After the USA and Japan, Germany is the world’s most important location for medical technology companies. In 2019, the turnover of the medical technology industry in this country amounted to 33.3 billion euros (43.9 billion euros with micro-enterprises). Of this, 22 billion euros, or just under two-thirds, was generated abroad, while 11.3 billion euros, or a good third, was generated domestically. The medical technology sector provides almost 150,000 jobs. It is primarily characterized by small and medium-sized enterprises. This article is based on the unique List of the 200 largest medical technology companies in Germany.

-

Rated 4.50 out of 5€199,99 Incl. VAT

- Article based on database of the 200 most important medical technology companies in Germany

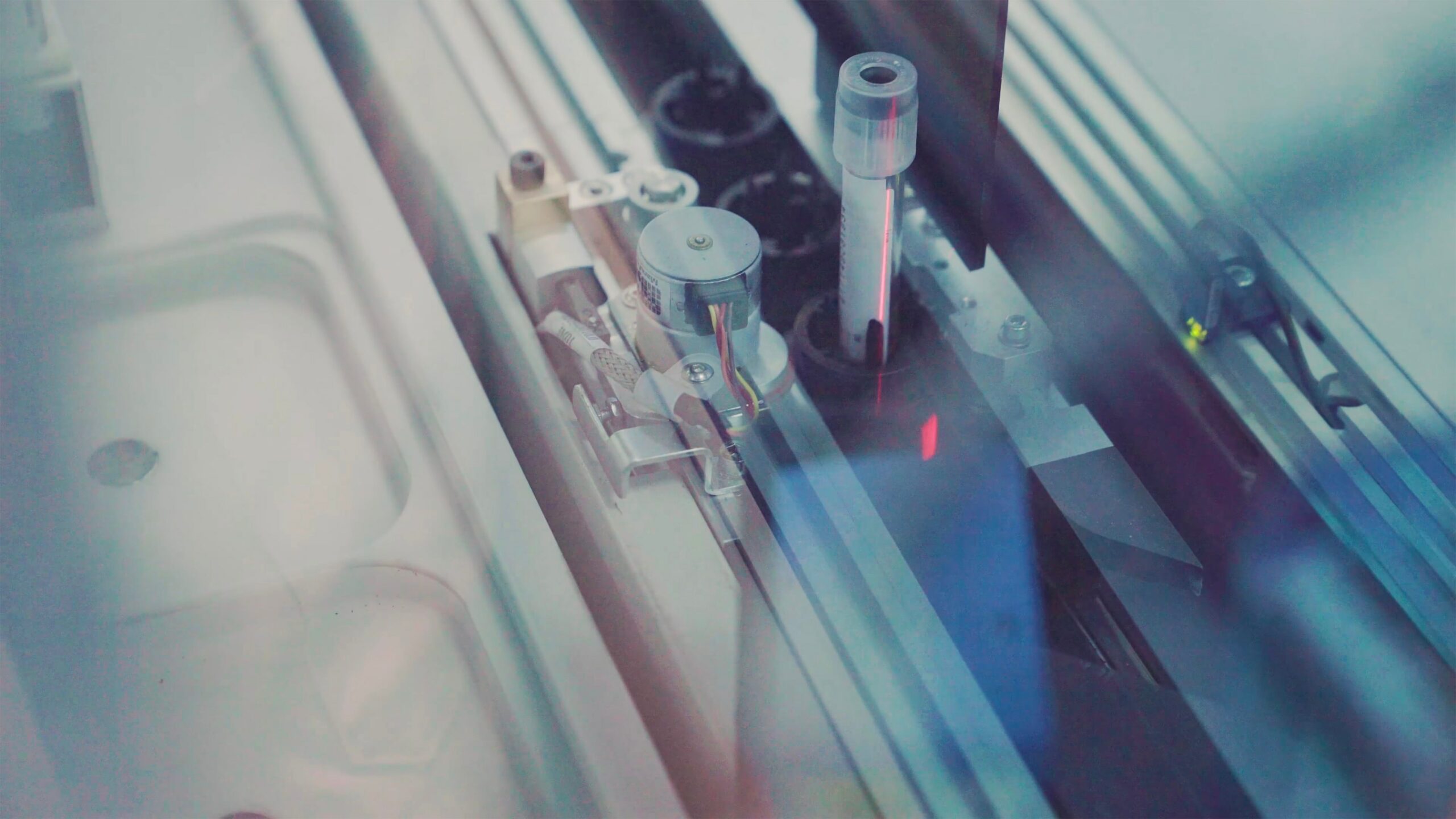

- Detailed information on the field of activity (orthopaedics, surgical instruments, implants, laser, centrifuges, ventilation technology, diagnostics, etc.)

- Including: sales (2015-2018), number of employees, e-mail, address, telephone number, management, etc.

- Direct download as Excel file via the ResearchGermany online store possible

- Free preview file available on request

Medium-sized and micro enterprises dominate

The above figures do not include the many micro-enterprises (companies with fewer than 20 employees) in the medical technology sector. There are around 13,000 of these with 60,000 employees. On average, there are four to five jobs per company. The medical technology micro-enterprises generated a turnover of 10.6 billion euros in 2019. That is a little more than 800,000 euros per company. Of the remaining just over 1400 medical technology companies, 93 percent belonged to the SME sector. The employment range here was between 20 and 250 employees.

Smaller companies also dominate in this segment. A good two thirds of the companies did not exceed the threshold of 50 employees. Only slightly more than 90 medical technology firms can be counted among the larger companies with more than 250 employees. If we look at all medical technology companies (including micro-enterprises), large medical technology companies account for a good 56 percent of industry sales in 2019, medium-sized companies for 19.5 percent and micro-enterprises for 24.1 percent. The strongest medical technology states in the Federal Republic are Bavaria, Baden-Württemberg, Hesse, Schleswig-Holstein and North Rhine-Westphalia.

Source: Listenchampion Image source: Unsplash

In our sector report of the German medical technology industry you will find detailed information on areas of activity, an overview of the locations and clusters of the logistics sector, key financial figures as well as insights into the gender distribution and sustainability efforts of the industry. In addition to in-vitro diagnostics, which is essential for testing for Covid-19 viruses, other areas of medical technology are also considered and analysed.

In our sector report of the German medical technology industry you will find detailed information on areas of activity, an overview of the locations and clusters of the logistics sector, key financial figures as well as insights into the gender distribution and sustainability efforts of the industry. In addition to in-vitro diagnostics, which is essential for testing for Covid-19 viruses, other areas of medical technology are also considered and analysed.