Author: Leo

![List of 3 office real estate deals in Paris [2022]](https://www.researchgermany.com/wp-content/uploads/2022/07/Bildschirmfoto-2022-07-05-um-10.13.43-1024x262.png) Continue reading

List of 3 office real estate deals in Paris [2022]

Continue reading

List of 3 office real estate deals in Paris [2022]

![List of 3 office real estate deals in Paris [2022]](https://www.researchgermany.com/wp-content/uploads/2022/07/Bildschirmfoto-2022-07-05-um-10.13.43-1024x262.png) Continue reading

Continue reading

List of the 200 largest real estate investors France [2024 Update] Rated 5.00 out of 5 €349,99 Incl. VAT Add...

Continue reading

List of 3 active French Real Estate Investors [2022]

Continue reading

List of 3 active French Real Estate Investors [2022]

Continue reading

Continue reading

We are constantly screening the French real estate market for major investors and investments to keep our list of the...

Continue reading

List of the 3 largest construction chemicals companies in Switzerland

Continue reading

List of the 3 largest construction chemicals companies in Switzerland

Continue reading

Continue reading

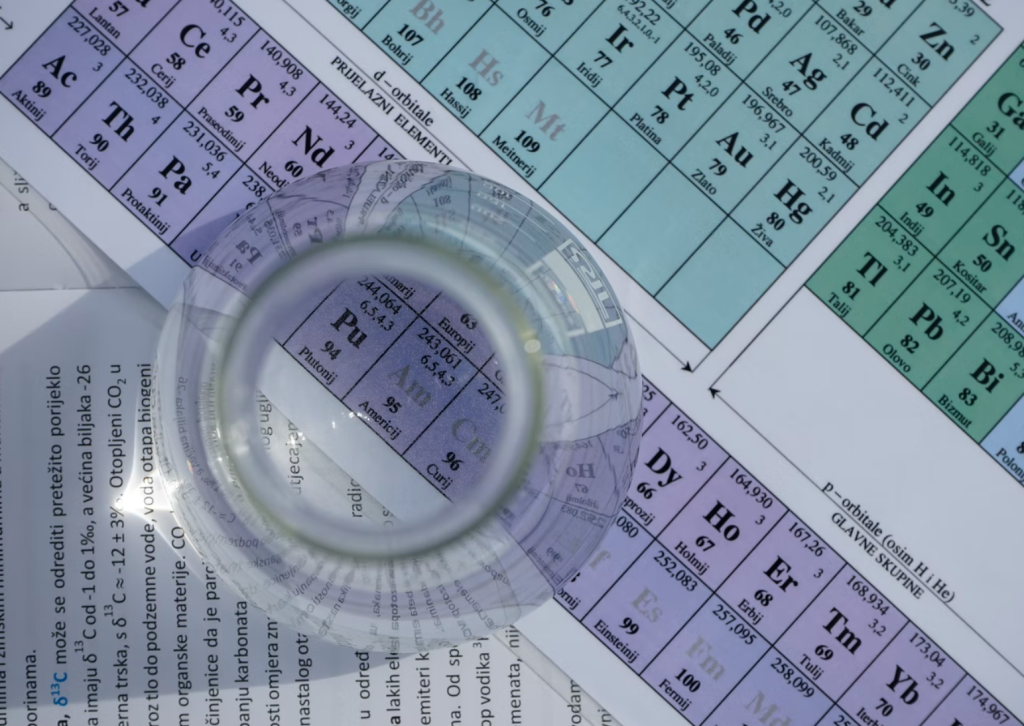

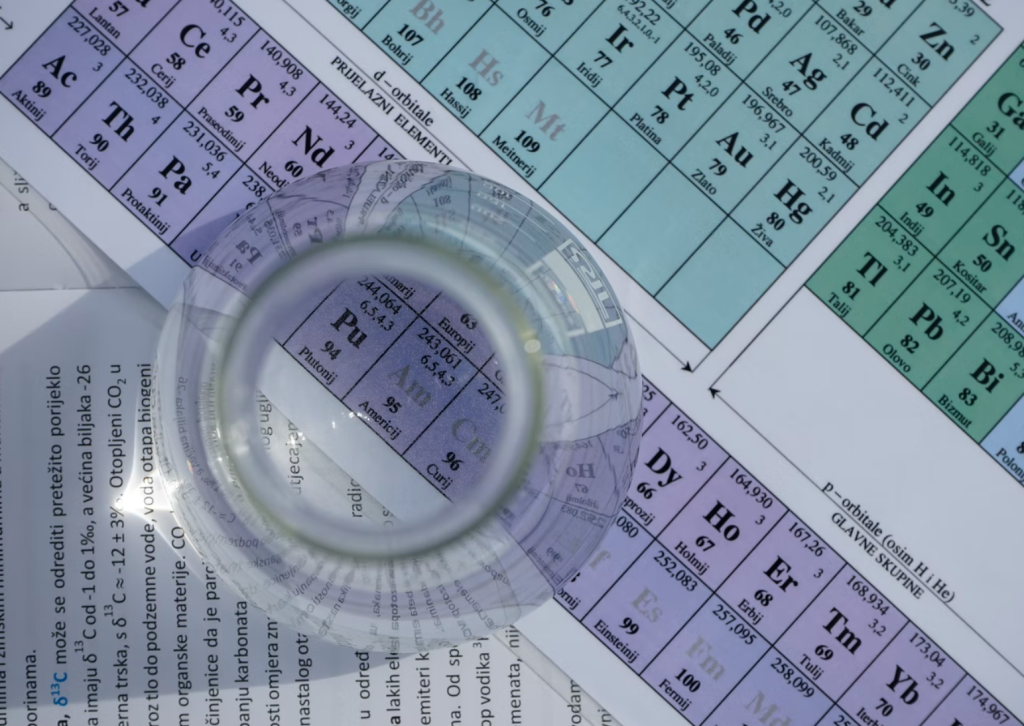

Switzerland is world-renowned for its chemical industry. Many of the largest chemical companies are located there. Over the past few...

Continue reading

List of the 3 largest chemical companies in Central Switzerland

Continue reading

List of the 3 largest chemical companies in Central Switzerland

Continue reading

Continue reading

Switzerland is world-renowned for its chemical industry. Many of the largest chemical companies are located there. Over the past few...

Continue reading

List of the 3 largest chemical companies from Geneva (Canton)

Continue reading

List of the 3 largest chemical companies from Geneva (Canton)

Continue reading

Continue reading

Switzerland is world-renowned for its chemical industry. Many of the largest chemical companies are located there. Over the past few...

Continue reading

List of the 3 largest chemical companies from Zurich (city)

Continue reading

List of the 3 largest chemical companies from Zurich (city)

Continue reading

Continue reading

Switzerland is world-renowned for its chemical industry. Many of the largest chemical companies are located there. Over the past few...

Continue reading

List of the 3 largest specialty chemicals companies in Switzerland

Continue reading

List of the 3 largest specialty chemicals companies in Switzerland

Continue reading

Continue reading

Switzerland is world-renowned for its chemical industry. Many of the largest chemical companies are located there. Over the past few...

Continue reading

List of the 3 largest logistics companies in Eastern Switzerland

Continue reading

List of the 3 largest logistics companies in Eastern Switzerland

Continue reading

Continue reading

Switzerland has a weighty logistics industry. In addition, Switzerland is an important transit country for logistics throughout Europe. Below we...

Continue reading

List of the 3 largest food logistics companies in Switzerland

Continue reading

List of the 3 largest food logistics companies in Switzerland

Continue reading

Continue reading

Switzerland has a weighty logistics industry. In addition, Switzerland is an important transit country for logistics throughout Europe. Below we...

Continue reading

List of the 3 largest logistics companies from Basel-Stadt (Canton)

Continue reading

List of the 3 largest logistics companies from Basel-Stadt (Canton)

Continue reading

Continue reading

Switzerland has a weighty logistics industry. In addition, Switzerland is an important transit country for logistics throughout Europe. Below we...

Continue reading

List of the 3 largest pharmaceutical logistics companies in Switzerland

Continue reading

List of the 3 largest pharmaceutical logistics companies in Switzerland

Continue reading

Continue reading

Switzerland has a weighty logistics industry. In addition, Switzerland is an important transit country for logistics throughout Europe. Below we...

Continue reading

List of the 3 largest logistics companies from Bern (city)

Continue reading

List of the 3 largest logistics companies from Bern (city)

Continue reading

Continue reading

Switzerland has a weighty logistics industry. In addition, Switzerland is an important transit country for logistics throughout Europe. Below we...

List of the 3 largest construction companies from Bern (Canton)

The construction industry is an important sector in all countries of the world. Switzerland's geographical location poses special challenges for...

Continue reading

List of the 3 largest construction companies in Eastern Switzerland

Continue reading

List of the 3 largest construction companies in Eastern Switzerland

Continue reading

Continue reading

The construction industry is an important sector in all countries of the world. Switzerland's geographical location poses special challenges for...

Continue reading

List of the 3 largest building construction companies in Switzerland

Continue reading

List of the 3 largest building construction companies in Switzerland

Continue reading

Continue reading

The construction industry is an important sector in all countries of the world. Switzerland's geographical location poses special challenges for...

Continue reading

List of the 3 largest construction companies in Northwestern Switzerland

Continue reading

List of the 3 largest construction companies in Northwestern Switzerland

Continue reading

Continue reading

The construction industry is an important sector in all countries of the world. Switzerland's geographical location poses special challenges for...

Continue reading

List of the 3 largest timber construction companies in Switzerland

Continue reading

List of the 3 largest timber construction companies in Switzerland

Continue reading

Continue reading

The construction industry is an important sector in all countries of the world. Switzerland's geographical location poses special challenges for...

Continue reading

List of the 3 largest food companies in the Lake Geneva region

Continue reading

List of the 3 largest food companies in the Lake Geneva region

Continue reading

Continue reading

The food industry is one of the most important sectors of the Swiss economy. Below we have picked out 3...

Continue reading

List of the 3 largest manufacturers of chocolate in Switzerland

Continue reading

List of the 3 largest manufacturers of chocolate in Switzerland

Continue reading

Continue reading

The food industry is one of the most important sectors of the Swiss economy. Below we have picked out 3...

Continue reading

List of the 3 largest food companies from Thurgau (Canton)

Continue reading

List of the 3 largest food companies from Thurgau (Canton)

Continue reading

Continue reading

The food industry is one of the most important sectors of the Swiss economy. Below we have picked out 3...

Continue reading

List of the 3 largest beverage producers in Switzerland

Continue reading

List of the 3 largest beverage producers in Switzerland

Continue reading

Continue reading

The food industry is one of the most important sectors of the Swiss economy. Below we have picked out 3...

Continue reading

List of the 3 largest food companies from Zurich (city)

Continue reading

List of the 3 largest food companies from Zurich (city)

Continue reading

Continue reading

The food industry is one of the most important sectors of the Swiss economy. Below we have picked out 3...

Continue reading

List of the 3 largest construction suppliers in northwestern Switzerland

Continue reading

List of the 3 largest construction suppliers in northwestern Switzerland

Continue reading

Continue reading

As in any other country, construction suppliers are needed in Switzerland. In the following we have picked out 3 highly...

Continue reading

List of the 3 largest building suppliers from Zurich (Canton)

Continue reading

List of the 3 largest building suppliers from Zurich (Canton)

Continue reading

Continue reading

As in any other country, construction suppliers are needed in Switzerland. In the following we have picked out 3 highly...

Continue reading

List of the 3 largest construction suppliers in Eastern Switzerland

Continue reading

List of the 3 largest construction suppliers in Eastern Switzerland

Continue reading

Continue reading

As in any other country, construction suppliers are needed in Switzerland. In the following we have picked out 3 highly...