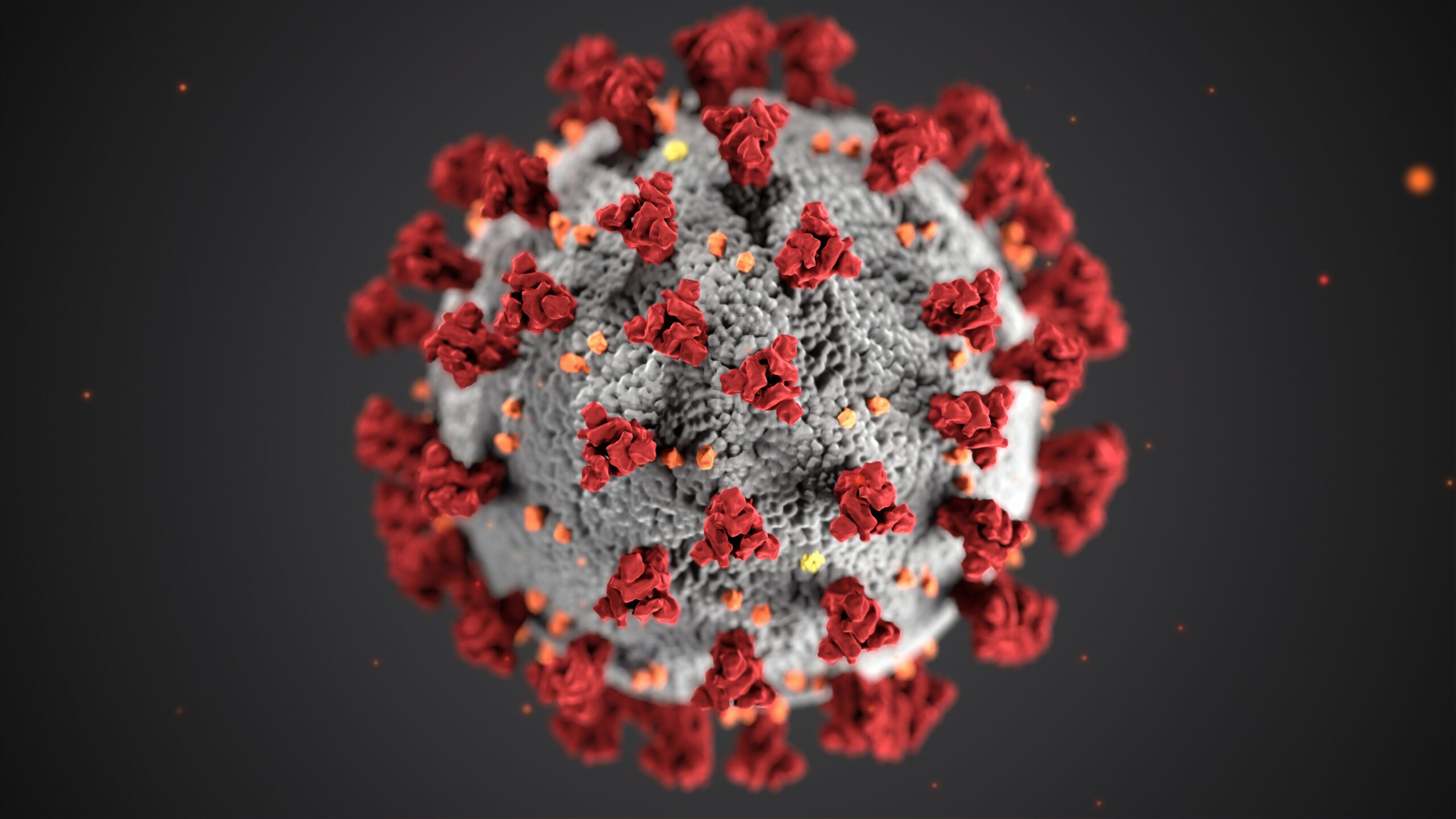

The novel coronavirus is a decisive turning point for the global economy: demand is falling, supply chains are being broken, uncertainty is high. But we ask ourselves: how are Germany’s largest automotive suppliers coping with the crisis? We took a look at the largest companies from our list of the 250 largest automotive suppliers in Germany and set out on a search for clues.

Robert Bosch GmbH, Stuttgart: Short-time work and innovation

Bosch, with its headquarters in Stuttgart and annual sales of almost 80 billion euros, is the world’s largest automotive supplier. The products offered range from sensor technology and control units to electrical motors. The Stuttgart-based company is concerned with cutting costs and securing liquidity. One thing is certain: the corona crisis will place additional burdens on Bosch. No layoffs have yet been announced yet, but short-time working is in place at 35 plants. Bosch is committed to development and innovation in combating the consequences of Corona virus. Some plants now manufacture disinfectants and masks. The Stuttgart-based company caused quite a stir when it launched a COVID-19 rapid test.

Layoffs: 0 (as of 11.05.2020)

Short-time work: Yes

Changeovers: Production of masks and disinfectants, product development (COVID-19 rapid test)

Continental AG, Hanover: Canceled spin-off, off for automated driving

The Hanover-based supplier Continental has been hit hard. The profit of the automobile heavyweight has dropped by 50 percent to 292 million euros in the first quarter of 2020 due to Corona. Sales dropped by 11 percent to 9.8 billion euros. The supplier, which is particularly well known for its tire division, expects strong negative financial effects in the further course of the year. In general, Corona has various consequences for Conti: 30,000 employees are on short-time work, the board is waiving 10% of their salary for 4 months, budgets are being cut or distributed differently. The spin-off of the drive division has been put on hold and no more investments are being made in automated driving, as there is no money for further development. Dismissals are being considered, but no concrete figures have been announced yet. As of now, Continental wants to get by without state aid. The plants are currently being changed in order to produce enough masks for the company’s own needs. In addition, Continental is producing covers for recovery beds on which lighter corona cases can be treated.

Layoffs: 0 (as of May 11, 2020)

Short-time work: Yes (30,000 employees)

Changeovers: Production of masks, covers

ZF Friedrichshafen AG, Friedrichshafen: temporary employment, preparation for resumption of production

ZF Friedrichshafen was one of the first suppliers to announce the introduction of short-time work. The company will increase its short-time work allowance to 90%. At times, 40-60 percent of employees were sent on short-time work, while other departments continued to work. In China, on the other hand, most plants are back in operation. Despite the tense situation, the company is paying out profit-sharing to its employees. In the meantime, ZF is preparing for a gradual ramp-up of production. For this purpose, working times are adapted, partitions between work areas are being erected, and disinfection dispensers are being installed. The home office has also found its way into ZF, and internal communications within the Group have become more digital.

Layoffs: 0 (Status: 05/11/2010)

Short-time work: Yes

Schaeffler AG, Herzogenaurach: Focus on cost reductions

The Herzogenaurach-based supplier Schäffler managed to keep its earnings relatively stable in the 1st quarter. Sales decreased by 9.2 percent from 3,622 million euros to 3,282 million euros. In China, the decline in sales – due to corona – was about 22.8 percent. Schaeffler is reacting to Corona in many areas, primarily by reducing costs. Short-time work has been introduced, vacation days and flexitime are to be reduced, hiring is to be stopped, plants closed. Liquidity is to be strengthened by the issue of a 350 million euro debt note. Schaeffler does not want to make a forecast for the rest of 2020.

Layoffs: 0 (as of 11.05.2020)

Short-time work: Yes

Mahle GmbH, Stuttgart: FFP3 respirators in cooperation with Triumph

The Stuttgart-based automotive supplier with sales in excess of 12.5 billion euros is reacting to Corona: The plants at most European locations have come to a standstill and short-time working has been introduced. The virus hits the company at an unfavorable time: the loss last year was 212 million euros. In the fight against the virus, the Group shows itself to be creative. Respiratory protection masks are produced together with the underwear manufacturer Triumph. Mahle supplies a special FFP3-compatible filter medium for this. The masks are supplied by the two companies to official authorities. In general, the masks can also be used in medical environments. Mahle is also investigating other possibilities for supporting the authorities. As support for workshops, this 6-month deferral of payment for the leasing of new equipment will be extended.