Description

List of 3 large asset managers in Germany

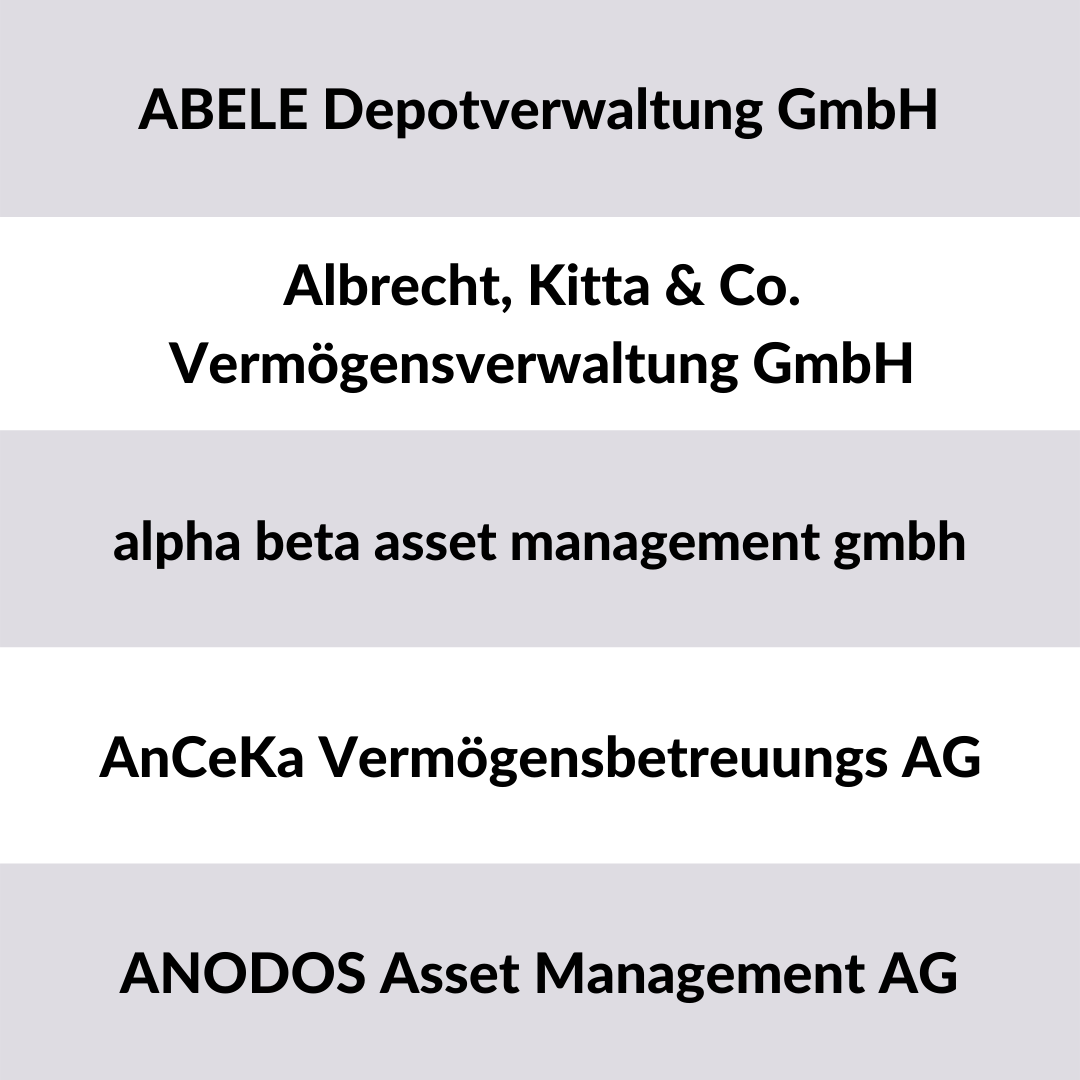

Below we present three major asset managers from our list.

1. albrecht, Kitta & Co. Vermögensverwaltung GmbH (Hamburg)

The Hamburg-based asset manager “Albrecht, Kitta & Co. Vermögensverwaltung GmbH” is a rather young German asset manager. Several hundred million euros are managed. The focus is on institutional investors, family offices and foundations. By refraining from brokerage transactions, conflicts of interest are avoided.

Update 2023: The asset manager from the Hanseatic city continues to focus on healthy growth and, in this context, also has an eye on future-proof investments in the hydrogen sector, which investors should not, however, view as an isolated topic. For a systematic decarbonization, the producers of electrolysers, green electricity or infrastructure companies are also interesting for hydrogen investments in the investment strategy – in addition to hydrogen producers.

2. DJE Kapital AG (Pullach)

Pullach-based asset manager DJE Kapital (named after Dr. Jens Ehrhardt) is one of the established names in the German asset management world. More than 16.4 billion euros are managed by approx. 160 employees. The Pullach-based investment house has a great deal of expertise in equity funds in particular.

Update 2024: Enormous award for the asset manager based just outside Munich: DJE Kapital AG was awarded the Golden Bull as “Fund Boutique of the Year”. The award is considered the Oscar of the German financial sector.

3. FERI Trust GmbH (Bad Homburg)

The Bad Homburg-based FERI Group is one of the leading asset managers in Germany. Founded in 1987, FERI stands for Financial Economic Research International. More than 200 employees manage over 53 billion euros in assets. In addition to institutional investment management, family office services are also offered.

Picture source: Joshua Sortino via Unsplash (23.08.2023)

What are asset management companies?

As the name suggests, asset managers take care of managing their clients’ assets. In most cases, this is done by imposing equity funds. In Germany, the service provided by asset managers is referred to as “financial portfolio management” (regulated by Section 1 (1a) No. 3 of the German Banking Act (KWG)). The clients of asset managers mostly include institutional investors, such as insurance companies, pension funds or foundations. However, many asset managers also offer their services to private investors or family offices.

Access to the largest financial portfolio managers

Asset managers occupy an important place in the German investment industry. Similar to multi family offices (MFO), they often manage billions of euros of wealthy clients. These can be private clients, as well as foundations or institutional partners who have their assets invested by professionals. Most MFOs are headed by experienced asset managers who have often previously held senior positions at private banks or in investment banking. Our listing of the largest asset managers in Germany enables an effortless entry into the world of asset management. The database is available to you immediately after purchase as a clear Excel list and is perfect for directly contacting asset managers. The list contains contact details (address, e-mail address, telephone number, URL), the names of the management, a breakdown by client group (institutional clients or private clients) and information on whether real estate investments are made.

Database of the most important German wealth managers

The market of the largest German asset management companies is comparatively opaque. Until now, there was no overview of the most relevant German asset managers, making it difficult to target highly liquid companies. Listenchampion’s experienced research team has changed this and created a comprehensive database of the most important asset managers in Germany. You benefit from our know-how of the European investment scene, which we also demonstrate with other lists from the surrounding area. Thanks to our list you save hours of research and can start directly with the actual work.

This information is included in the list

- Company name

- Contact details (postal address, e-mail address, telephone number, URL)

- Names of the management

- Breakdown by client group (private clients, institutional clients, foundations, family offices)

- Real estate investments (yes/no)

- Assets under management (if publicly disclosed)

- Ranking from A-C measured by amount of assets under management, experience and size

Picture source: Juan Marin via Unsplash (23.08.2023)

Lead generation for fund managers, consultants, brokers, banks as well as private individuals

Our satisfied customers include experts from a wide variety of fields. The list of the largest German asset managers is of particular interest to fund managers, consultancies and banks that wish to work with asset managers. However, brokers have also been able to profitably use our database to acquire new clients. Of course, the overview is also used by investors from private and institutional environments to identify the right asset manager for their own requirements. You can use the list for lead generation as you see fit – whether by mail, e-mail or phone call. We wish you every success and sustainable partnerships.

Exclusive ranking of the most important players

When researching the companies for our database of the most relevant German asset managers, we analyzed the companies in detail. Our clients benefit from a wealth of information that we have clearly presented. They can immediately filter for asset managers that specialize in institutional clients, offer foundation consulting or provide multi-family office services. The list also includes a ranking that ranges from A to C. Asset managers with an A ranking have particularly high assets under management and generally cover the whole of Germany. Asset managers with a B ranking often operate with a regional focus, but still manage veritable assets and are characterized by years of expertise. Firms ranked C are somewhat smaller. This is reflected in the team size, assets under management and number of clients. The ranking provides you with a simplified introduction to the world of Germany’s most important asset managers.

What distinguishes the scene in Germany?

Asset management is a competitive business with numerous players active. Our database provides some interesting details about the scene in Germany. While 56% of the German asset managers from our list serve institutional clients, 95% of asset managers operate in the private client business. Thus, very few companies focus exclusively on institutional clients. Some asset managers launch their own funds, while others rely on third-party investment products. In addition, more and more asset managers are also present in the real estate sector. As many as 23% of the companies on our list are active in real estate investments and are participating in the real estate boom of recent years. Even these brief remarks make it clear how diverse the sector of the largest asset managers in Germany is. They offer promising opportunities for cooperation to numerous client groups and we are happy to assist in the initial contact.

Germany coverage: Munich, Frankfurt, Hamburg, Berlin, Düsseldorf and Co.

The German asset management scene covers the whole of Germany. While the largest asset managers operate throughout Germany, some (mid-sized) asset managers focus on specific regions. For this reason, it is important to analyze the complete German market. Listenchampion’s research team has used advanced methods to identify the most relevant players across Germany. A particularly large number of asset management companies are based in Munich, Frankfurt and Hamburg. But of course the list of top asset managers also includes numerous companies from other large cities such as Berlin but also smaller places such as Bad Homburg or Grünwald. Whether you focus on northern Germany, have clients mainly from Bavaria, or operate nationwide, our database will help you find valuable partners throughout Germany.

Picture source: Towfiqu barbhuiya via Unsplash (23.08.2023)

Any questions? Get in touch!

Leo Semmelmann, Founder

contact [at] researchgermany.com

+49 (0) 89 92927741

We are looking forward to help you in case of any questions, remarks and individual requests. Feel free to get in touch via email, live chat or phone. We can also offer you package prices and can create individual lists.

Contains the 300 largest asset & wealth managers from Germany including information on the client groups served (private clients, institutional clients, foundations, family offices).

Contains the 300 largest asset & wealth managers from Germany including information on the client groups served (private clients, institutional clients, foundations, family offices).

Reviews

There are no reviews yet.