ResearchGermany Sector Reports (Part 1)

The medical technology industry in Germany: turnover, statistics, background

Along with the USA and Japan, Germany is one of the countries with the most medical technology suppliers. The turnover of the German MedTech industry was 33.4 billion euros in 2019. In addition to its economic importance, the industry is an important employer with around 210,000 employees. The industry is predominantly characterised by medium-sized companies. The German medical technology industry occupies second place in terms of worldwide patent applications and generates around 1/3 of its turnover with products that are less than 3 years old. The sector is therefore highly innovative and dynamic [1]. The following sector report provides detailed insights into the fields of activity and innovations in the medtech industry, the most important locations, key financial figures and insights into the gender ratio and efforts in the area of sustainability.

1) Field of activity of the German medical technology industry: What is produced?

In total there are three areas in which medical technology develops and uses products: Medical devices and implants, imaging diagnostics and in-vitro diagnostics [2].

Medical devices and implants – artificial organs, prostheses, infusion pumps, etc:

Medical devices, systems and software solutions are the largest and most diversified sector within medical technology. One of the biggest players in the MedTech industry and especially in the medical equipment sector is the Fresenius SE & Co. KGaA, whose subsidiary Fresenius Medical Care is the world leader in the treatment of chronic kidney failure. Every second dialysis machine comes from Fresenius Medical Care. Dialysis systems from Fresenius are in great demand worldwide and, depending on the region, sales are growing between 5% and 9% annually. Another company that specialises in medical devices is Drägerwerk AG & Co. KGaA. In addition to anaesthesia and respiratory equipment, the company produces a wide range of monitoring systems, lighting and video systems and other medical system and software solutions. Also the Paul Hartmann AG, Top 5 of the largest German medical technology companies, has an extensive product portfolio, ranging from wound care products, care sets and surgical supplies to diagnostic products and systems, such as blood pressure monitors or clinical thermometers.

Image Source: Sartorius

Diagnostic imaging: ultrasound, X-ray, magnetic resonance therapy (MRT) etc.

Imaging diagnostics, also known as in vivo diagnostics, comprises a wide range of procedures for the visual examination of a patient’s structures and organs. A leading company in the production of systems and software solutions for medical imaging is Siemens Healthineers AG. Approximately 61% of the sales of the group, which has been independent since 2015, are generated by products for imaging diagnostics. The product portfolio of Siemens Healthineers is broad; from mammograms to computed tomography and state-of-the-art “molecular imaging” systems, they represent everything.

In-vitro Diagnostic

Image Source: Siemens Healthineers

In vitro diagnostics (Latin for “in the test tube”) describes the analysis of samples from the human body. The aim of the analysis is the (early) detection of diseases as well as the finding of therapies. The segment is changing; many hospital laboratory services are being outsourced and the trend is moving towards international laboratory services that are more efficient and, above all, cheaper [3]. For the Siemens Healthineers AG the production of in-vitro diagnostic systems and related services is the second largest pillar with around 5%. It manufactures comprehensive test systems (drug and medication tests, molecular test systems, ammunoassay systems, etc.) as well as laboratory automation equipment, IT solutions and digitalisation systems.

Our list of the 100 largest medical technology companies in Germany provides a detailed directory of German MedTech companies and their segments.

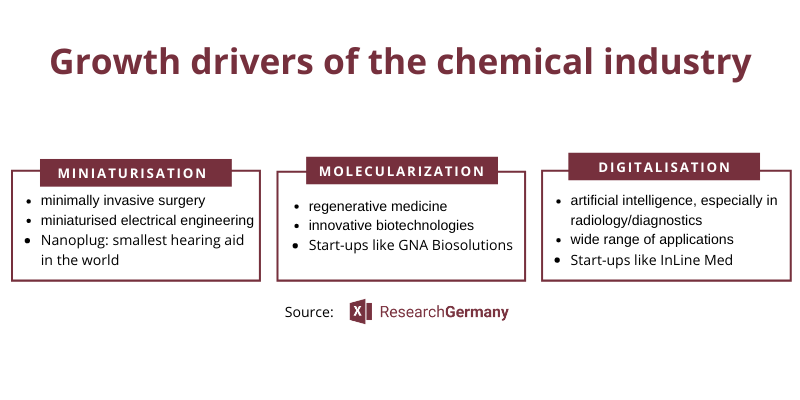

Innovations, trends and growth drivers in the industry

Image Source: Siemens Healthineers

Complex medical technologies are the last solution for many patients who have undergone drug therapy. The progress within the MedTech industry in recent years has been enormous – but we are still only at the beginning of a medical technology revolution. There are essentially three areas that offer immense progress and innovative solutions for medical technology: Miniaturisation, molecularisation and digitalisation. Miniaturisation is already taking place in minimally invasive surgery as well as in a wide variety of implantable microsystems. Whether cameras, probes or sensors; especially the strongly decreasing size of electrical engineering plays a major role here.The smallest hearing aid ever produced, the so-called Nanoplug, is just one of many examples where quality and size come together through highly complex systems. Molecularisation is a highly interesting field, especially for regenerative medicine, and polarises through the development of novel biomaterials as well as cell and tissue technologies. As in almost all industries, digitalisation is of great importance for the MedTech sector – in addition to improved image processing, modelling or simulations, the implementation of artificial intelligence (AI) is a very big step in the revolution of health care [1]. Siemens Healthineers AG describes the possible applications of artificial intelligence, which have arisen from greatly improved computing power, as “Mathematical revolution in radiology“. Whether counting cell nuclei, determining bone age or the early recognition of brain facts, these tasks are already being performed by artificial intelligence, leaving medical scientists more time for more complex questions. Expectations are high – 70% of managers in clinical laboratories expect AI systems to be introduced into in-vitro diagnostics within four years; 90% assume that AI will have long-term effects on the healthcare system and 50% are already actively involved in AI in laboratory medicine [4].

A promising start-up in the field of eHealth is the Startup InLine-Med, which has developed a solution for cancer diagnosis and treatment by combining AI, innovative guidance instruments and high-quality biopsy needles. Algorithms are used to achieve exact needle placement and ensure a more efficient procedure. EBS Technologies is also a potential start-up in the MedTech sector. The startup has developed a simulation system that can be used for the treatment of neurologically induced impairments of the visual field, caused for example by a stroke or traumatic brain injury. Non-invasive stimulation of the optic nerve can lead to neuroregeneration. Studies show that this procedure can partially restore the patient’s visual field. The BioTech Startup GNA Biosolutions produces molecular test systems that are faster and smaller than comparable models. By the end of 2019, they have raised a full $13.5 million in a financing round.

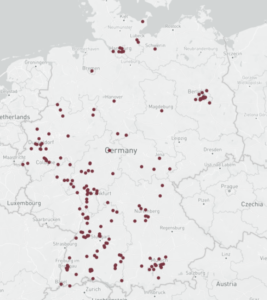

2) Map of medical technology companies: Where is production?

Medical Technology Cluster in Germany: MedTech Valley in Hessen and Baden-Württemberg

Medical Technology Cluster in Germany: MedTech Valley in Hessen and Baden-Württemberg

With more than 800 companies and over 50,000 employees in the MedTech sector, Baden-Württemberg is the largest location for medical technology companies. In addition to a steady stream of new start-ups, the turnover figures speak for a successful industrial location: In 2016, Baden-Württemberg generated a total of around 13.5 billion euros with an annual growth expectation of 4%. At the same time, 70% of the turnover is generated by 34 companies. About 2% of the total turnover is produced by approximately half of the companies -those employ less than 10 employees. The diversity of the segments is also impressive: In addition to the focus on surgical instruments and therapeutic systems and devices, fields such as implants, dental products, point-of-care diagnostics, in-vitro diagnostics and many others are served [5]. Europe’s largest medical technology cluster is located in Tuttlingen, also known as the “city of healing knives”. In addition to around 400 MedTech companies, Tuttlingen also has many suppliers and service providers specialising in medical technology [6].

n addition to global players in the MedTech sector such as Fresenius, B. Braun, Merck and Heraeus Holding GmbH, there are many small and medium-sized companies in Hessen – in total, the sector provides as many as 20,000 jobs. With an export quota of 68%, Hessen’s export share to international markets is high compared to the rest of the industry (60%). In addition, investment in research and development, at 13.5%, is also above the industry average (8%-9%). Hessen’s location factors also speak in favour of the industrial location – in addition to highly qualified personnel, the infrastructure, support offers and proximity to customers and suppliers are positively evaluated. This positive assessment leads to an impressive 90% satisfaction rate with the Location among medical technology companies in Hessen [5].

Lists matching this industry report

-

Rated 4.50 out of 5€1.499,99 Incl. VAT

-

Rated 5.00 out of 5€199,99 Incl. VAT

-

Rated 4.50 out of 5€199,99 Incl. VAT

-

Rated 5.00 out of 5€349,99 Incl. VAT

3) Key financial figures of the medtech industry: What is the market volume?

Market volume

Companies with turnover below €1 billion (2018)

Sales development of the top 5

The figures are based on our database and can be found in the list of the top 100 medical technology companies in Germany.

Market volume and total sales in the German medical technology industry: 2015-2018

The German MedTech industry is a growth market. This is mainly due to the constant medical-technical progress and the demographic development, which leads to an increasing demand for innovative and gentle medical technology. In addition, more and more importance is being attached to health in private and professional contexts. The broadened concept of health is leading to a greater awareness of a better quality of life and thus to expectations of high-quality, modern medical technology. This growing demand is reflected in the development of sales in recent years: the trend is clearly upwards. And the upswing will remain the same – an annual growth rate of 6% is predicted in the global MedTech industry until 2024 [1].

The graphs are based on our list of the top 100 medical technology companies in Germany. As our database contains the total turnover of the companies, there may be deviations from figures on turnover only in the MedTech sector.

Competition analysis: What is the market structure in the medtech industry?

The MedTech industry in Germany is characterised by medium-sized companies; a remarkable 93% of the industry employs less than 250 people. This includes 13,000 micro-enterprises. Only 90 companies in the medical technology sector have more than 250 employees. This is also reflected in the turnover figures: the big players generate a considerable part of the market volume. In 2015-2018 the top 5 German MedTech companies will generate over 70% of the total turnover of the sector. 92% of the companies have an annual turnover of less than € 1 billion.

Development of the German market leaders in the medical technology industry

The largest MedTech manufacturers in Germany are very diverse – the market leader, founded in 1912, is Fresenius SE & Co. KGaA the largest private hospital operator in Germany and with its subsidiary Fresenius Medical Care AG & Co. KGaA the world leader in the manufacture and distribution of dialysis machines. In the Forbes Global 2000, Fresenius SE & Co. KGaA ranks 240th (as of June 2020) and is thus one of the largest and best-selling companies in the world.

The independent group since 2015 Siemens Healthineers AG is one of the top 10 largest MedTech companies in the world. The Group’s largest pillar is imaging procedures; in addition, the medical technology company develops equipment for laboratory diagnostic procedures and ultra-modern systems for minimally invasive procedures, among other things.

The Hessen-based B. Braun Melsungen AG divides its business into four different divisions: Hospital Care is the world leader in products for clinical care and treatment of inpatients. Aesculap is the market leader for hand-held surgical instruments, Out Patient Market focuses on the treatment of patients outside the hospital, for example chronically ill patients. The last division, B. Braun Avitum is one of three globally active full-service providers of extracorporeal blood treatment (dialysis). Worldwide, all divisions show a strong sales development.

The Drägerwerk AG & Co. KGaA with its 100 subsidiaries is divided into two divisions: medical and safety technology. The medical technology division accounts for around 2/3 of total sales. Drägerwerk mainly offers anaesthesia workstations, ventilators, patient monitoring and various systems for perinatal medicine. Compared to the other market leaders, the MedTech company’s sales performance is relatively low, but very stable and solid.

The family business Karl Storz SE & Co. KG was founded in 1945 and is represented in 44 countries with 47 locations. The Tuttlingen-based company is divided into three divisions: human medicine, industry and veterinary medicine. The company’s product range is broad and includes neurosurgery, plastic surgery and microscopy. Although Karl Storz has the lowest turnover of the market leaders, it is the world market leader in human medical instruments for both minimally invasive surgery and rigid endoscopes.

4) Gender balance and sustainability

Share of women on management boards

Gender distribution in the medical technology industry

The proportion of women on management boards in the MedTech industry in Germany is 10%. According to the Federal Statistical Office, the national average of female executives is 30%, but this figure includes supervisory boards. Looking at the top 5 of the large medical technology companies in Germany (Fresenius SE & Co. KGaA, B. Braun Melsungen AG, Drägerwerk AG & Co. KGaA, KARL STORZ SE & Co. KG and Siemens Healthineers AG), one can see that out of 23 managing directors, 4 are female – that is 7%. Drägerwerk AG is setting a good example – 50% of the members of the Executive Board are women.

The data for the graphics and text are taken from our database and refer exclusively to the (managing) directors.

Sustainability in German medical technology:

According to the NGO Health Care without Harm the health sector, including medical technology companies, is responsible for 4.4% of global pollutant emissions. Sustainability has therefore long been an important topic for German MedTech companies, where there are different approaches to becoming more sustainable, environmentally aware and resource-saving. In the following, we will present the most important sustainability areas in medical technology and present concrete examples and implementations.

Energy is one of the most important starting points for more sustainable action. The production site of Drägerwerk AG in Lübeck sets a good example in this respect – according to the Sustainability Report from 2019, the site uses heat from the local waste disposal site in addition to its own gas-fired block heating plant. There is also a heat recovery system that reduces exhaust air losses by 75%. Sales growth also means an increasing demand for energy – the B. Braun Melsungen Group continues to focus on renewable energies, according to their Sustainability Report (2018). From 2015-2017, non-renewable energies will increase by 6%, while renewable energies will grow by as much as 23%. Germany has the largest share of renewable energies at 33%.

Energy is one of the most important starting points for more sustainable action. The production site of Drägerwerk AG in Lübeck sets a good example in this respect – according to the Sustainability Report from 2019, the site uses heat from the local waste disposal site in addition to its own gas-fired block heating plant. There is also a heat recovery system that reduces exhaust air losses by 75%. Sales growth also means an increasing demand for energy – the B. Braun Melsungen Group continues to focus on renewable energies, according to their Sustainability Report (2018). From 2015-2017, non-renewable energies will increase by 6%, while renewable energies will grow by as much as 23%. Germany has the largest share of renewable energies at 33%.

Water management begins with the procurement and use of waste water and ends with its disposal. The Fresenius Group announces in its Annual Report from 2019 that 91% of the water was provided by the respective public supply, only 7% is groundwater. Especially in countries with water scarcity, where many production sites of MedTech companies are located, this valuable resource must be handled carefully. The B. Braun Group cooperates according to their Sustainability Report with the WWF’s Water Risk Filter to identify countries where water is scarce. In these countries, the respective production sites then recycle around 60% of the water extracted, the rest is either bound to products or evaporated.

The Fresenius Group announces in its Annual Report from 2019 that 91% of the water was provided by the respective public supply, only 7% is groundwater. Especially in countries with water scarcity, where many production sites of MedTech companies are located, this valuable resource must be handled carefully. The B. Braun Group cooperates according to their Sustainability Report with the WWF’s Water Risk Filter to identify countries where water is scarce. In these countries, the respective production sites then recycle around 60% of the water extracted, the rest is either bound to products or evaporated.

Waste management and recycling go hand in hand. In order to make products more durable, Drägerwerk offers maintenance and repairs. Thanks to the company’s commitment, materials are also reused or properly disposed of – for example, the recycling of products containing soda lime has led to a saving of almost 30 tons of CO2 in 2019. Also B. Braun Melsungen also offers innovative solutions: Raw material waste and costs are minimized by regranulating polyethylene residues that remain as waste during production. Every day, 17 tons are thus recycled and reused.

Waste management and recycling go hand in hand. In order to make products more durable, Drägerwerk offers maintenance and repairs. Thanks to the company’s commitment, materials are also reused or properly disposed of – for example, the recycling of products containing soda lime has led to a saving of almost 30 tons of CO2 in 2019. Also B. Braun Melsungen also offers innovative solutions: Raw material waste and costs are minimized by regranulating polyethylene residues that remain as waste during production. Every day, 17 tons are thus recycled and reused.

5) Statistics and facts in the medical technology sector

- There are three categories into which medical technology can be divided:

- Medical devices and implants (e.g. dialysis machines from Fresenius or monitoring systems from Drägerwerk)

- Diagnostic imaging (e.g. mammograms from Siemens Healthineers)

- In-Vitro Diagnostics (e.g. drug and medication tests from Siemens Healthineers)

- The growth drivers in the MedTech industry can also be divided into three are

- Miniaturisation, above all made possible and implemented by miniaturised electrical engineering

- Molecularisation, which is very important for regenerative medicine

- Digitalisation, which is gaining in importance, especially through AI systems in radiology and diagnostics

- In the traditional locations of Hessen and Baden-Württemberg, large MedTech clusters are to be found in both the market structure and the product portfolios due to their high diversity

- Medical technology is a growth market – an annual growth rate of 6% is predicted

- The market structure is characterised by medium-sized companies and has few large players (only 8% have an annual turnover of > €1 billion)

- The management is predominantly male with 90% of the members

- Energy, water and waste management are key sustainability issues for German medical technology companies

Article Image Source: Drägerwerk AG & Co. KGaA

Sources (last accessed on 07.06.2020)

[1] https://www.bvmed.de/download/bvmed-branchenbericht-medtech.pdf

[2] https://www.technologieland-hessen.de/medizintechnik

[3] https://www.technologieland-hessen.de/mm/Broschuere_VitroDiagnostik.pdf

[4] https://www.siemens-healthineers.com/de/news/medizin-von-morgen.html

[5] https://www.technologieland-hessen.de/mm/1.02_ha_medizintechnik_12_screen_final.pdf

[6] http://www.medizintechnik-tuttlingen.com/

Iconsources (last accessed on 07.06.2020):

(a) https://www.flaticon.com/de/autoren/freepik

(b) https://www.flaticon.com/de/autoren/good-ware

(c) https://www.flaticon.com/de/autoren/bqlqn