Description

List of 3 residential real estate investors in Europe

Residential real estate is a core business of the real estate industry. In our database we have collected the largest investors actively investing in Europe. Here is a sample of 3 residential real estate investors.

1. PATRIZIA SE (Augsburg/Germany)

PATRIZIA is a real estate investor based in Augsburg, Germany. The company was founded in 1984 and manages real estate assets of 48 billion euros. PATRIZIA offers investments for institutional investors worldwide, and for private investors from Germany. In the residential real estate segment, PATRIZIA buys core, core+, and value-add properties with a value of 10 million euros or more. The project development department buys developed and undeveloped land and existing projects with development potential from a project volume of 35 million euros.

Update 2023: PATRIZIA was frequently active as a seller of real estate last year. For example, the CO:WK office building in Munich was sold, as was a retail property in Stadtberge.

2. MARK Capital Management LIMITED (London/England)

MARK is a British real estate investor that actively invests in residential real estate. The company invests using a multi-platform strategy through which they manage multiple funds. Through “Doma”, the company invests in residential properties in urban city centers in Europe. Doma currently owns over 700 apartments. With the platform “Meyer Homes” the company develops apartments in London.

Update 2024: The privately managed real estate investment management company MCM (MARK Capital Management) now manages assets of more than EUR 7 billion.

3. Pensionskasse des Bundes PUBLICA (Berne/Switzerland)

PUBLICA is a pension fund based in Bern. As a pension fund, it is organized under public law and serves over 66,000 people. PUBLICA is one of the largest Swiss pension funds with a balance sheet total of 42.5 million Swiss francs. The company invests in office, residential and retail properties in city centers and agglomeration communities in Switzerland. PUBLICA currently owns 75 properties.

Picture source: Isaac Quesada via Unsplash

These investor types are included in the list:

- Investment managers

- Real estate companies

- Project developers with portfolio acquisition

- Private equity investors

- REITs

- Pension funds

- Foundations

These property types are purchased:

- Multi-Family Properties

- Mixed-Use Residential Properties

- Residential neighbourhoods

- Residential Portfolios

- Serviced Apartments

- Microliving

Investors in the list are interested in:

- Core Real Estate

- Value add real estate

- Sales-and-Leaseback

- Trophy real estate

- Distressed Assets

- Project developments and forward deals

Included columns in our directory

- Company data (name, legal form, country of origin)

- Contact details (address, URL, e-mail, telephone number, management)

- Form of address of the management suitable for serial letters (e.g. “Dear Dr. Müller”)

- Investor type (investment manager, REIT, pension fund, private equity, etc.)

- Investment focus (asset classes, ranking from A to E, (global) investment volume / assets under management, detailed geographical focus)

- Special investment focus (debt, parking, forward deals, etc.)

- Link to the acquisition profile of the companies and contact details of an acquisition manager (if indicated on the investors’ website)

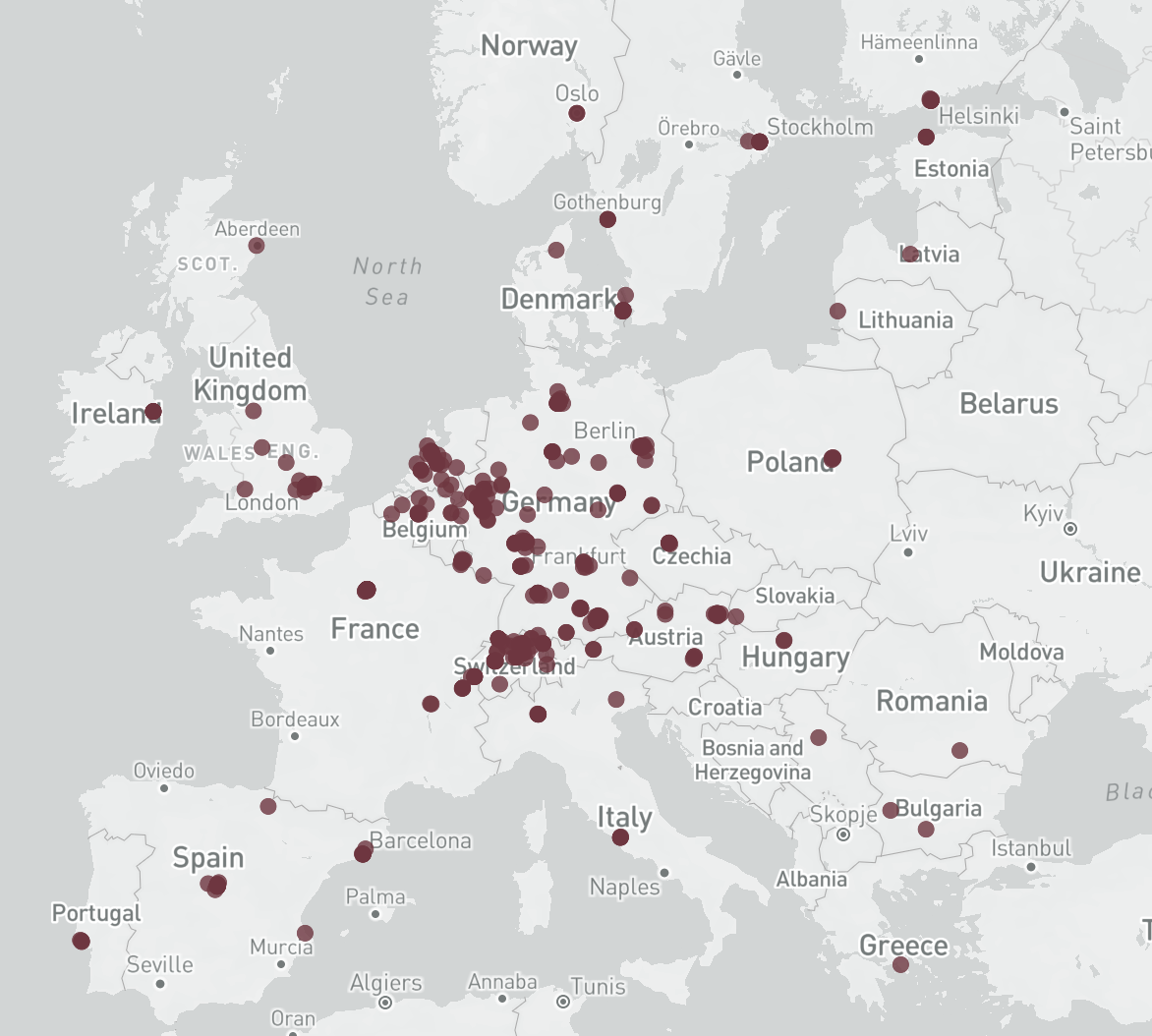

Where are European investors located?

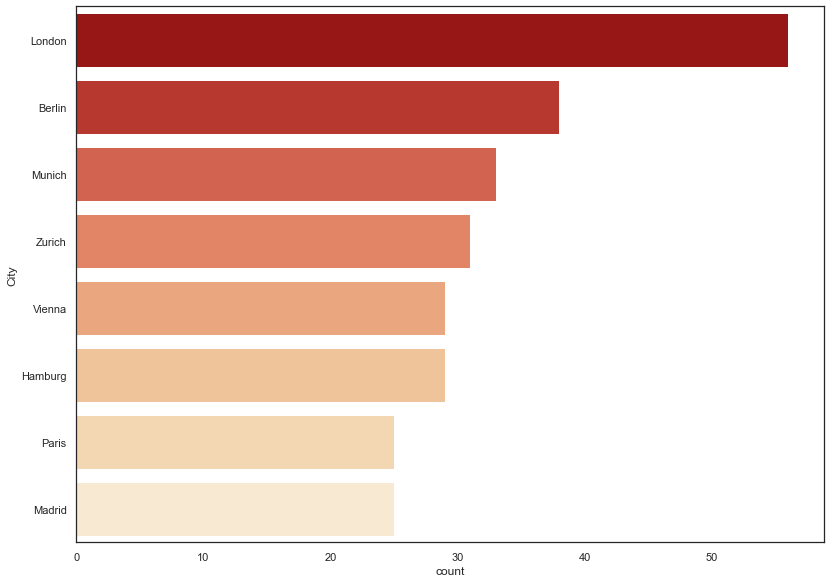

The map on the left provides an insight into our database of the largest residential real estate investors in Europe. The majority of investors is located in Germany, Switzerland and UK. Beside these countries, office real estate investors have their headquarters in other European nations.In many European countries, the most relevant real estate buyers cluster in the respective capitals.

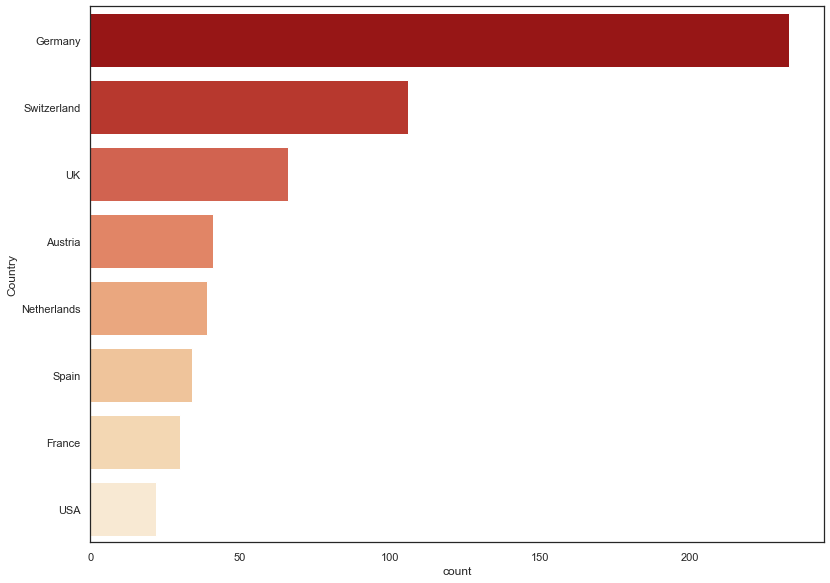

Countries of origin

Most of the residential real estate investors in our European list come from Germany. This is followed by Switzerland, the United Kingdom, and Austria. Also active are investors from the Netherlands, Spain, and France.

Investment classes in focus: multi-family homes, co-living and microliving

Residential real estate is one of the most popular asset classes in the real estate industry. The high demand for residential space in conurbations and metropolitan areas leads to a constantly high interest of investors and project developers in interesting projects. The residential asset class essentially comprises multi-family houses and residential properties with a mixed-use component. These can be stores as well as offices, with these components often found on the first floor. One type of property that has become increasingly important in recent years is microliving. This includes not only student living, but also serviced apartments and similar types of apartment buildings. Entire residential portfolios are of interest to large, often international investors. So if you want to sell one of these property classes, our database is an optimal entry point into the market.

Picture Source: Unsplash (Grant Lemons), K8 via Unsplash (23.08.2023)

Any questions? Get in touch!

Leo Semmelmann, Founder

contact [at] researchgermany.com

+49 (0) 89 92927741

We are looking forward to help you in case of any questions, remarks and individual requests. Feel free to get in touch via email, live chat or phone. We can also offer you package prices and can create individual lists.

Includes institutional investors, investment managers, project developers, real estate companies, REITs and pension funds that actively acquire residential real estate in Europe. This list is based on our

Includes institutional investors, investment managers, project developers, real estate companies, REITs and pension funds that actively acquire residential real estate in Europe. This list is based on our

Reviews

There are no reviews yet.