Description

List of the 10 largest medical technology companies in Germany

Alongside with the USA and Japan, Germany is one of the countries with the most medical technology suppliers. The turnover of the MedTech industry in 2019 was 33.4 billion euros. Around 210,000 people work in the industry, which is organised on a very small scale. Only 90 medical technology companies have more than 250 employees.

1. Fresenius SE & Co. KGaA, Bad Homburg

Fresenius has its origins in a pharmacy founded in Frankfurt am Main in 1462 and is one of the largest German health care groups. The company operates as a clinic operator (Fresenius Helios) as well as a manufacturer of medical technology and provider of health services. Medical technology is provided by the subsidiaries Fresenius Medical Care AG & Co. KGaA (dialysis technology) and Fresenius Kabi AG. Fresenius Kabi produces, among other things, application technology and application systems for infusion therapies and clinical nutrition. The two subsidiaries employ about 160,000 people, the total group has about 294,000 employees. This makes Fresenius one of the most important medical technology companies in germany.

Update 2022: Fresenius recently launched a new company in the U.S. under the InterWell Health brand. InterWell Health combines the expertise of various players, including Fresenius Health Partners, in the field of value-based renal care.

2. Siemens Healthineers AG, Erlangen

Siemens Healthineers is a subgroup of the Siemens Group. It bundles the medical technology activities. Siemens Healthineers was founded in 2015 from a previously legally dependent business unit and was converted into a stock corporation in 2017 in the course of the IPO. The subgroup employs around 50,000 people in 75 countries worldwide. Siemens Healthineers stands for a wide range of medtech products – including diagnostic equipment, radiation and particle therapy systems and medical informatics equipment. This makes the stock corporation one of the most important medical technology companies in germany.

3. B. Braun Melsungen AG, Melsungen

A pharmacist from Melsungen founded B. Braun Melsungen in 1867. The company supplies medical technology, pharmaceutical products, and services for various sectors. One focus is on technical solutions for surgery, and the company also offers various forms of therapy, hygiene and wound management, and medical care. B. Braun Melsungen employs nearly 65,000 people in 64 countries worldwide. This makes Braun one of the most important medical technology companies in germany.

Update 2023: As of January 01, 2023, Aesculap AG became the sole shareholder of Schölly Fiberoptic GmbH. The integration of the company founded by Regula Schölly into Aesculap AG and thus also into the B. Braun Group was thus further advanced. In the field of visualization systems, the North Hessian group thus consolidates its strong position.

Update 2024: From 01.04.2024, Dr. Jean-Claude Dubacher will become a member of the Management Board of B. Braun SE. He will assume responsibility for B. Braun Avitum.

4. Drägerwerk AG & Co. KGaA, Lübeck

Dräger has been based in Lübeck since 1889, a German technology group with two pillars: medical technology and safety technology. The descendants of the founder Johann Heinrich Dräger continue to exert a significant influence. In medical technology, Dräger supplies ventilators, anesthesia equipment, patient monitoring devices and perinatal care. The company has almost 15,000 employees and sells Dräger products worldwide.

5. Paul Hartmann AG, Heidenheim an der Benz

The Hartmann-Group emerged from a spinning mill taken over in 1818. The company grew up with dressing materials and wound care products. Today Hartmann offers a wide range of small medical and care products. They also include smaller medical devices such as ECG and blood pressure monitors, infrared thermometers, medical scales or activity wristbands. The company, which is divided into several subsidiaries, provides work for around 11,000 employees.

6. Röchling SE & Co. KG, Mannheim

Röchling has its roots in the Saarland coal and steel industry, but today its business model is based on plastics processing. Röchling Medical is one of three divisions and manufactures plastic components for medical technology companies and the pharmaceutical industry. Here, Röchling functions as a medical technology supplier in the segments Diagnostics, Fluid Management, Pharmaceuticals and Surgery & Interventional. The company has approximately 11,000 employees.

7. KARL STORZ SE & Co. KG, Tuttlingen

KARL STORZ is a typical family business. Founded in 1945 with a focus on instruments for ENT medicine, the company has developed into the leading supplier of endoscopes. Medical technology endoscopes are manufactured for use in human and veterinary medicine. They are of great importance in diagnostics and minimally invasive procedures. Endoscopes are also manufactured for industrial applications. The company has about 8,000 employees.

8. Sartorius AG, Goettingen

Sartorius started in 1870 as a precision engineering workshop in Göttingen. Today, Sartorius ranks among the 20 largest companies in Lower Saxony with over 9,000 employees and is a major pharmaceutical and laboratory supplier. For these two areas, Sartorius supplies technical equipment and also software for analysis purposes. Sartorius products include, for example, biorectors/fermenters, filters, laboratory balances, analytical equipment and much more.

9. Carl Zeiss Meditec AG, Jena

Carl Zeiss Meditec was formed in 2002 from a business combination and is majority-owned by the Carl Zeiss Group. The business model is entirely focused on medical technology and comprises two areas: Opthalmic Devices (laser and diagnostic systems for ophthalmology) and Microsurgery (surgical microscopes for ENT and neurosurgical operations). Another field of activity is intraoperative radiotherapy. Carl Zeiss Meditec has over 3,000 employees.

10. Gerresheimer AG, Düsseldorf

Gerresheimer has been in existence since 1864 and manufactures specialty products made of glass and plastic for the pharmaceutical, healthcare, cosmetics and food industries – often on a contract manufacturing basis. Activities in this field were intensified with the takeover of the Swiss medical technology company Sensile Medical. The focus is on micropumps for dispensing liquid medications. The subsidiary respimetrix GmbH – acquired in 2019 – is developing a technical platform for inhalation measurement. Gerresheimer has almost 10,000 employees.

Picture source: National Cancer Institute via Unsplash (29.06.2023)

The following information is included

- Company name

- General contact data (address, e-mail address, telephone number, URL)

- Name of the management

- Serial letter suitable for addressing the management (e.g. “Dear Dr. Müller”)

- Sales figures for the years 2021, 2020, 2019, 2018, 2017, 2016 and 2015 (taken from the annual and consolidated financial statements)

- Employee figures for the years 2021, 2020, 2019 and 2018 (taken from the annual and consolidated financial statements)

- Sector classification & Field of activity

Note: If the sales and employee figures are not included in a company’s own financial statements but in the parent company’s consolidated financial statements, the data from the respective consolidated financial statements are provided.

Picture source: Piron Guillaume

MedTech players: Covered areas

- Diagnostic Systems

- Solutions for intensive care and emergency medicine

- Implants and implant technology

- Dental products and technologies

- Medical imaging

- Catheter

- Surgical microscopes

- Medical lasers

- Prostheses

- etc.

Picture source: Robina Weermeijer

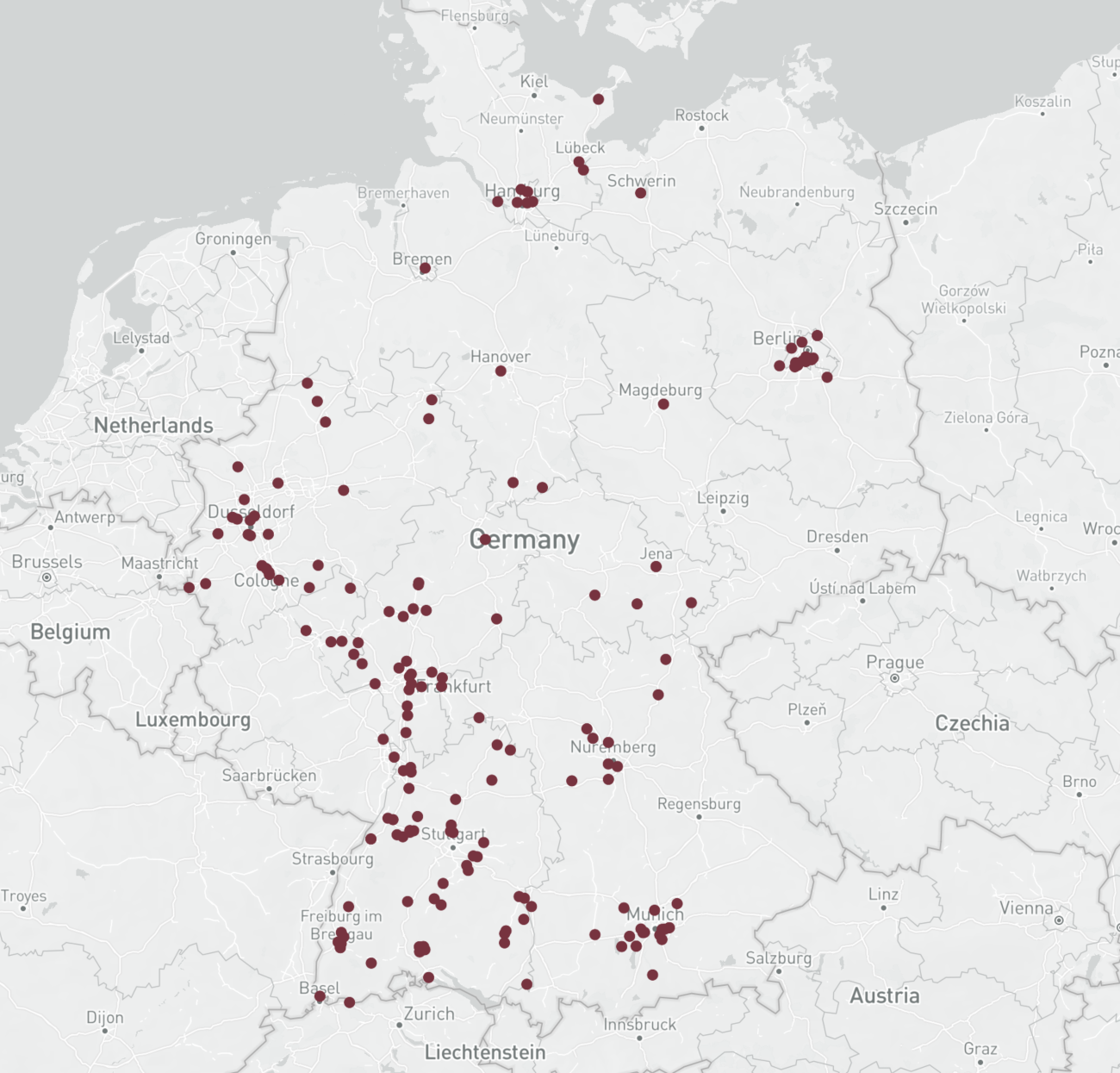

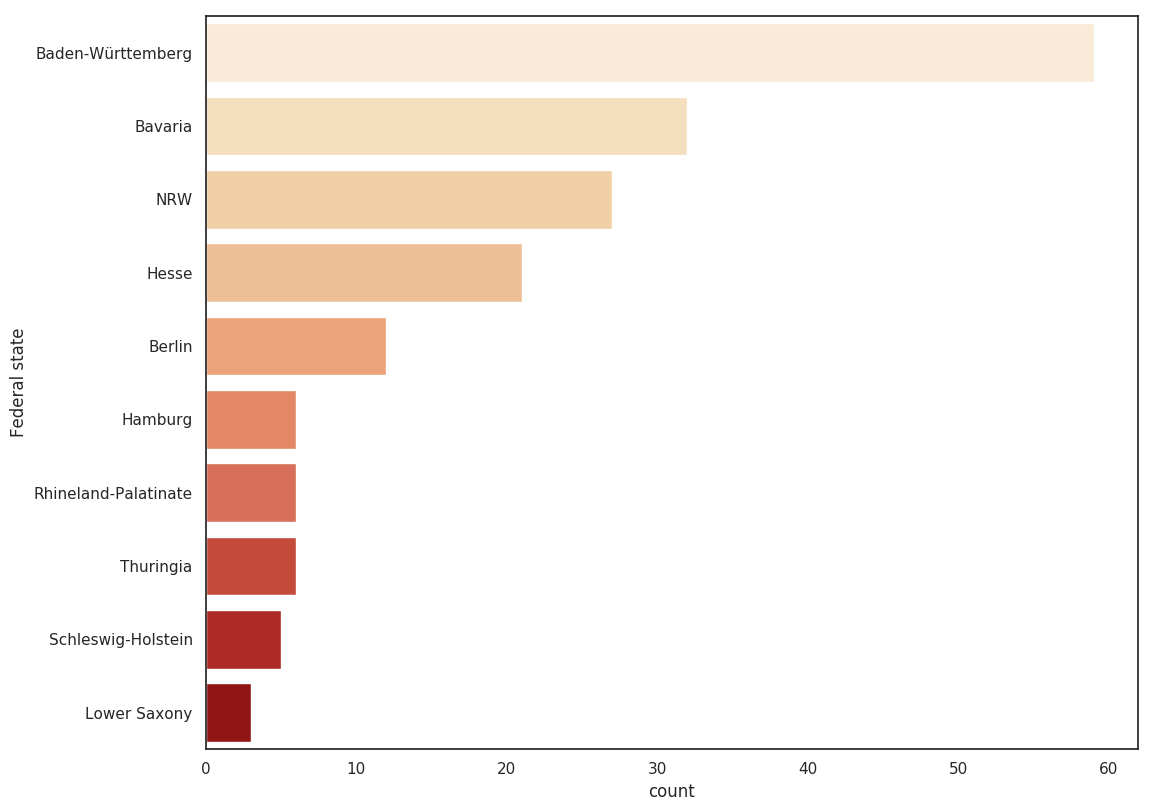

Headquarters in one Map & Distribution by federal state

Medical Engineering industry Germany: Statistics and facts

MedTech – that is the combination of medicine and technology. No medical practice or hospital today can do without complex medical equipment. Manufacturing and distribution form the business model of the MedTech industry. The industry association BVmed brings together just over 100 companies. There are only a few large medical technology companies on the market. Most companies are medium-sized, over 90 percent have less than 250 employees.

In total, the industry offers more than 200,000 jobs. The largest providers are Siemens Healthineers (examination and diagnostic technology, radiotherapy, medical information processing), Fresenius Medical Care (dialysis equipment and services), B. Braun Melsungen (hospital equipment, surgical instruments), Bayer (image diagnostic procedures), the Hartmann Group (wound treatment and care) and Drägerwerk (respiratory equipment).

The medtech industry is highly innovative and a driver of medical progress. Very short product cycles are typical. One third of sales are generated with medical technology that is no older than three years. Exports are very important for the business. Exports account for almost two thirds of sales. The total turnover of German MedTech companies in 2019 was 33.4 billion euros, of which 21.9 billion euros were generated by exports. 42 percent of exports went to EU countries. Important other sales markets are the USA and China.

Any questions? Get in touch!

Leo Semmelmann, Founder

contact [at] researchgermany.com

+49 (0) 89 92927741

We are looking forward to help you in case of any questions, remarks and individual requests. Feel free to get in touch via email, live chat or phone. We can also offer you package prices and can create individual lists.

Contains the 250 largest medical technology companies from Germany from numerous sectors such as orthopedics, surgical instruments, implants, lasers, centrifuges, respiratory technology, diagnostics, etc. The list is an excerpt from our

Contains the 250 largest medical technology companies from Germany from numerous sectors such as orthopedics, surgical instruments, implants, lasers, centrifuges, respiratory technology, diagnostics, etc. The list is an excerpt from our

Karl Laab (verified owner) –

Thanks for making the database available quickly. I am satisfied with the data and recommend ResearchGermany. But there are a few entries from German medium-sized companies missing, which I have in my address list.

Changyang Li (verified owner) –

Comprehensive overview, good data quality. Thank you.