell by a good 10 per cent compared to 2019. For 2021, they are expecting significantly better figures again – among other things due to new e-models. The Audi e-tron GT and Audi Q4 e-tron model series expand the electric portfolio and are expected to boost business.

16. Bayer AG, Leverkusen

Bayer, headquartered in Leverkusen, is one of the major pharmaceutical and chemical companies. The group is divided into three divisions: Pharmaceuticals, Consumer Health (dietary supplements, non-prescription products) and Crop Science (crop protection products). With the acquisition of the US agricultural chemicals group Monsanto, Bayer intends to further expand its market position.

Update 2021: Bayer sales declined by 4.9 percent in 2020 – due to currency effects in Latin America. A record loss of -10.1 billion euros was achieved. This is due to extensive risk provisioning because of the Monsanto glyphosate problem – a good basis for better figures again from 2021.

17. Talanx AG, Hanover

After Allianz and Munich Re or Ergo, the Talanx Group is number 3 in the German insurance market. The main owner is HDI VvaG. A large number of insurance activities are bundled under the Talanx umbrella. Talanx includes Hannover Re – a large reinsurer – HDI Haftpflichtverband der Deutschen Industrie, HDI-Gerling Industrieversicherung, PB Versicherung and Targo Versicherungen, among others.

Update 2021: Talanx was able to achieve a premium increase of a good 4 percent and a consolidated result of 637 million euros in 2020. In 2021, the company aims to increase the result to between 800 and 900 million euros. The insurer is pushing sustainability – in operations, underwriting, investments and social commitment.

18. Deutsche Bahn AG

Deutsche Bahn is still 100 percent state-owned. Formed in 1994 from the merger of Bundesbahn and Reichsbahn, the group operates rail-based long-distance and short-distance passenger transport as well as freight transport. The railway network is the largest in Europe. The complex group with over 300,000 employees is constantly struggling with its structures.

Update 2021: Deutsche Bahn is one of the pandemic sufferers. 2020 ended with a drop in turnover of over 10 per cent and an operating loss of 2.9 billion euros. The main loss-maker was long-distance passenger transport. The railway expects better figures for 2021. A positive operating result is not expected until 2022.

19. Continental AG, Hanover

Continental grew up with tyres for automobiles. Today, the Hanover-based company is considered one of the world’s largest automotive suppliers. The rubber and tyre business is still of central importance. A second mainstay is automotive solutions (chassis, powertrains, interior equipment). Continental AG has been a sister company of the Schaeffler Group since 2009.

Update 2021: Corona hit Continental in 2020 in the middle of a challenging restructuring process and came at the worst possible time given the company’s 150th anniversary. Consequence: a double-digit decline in sales and almost one billion euros in losses. With the spin-off of the subsidiary Vitesco Technologies and systematic cost reductions, the company now wants to reposition itself.

20. Fresenius SE & Co. KGaA, Bad Homburg

Fresenius traces its roots back to a Frankfurt pharmacy founded in the 15th century. Today, Fresenius SE & Co. KGaA is Germany’s largest hospital and health care group. The Fresenius Helios division operates 112 hospitals. The majority-owned Fresenius Medical Care is a leader in dialysis procedures. Other business segments are hospital and therapy services.

Update 2021: In 2020, the Fresenius health care group achieved about 5 percent sales growth and almost stable earnings. As a large hospital operator, it was directly affected by the pandemic. Despite the expected negative Corona effects in 2021, the company is aiming for comparable sales growth and earnings stability in 2020.

21. ZF FRIEDRICHSHAFEN AG, Friedrichshafen

The history of ZF FRIEDRICHSHAFEN began in 1915 with gears and transmissions. Today, chassis and driveline technology for vehicles form the core business and make the company one of the largest automotive suppliers in the world. However, ZF FRIEDRICHSHAFEN also has a widely diversified Industrial Technology division. The company has almost 150,000 employees.

Update 2021: 2020 was marked for ZF Friedrichshafen by the pandemic and the transformation of the automotive industry. Both factors caused weaker business with a 10 percent drop in sales and several hundred million euros in losses. The acquisition of the US automotive supplier WABCO means an institution for the future. Better business is expected in 2021.

Update 2024: At the end of 2023, ZF Friedrichshafen announces that the Group will limit its role in the shuttle business to that of a technology provider and supplier. The company is no longer aiming to develop its own autonomous transportation systems.

22. thyssenkrupp AG, Essen

The company name thyssenkrupp combines two traditional names in German steel production. Steel is still the core business today. In addition, thyssenkrupp is active in international raw materials trading and as a supply chain management service provider. As part of a merger of its steel activities with the Indian group Tata Steel, thyssenkrupp is realigning itself.

Update 2021: For the 2019/2020 financial year, thyssenkrupp suffered a 15 per cent drop in sales due to the pandemic, mainly in the materials and components business, which is dependent on the automotive industry. EBIT was -1.6 billion euros. Nevertheless, thyssenkrupp continues to restructure the group – among other things through restructuring and the sale of the lift business.

23. Porsche AG, Stuttgart

Porsche in Stuttgart-Zuffenhausen is a world-renowned sports car manufacturer. The name of the company’s founder Ferdinand Porsche is closely associated with VW history. Since 2009, Porsche AG has been part of Volkswagen as a subgroup, but Porsche remains an independent brand. The company has about 30,000 employees.

Update 2021: Porsche is an exception among German car manufacturers. In the Corona year 2020, they also achieved a new sales record – albeit with a mini plus of 0.6 percent. The E-Performance concept Porsche is gearing up for electromobility – with electric and plug-in hybrid models such as the Porsche Taycan.

24. PHOENIX Pharma SE, Mannheim

Mannheim-based Phoenix Pharma SE is the largest pharmaceutical wholesaler in Germany. The company has 164 distribution centres in Europe alone and is one of the leading healthcare providers in Europe. Phoenix Pharma SE was formed in 1994 through the purchase of several regional pharmaceutical companies by Adolf Merckle. The company continues to be part of the Merckle Group.

25. METRO AG, Düsseldorf

METRO was one of the pioneers of self-service wholesale in Germany in 1963 and developed into a major retail group in the following decades. In the last ten years, the company has been completely restructured. In 2015, the Kaufhof department stores’ chain was sold and in 2017 the food business was spun off. The spun-off food division continues to use the name METRO. It operates 760 METRO stores with 150,000 employees.

Update 2021: METRO ended the financial year 2019/2020 with sales losses of 5.4 percent due to Corona. Each month of lockdown cost the company 400 million euros. The financial year 2020/2021 will also be marked by Corona effects. After that, the company aims to return to pre-pandemic levels of turnover and profit.

Picture source: Unsplash(Florian Wehde)& Unsplash(Mateo Krössler)

Our Excel list of the largest German companies is a unique, unprecedented product. With just a few clicks you can download the most up-to-date overview of the German business world, filter out relevant contacts and contact them by mail, post or telephone.

Statistics on our list

With the following statistics we give a helpful insight into our unique Excel list. We show you which industries are covered in which degree of detail, which federal states are particularly represented and from which cities most of the companies in our list come from.

Picture source: S. Widua via Unsplash (19.06.2023).

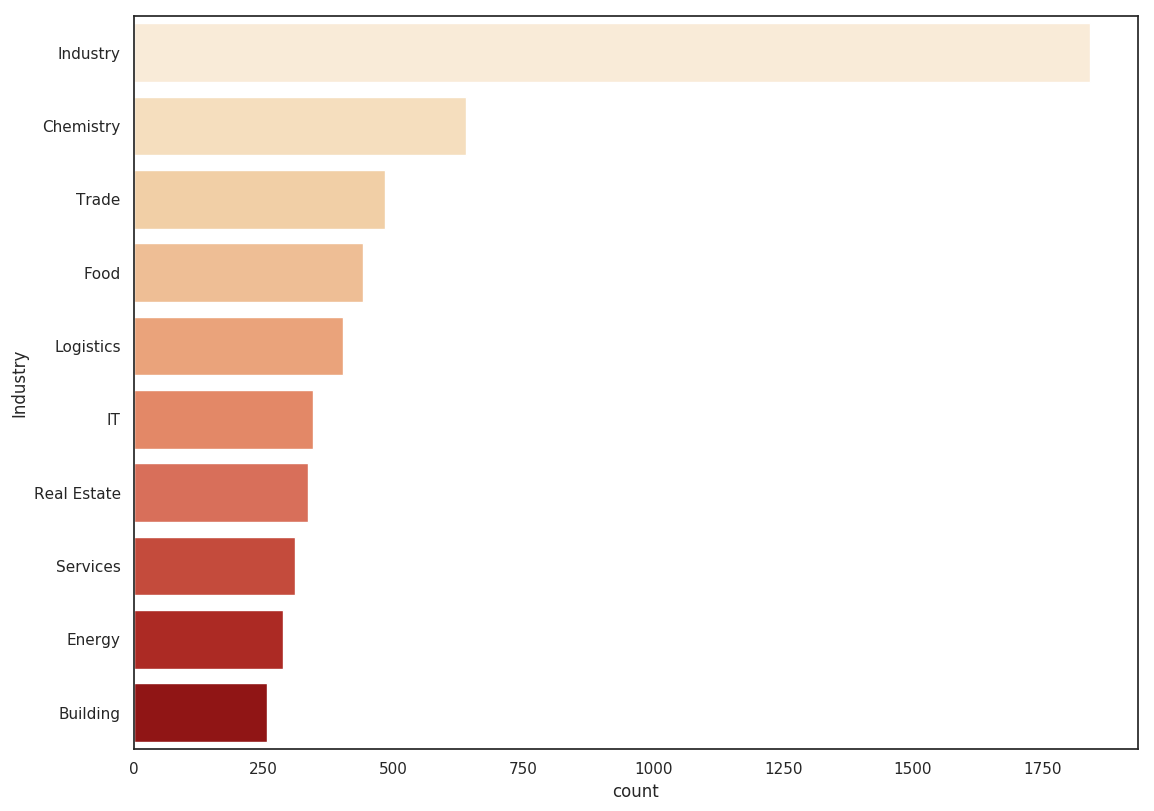

Industries of the companies with the highest revenue in Germany

You can quickly see from the bar chart: Germany’s economy is based on a multitude of strong industrial companies. Our database contains over 1,500 industrial companies. But other industries also play a role: the chemical industry with over 600 entries or trade and food with over 300 entries. Growth industries such as IT are also part of our database.

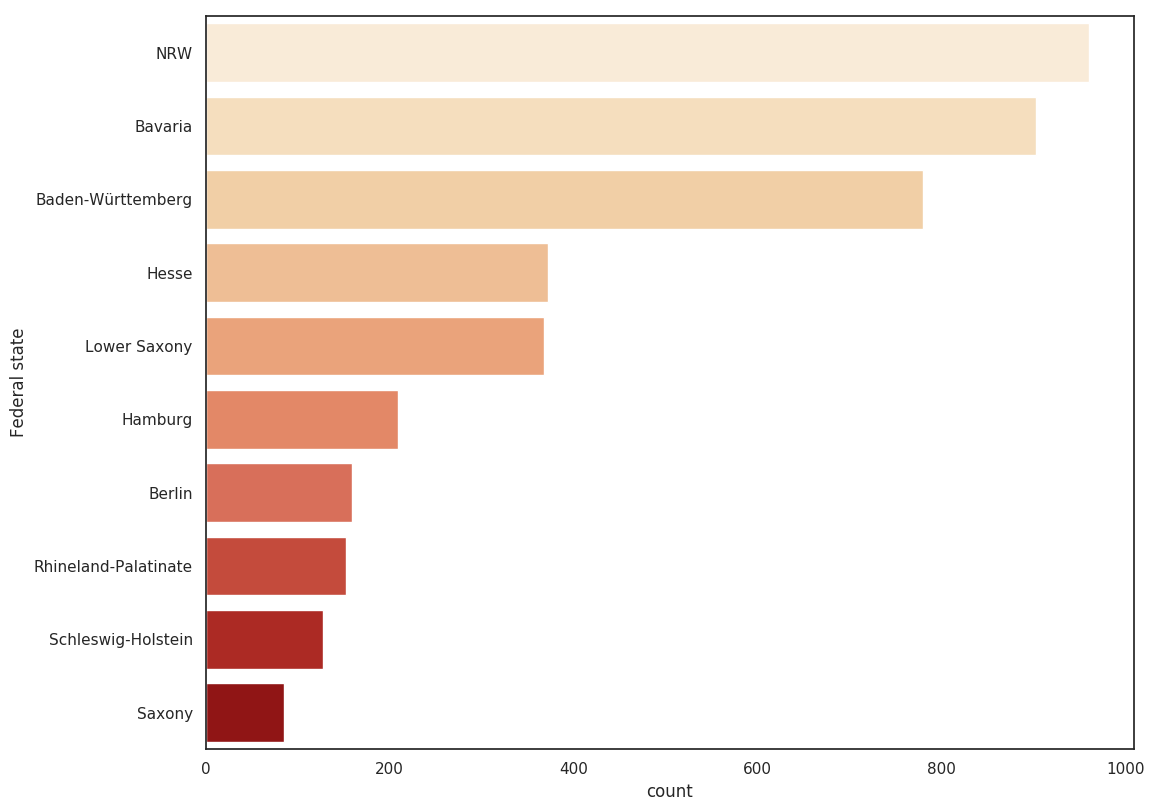

Federal states-origin of Germany’s top-selling companies

Most of the companies come from North Rhine-Westphalia – according to the population figures. The western federal state is home to over 800 companies from our list. Also strongly represented is the industrial south with Baden-Württemberg and Bavaria.

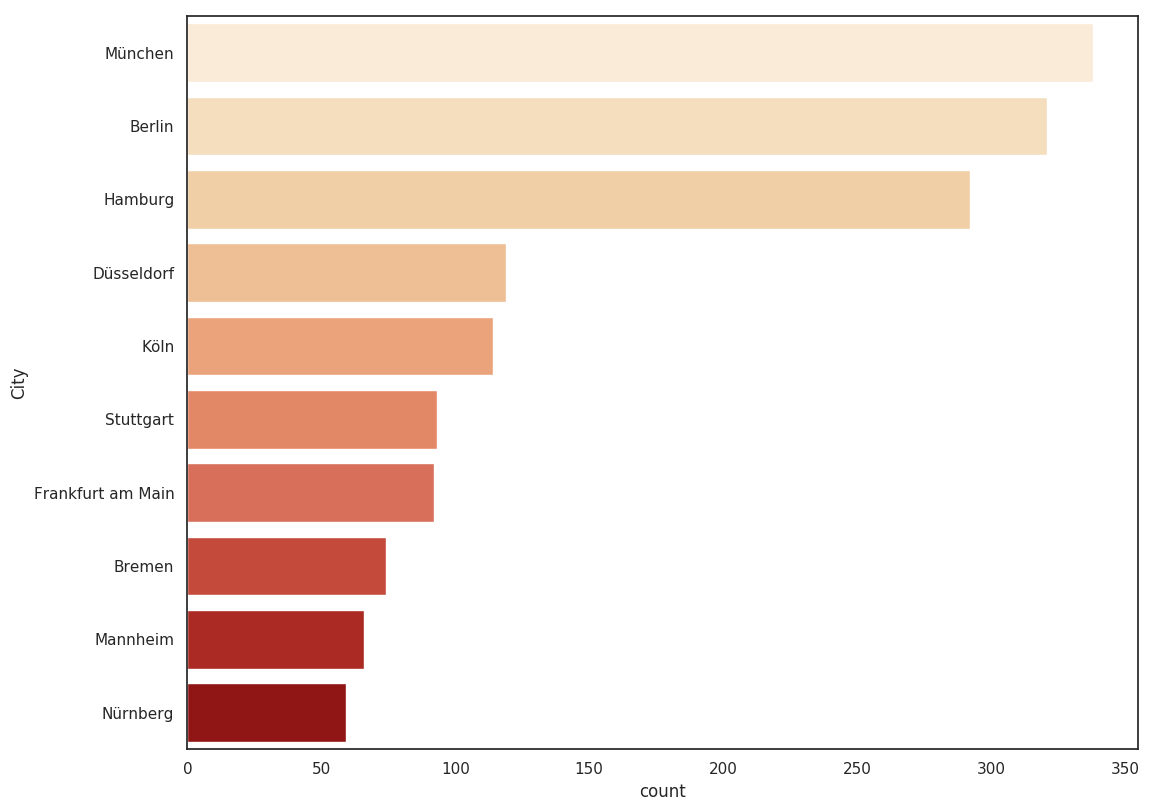

Cities of the companies with the highest turnover in Germany

Most companies in our list are located in the top 3 cities: Munich, Berlin and Hamburg. Other relevant cities include Düsseldorf, cologne, Stuttgart, and Frankfurt.

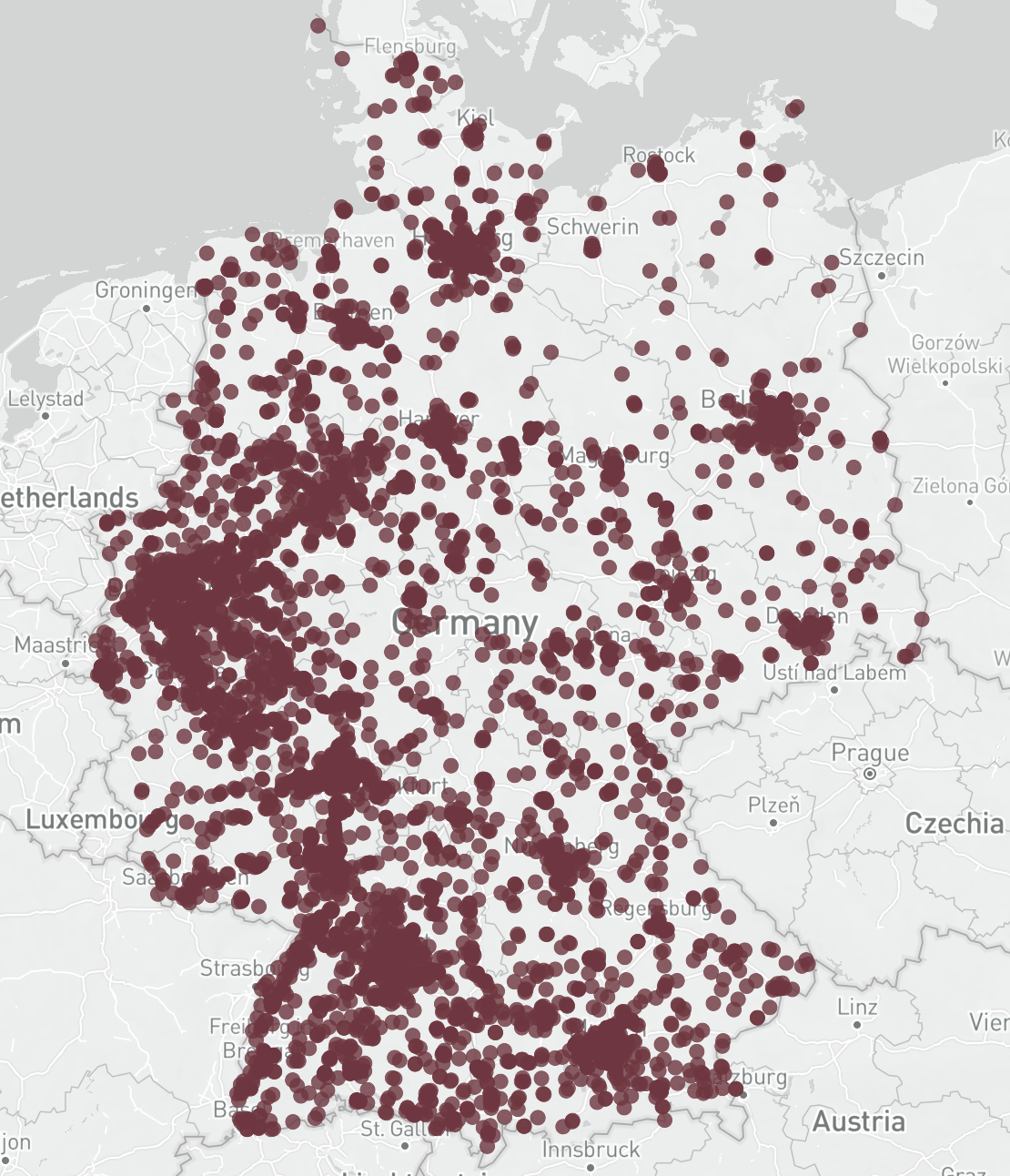

Map of the largest companies in Germany

The 5,000 largest German companies are distributed throughout the Federal Republic. One can see a strong concentration in traditionally strong economic regions such as North Rhine-Westphalia, Baden-Württemberg and Bavaria. The Rhine-Main region and the Rhine-Neckar region are also home to hundreds of companies. In addition, in major cities such as Hamburg, Berlin and Munich numerous high-revenue companies are located.

These lists are included in our directory

Our unique database of the top-selling companies in Germany is the basis for numerous focus lists. These include the largest companies in various industries or areas of activity.

Industries

Top 2,000 Industrial Companies Germany

Top 700 Chemistry Companies Germany

Top 500 Retail and Wholesale Companies Germany

Top 400 Food Producers Germany

Top 600 IT Companies Germany

etc.

Fields of activity

Top 500 Mechanical Engineering Companies Germany

Top 300 Automotive Suppliers Germany

Top 300 Software Companies Germany

Top 300 Companies in the Electrical Industry Germany

Top 200 Medical Technology Companies Germany

etc.

This information is included in the list

- Company name

- General contact data (address, e-mail address, telephone number, URL)

- Name of the management

- Serial letter suitable for addressing the management (e.g. “Dear Dr. Müller”)

- Sales figures for the years 2021, 2020, 2019, 2018, 2017, 2016 and 2015 (taken from the annual and consolidated financial statements)

- Employee figures for the years 2021, 2020, 2019 and 2018 (taken from the annual and consolidated financial statements)

- Sector classification & Field of activity

Note: If the sales and employee figures are not included in a company’s own financial statements but in the parent company’s consolidated financial statements, the data from the respective consolidated financial statements are provided.

Which industries are included?

A special feature of the list of the largest German companies is the classification of the companies into industries. The industry classification was made on the basis of the companies’ core business and allows an uncomplicated filtering of the Excel list according to relevant companies for the respective concern. The following industries can be found in the overview (including sample companies):

- Industrial companies (automotive suppliers, mechanical engineering companies, etc.) | e.g. Leoni AG, Gebr. Knauf KG

- Chemical companies (paint & coatings manufacturers, pharmaceuticals, specialty chemicals companies, construction chemicals, etc.) | e.g. BASF SE, Wacker Chemie AG

- Trading companies (retail, wholesale, etc.) | e.g. Otto (GmbH & Co KG), Gebr. Heinemann SE & Co. KG

- Food companies (baked goods manufacturers, breweries, meat producers, etc.) | e.g. DMK Deutsches Milchkontor GmbH, J. Bünting Teehandelshaus GmbH & Comp.

- Real estate companies (housing companies, project developers, etc.) | e.g. Vonovia SE, Vivawest Wohnen GmbH

- Service companies (consulting firms, cleaning companies, etc.) | e.g. Bilfinger SE, DEKRA SE

- Logistics companies (freight forwarding logistics, parcel logistics, etc.) | e.g. Dachser SE

- Construction companies (building construction, civil engineering, road construction, etc.) | e.g. Bauer AG

- IT companies (software companies, hardware companies, IT consultancies, etc.) | e.g. SAP SE, Bechtle AG

- Energy companies (electricity suppliers, electricity producers, network operators,e tc.) | e.g. Stadtwerke Köln GmbH

- Financial companies (banks, asset managers, insurance companies, etc.) | e.g. DZ BANK AG, LVM Versicherung

- Consumer goods companies (fashion companies, toy manufacturers, sports companies etc.) | e.g. PUMA SE

- Holding companies (automotive suppliers, mechanical engineering companies, etc.) | e.g. Körber AG, INDUS Holding AG

- Healthcare companies (hospitals, nursing home operators, etc.) | e.g. Vivantes – Netzwerk für Gesundheit GmbH, Schön Klinik SE

- Gastronomy companies (system gastronomy, catering, etc.) | e.g. Compass Group Deutschland GmbH

- Media companies (newspapers, TV, book publishers, etc.) | e.g. Bertelsmann SE & Co. KGaA

Any questions? Get in touch!

Leo Semmelmann, Founder

contact [at] researchgermany.com

+49 (0) 89 92927741

We are looking forward to help you in case of any questions, remarks and individual requests. Feel free to get in touch via email, live chat or phone. We can also offer you package prices and can create individual lists.

Our exclusive Excel list of the 5,000 largest companies in Germany by revenue. Includes amongst others firms from the industrial, retail, trading, financial, IT, food, chemistry, logistics or service sector.

Our exclusive Excel list of the 5,000 largest companies in Germany by revenue. Includes amongst others firms from the industrial, retail, trading, financial, IT, food, chemistry, logistics or service sector.

Richard Smith (verified owner) –

First downloaded the free top 50. After evaluating the list we acquired the top 1,000.

The list is great and gives us the opportunity to prepare our market launch in Germany. We already identified dozens of highly relevant leads.

Recommended!

Colin Ferguson (verified owner) –

We were able to gain dozens of new leads through the list. Our team was surprised how well the database is maintained. Well done!