Description

List of 5 large hotel investors in Europe

In the following, we would like to briefly present three examples from our list of the most important hotel investors in Europe, so that you can get a better impression of our offer. The three investors represent very different types of investment companies and show how wide the range of companies in our database is. We keep a constant eye on current hotel purchases so that we can continually expand our list. If you have specific questions about this, we would be pleased to hear from you.

1. Schroders (UK)

An important investor on the European hospitality and hotel real estate investment market is Schroder Real Estate. The UK-based investment manager invests in different asset classes, amongst offices, retail properties and industrial real estate also in hotels. Alon in the German-speaking region, the investment manager is controlling more than €4.3BN assets under management in their real estate section.

Update 2023: Schroders announced an acquisition of two Hoxton hotels in December 2022. The hotels are located in Amsterdam and Paris. The deal is valued at €260M, thereby underlining the important role of Schroders as investor in European hotel real estate.

2. Highgate Hotels, L.P. (USA)

One of the world’s largest and most relevant hotel investors is Highgate Hotels from New York. The portfolio includes hotels in the USA and Europe and covers all hotel classes from standard to premium. In total, the investment company operates more than 100 hotels with over 30,000 rooms. Transactions with a value of over 25 billion USD have already been executed.

Update 2024: Highgate continues to be active in the sector and will take over the management of the Joule in Dallas and Le Meridien Central Park in New York City. The hotel investor will also manage the refurbishment of the Bellevue Hotel in Philadelphia.

3. Aina Hospitality Sàrl (Luxembourg)

The Aina Hospitality is an essential part of our list of the largest hotel investors in Europe. The portfolio includes hotels in various European countries such as Austria (Vienna), the Netherlands (Eindhoven), Italy (Milan), Spain (Madrid) and France (Paris). With offices in Andorra, Luxembourg and Spain, Aina Hospitality has made a name for itself in the EU real estate scene in recent years and has made an interesting exit in Germany with the Axel Hotel Berlin in 2017.

Update 2023: AINA continues to show itself as a very active player in the European hotel scene. Most recently, hotel real estate expert Christie & Co was exclusively commissioned by AINA Hospitality to market three exceptional hotels in Vienna, Brussels and Paris. This enabled the company to target a total of 496 rooms and thus a further portfolio of top-located and established lifestyle hotels in some of the most popular European capitals.

4. 12.18. Investment Management GmbH (Germany)

With projects in Spain and Germany, 12.18. has been an exciting investor in high-quality hotel and holiday properties for several years. Not only are hotels purchased, but also developed and completely redesigned. Profound experience in the hospitality scene and an eye for the special makes this company so exciting. One example of the far-sightedness and innovative approach of the Düsseldorf-based company is the development of a restaurant chain together with OhJulia.

Update 2022: The investor 12.18. Asset Management remains active: so the TOP Hotel Hochgurgl in the Ötztal was acquired. This is located at 2,200 meters and directly on the ski slope there. In the future, 12.18. will take over the operation of the hotel itself.

5. All Iron Group (Spain)

The Spanish investment manager All Iron Real Estate is a Spanish REIT that invests in European hotel real estate. The REIT has so far in objects in Spain and Hungary. It is focused on 3 to 4 star hotels in European cities. In 2021, the investor acquired a hotel property in Bilbao for €5.1M. The fund is actively looking for further purchases.

These investor types are included in the list:

- Investment managers

- Real estate companies

- Project developers with portfolio acquisition

- Private equity investors

- REITs

- Pension funds

- Foundations

These property types are purchased:

- Hotels

- Hospitality real estate

Investors in the list are interested in:

- Core Real Estate

- Value add real estate

- Sales-and-Leaseback

- Trophy real estate

- Distressed Assets

- Project developments and forward deals

- Debt investments

Included columns

- Company data (name, legal form, country of origin)

- Contact details (address, URL, e-mail, telephone number, management)

- Form of address of the management suitable for serial letters (e.g. “Dear Dr. Müller”)

- Investor type (investment manager, REIT, pension fund, private equity, etc.)

- Investment focus (asset classes, ranking from A to E, (global) investment volume / assets under management, detailed geographical focus)

- Special investment focus (debt, parking, forward deals, etc.)

- Link to the acquisition profile of the companies and contact details of an acquisition manager (if indicated on the investors’ website)

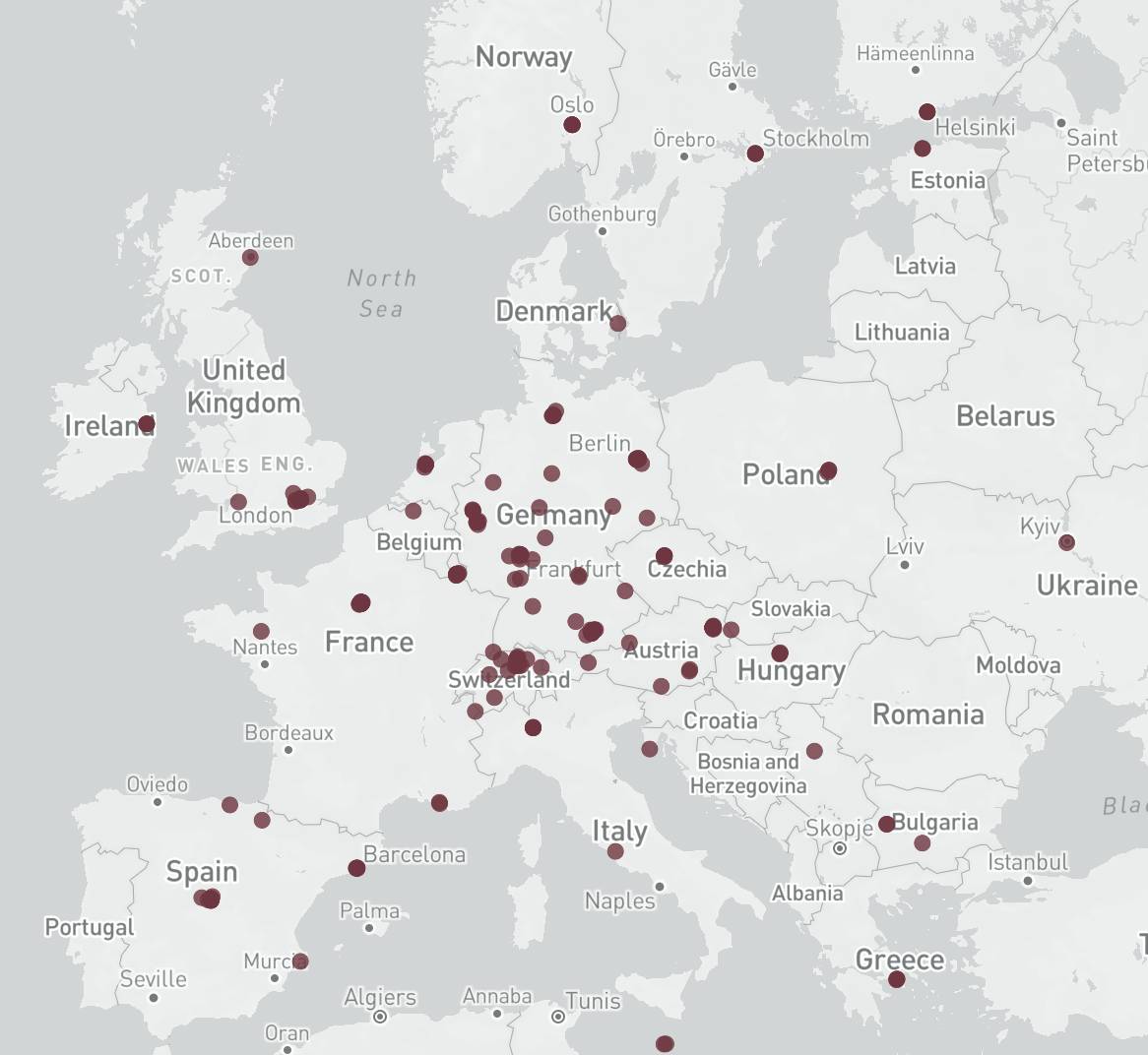

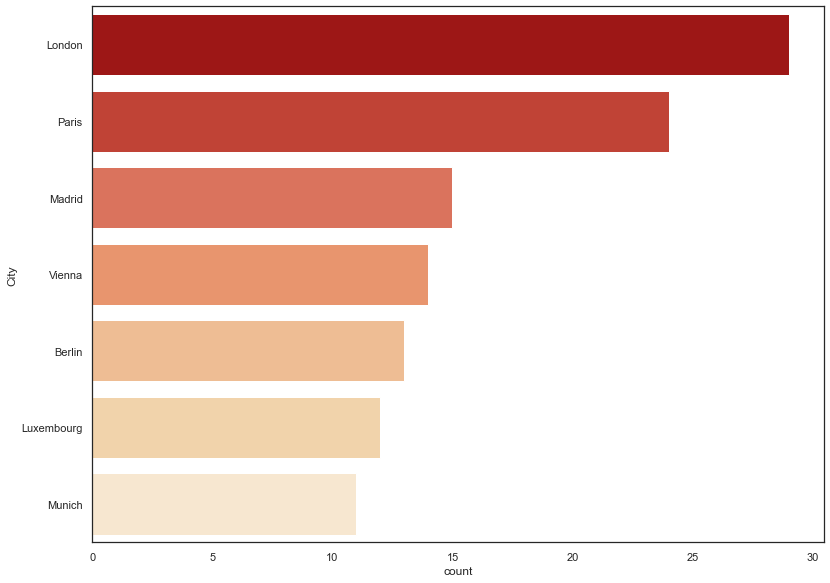

Map of European Hospitality Investors

Hotel investor are foremost buyers of hotel real estate. European hotel investors are often located in Germany, France and the UK. Investors that are based overseas either in North America or South-East Asia are also actively investing in European hotel real estate.

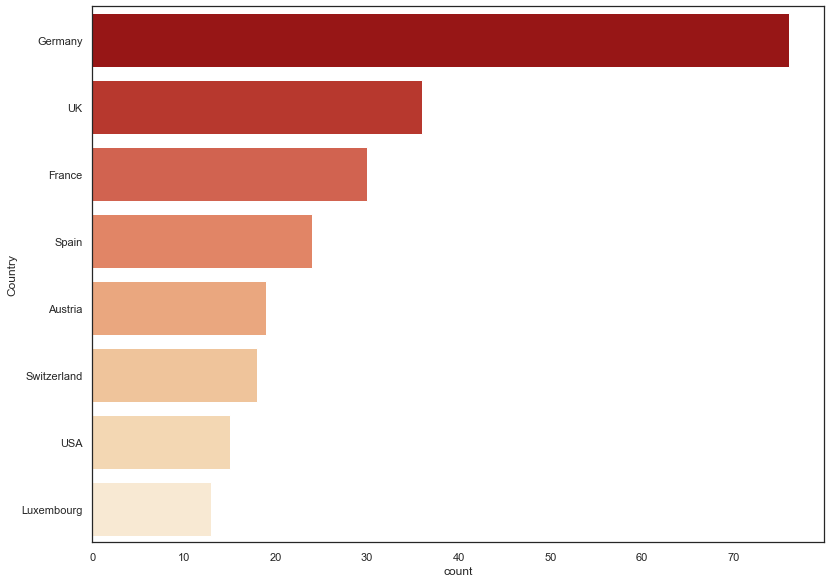

Countries of origin

Most hotel real estate investors in our list come from Germany. This is followed by the United Kingdom, France and Spain. Also active are investors from Austria, Switzerland and the USA.

Insights into the European hotel investment industry

Our list of the largest hotel investors in Europe helps all players in the European property market who are involved in the marketing or sale process of a hotel. Leading real estate agents, project developers, consultancies, co-investors, asset managers, hotel owners and hotel chains use our database to contact potential buyers of all types of hospitality buildings. The file of Hotel Investors Europe can be easily ordered with a few clicks via our online shop and downloaded directly. Whether you wish to contact the hotel investors by post, telephone or e-mail, our Excel list will save you hours of work in researching the right contacts and contains valuable additional information on investment companies and REITs. We are sure that you will discover some hotel buyers in the overview who, despite their relevance, were not previously included in your contact database.

Database with investors from the EU, USA and Asia

In order to analyse the European market for investments in the hospitality environment, hotel investors from all over the world have to be considered. With our research team we have examined the most relevant investment companies from the EU as well as real estate buyers from other countries such as the USA, Singapore, China, Qatar or Canada. It has never been easier to contact all the major buyers of holiday properties, resorts, luxury hotels and co. Our database is provided as an Excel file which you can easily download to customize and edit according to your needs.

Buyers of 5-Star hotels, holiday resorts, family hotels and small boutique hotels

Whether you are looking to sell a modern boutique hotel in Berlin or are looking for a buyer for a holiday resort in Spain or Italy: our overview of the largest hotel investors in Europe is guaranteed to include a suitable buyer. We could already help numerous real estate agents, project developers, hotel owners and fund managers to sell their hotel at an attractive price. Our clients are active throughout Europe and are located in Germany, Austria, Switzerland, Eastern Europe, the Benelux countries and Spain. Even if you have built up your own database of potential hotel investors in Europe over many years, we are confident that we can provide you with additional valuable contacts.

Hotel sales and lead generation due to exclusive investment profiles

Of course not all hotels are the same and a 5-star luxury hotel in a big city is more interesting for other investors than a cosy family-run hotel in the Alps. For this reason, we have integrated a ranking into our list of the best European hotel investors, which ranges from A (large investment volume, globally active, covering various asset classes) to E (lower assets under management, regionally active, exclusive focus on hotels). This enables you to carry out an initial screening and directly identify the most important investors for your project. Also the specification of the regional or geographical focus makes working with our database much easier for brokers, asset managers and hotel owners in their search for the right buyer. Use the level of detail in the list of the most important hotel investors in Europe to sell your property successfully.

Any questions? Get in touch!

Leo Semmelmann, Founder

contact [at] researchgermany.com

+49 (0) 89 92927741

We are looking forward to help you in case of any questions, remarks and individual requests. Feel free to get in touch via email, live chat or phone. We can also offer you package prices and can create individual lists.

Includes institutional investors, investment managers, project developers, real estate companies, REITs and pension funds that actively acquire hospitality properties and hotels in Europe. This list is based on our

Includes institutional investors, investment managers, project developers, real estate companies, REITs and pension funds that actively acquire hospitality properties and hotels in Europe. This list is based on our

Mike McArthur (verified owner) –

We are completely satisfied with the database. For the sale of a hotel we were looking for an international investor. The list covers investment companies from all over Europe and helps to identify suitable partners. Thumbs up.

Guillaume L. (verified owner) –

Good value for money, but I expected more French investors.