Description

List of 3 office real estate investors in Europe

Office real estate is an important sector of the real estate industry. Whether as an office building or as a mixed-use concept. In our list of the largest office real estate investors we have collected the most important ones.

1. CORESTATE Capital Holding S.A. (Luxembourg/Luxembourg)

CORESTATE is a real estate investor based in Luxembourg with a branch office in Frankfurt am Main. The company manages assets of 27, 4 billion euros and has 300 professionals and over 70,000 retail clients. CORESTATE is active in several real estate sectors, including investing in office properties. CORESTATE focuses on core, core+, and value-add properties with an individual property value of 10 million euros or more.

Update 2023: The real estate investment giant is currently facing not only hard times, but even the threat of bankruptcy. The beleaguered Corestate shares were already in free fall last year and have now sunk to a new record low of EUR 0.28.

2. Alstria Office REIT AG (Hamburg/Germany)

Alstria AG is a leading manager and investor of office real estate in Germany. The company owns office properties in many major German cities, such as Hamburg, Frankfurt or Berlin. Alstria is a publicly listed stock corporation organized as a legal form of a REIT. An exemplary investment is located at Platz der Einheit 1 in Frankfurt am Main with a rental area of 30,400 m² and a market value of 1.9 billion euros.

Update 2024: HCOB (Hamburg Commercial Bank AG) is refinancing a portfolio of eight office properties totaling EUR 100 million for Alstria. Specifically, this involves a total area of almost 70,000 m2, which is located in Hamburg, Berlin, Stuttgart and Düsseldorf and is let on medium to long-term leases.

3. Allianz Real Estate GmbH (Munich/Germany)

Allianz Real Estate is the real estate arm of Allianz SE based in Munich. The company invests in high-quality office and retail properties in Europe, the USA and Asia. Allianz Real Estate invests in core and value-add real estate with a minimum market value of 100 million euros. In addition, the company invests in funds with a minimum of 100 million euros. An exemplary investment is the Tour Cristal skyscraper in Paris.

Picture source: CHUTTERSNAP via Unsplash (23.08.2023)

These investor types are included in the list:

- Investment managers

- Real estate companies

- Project developers with portfolio acquisition

- Private equity investors

- REITs

- Pension funds

- Foundations

These property types are purchased:

- Office Building

- Mixed-Use Office Properties

- Office real estate portfolios

- High-rise buildings with predominant office use

- Office parks

Investors in the list are interested in:

- Core Real Estate

- Value add real estate

- Sales-and-Leaseback

- Trophy real estate

- Distressed Assets

- Project developments and forward deals

Included columns in our directory

- Company data (name, legal form, country of origin)

- Contact details (address, URL, e-mail, telephone number, management)

- Form of address of the management suitable for serial letters (e.g. “Dear Dr. Müller”)

- Investor type (investment manager, REIT, pension fund, private equity, etc.)

- Investment focus (asset classes, ranking from A to E, (global) investment volume / assets under management, detailed geographical focus)

- Special investment focus (debt, parking, forward deals, etc.)

- Link to the acquisition profile of the companies and contact details of an acquisition manager (if indicated on the investors’ website)

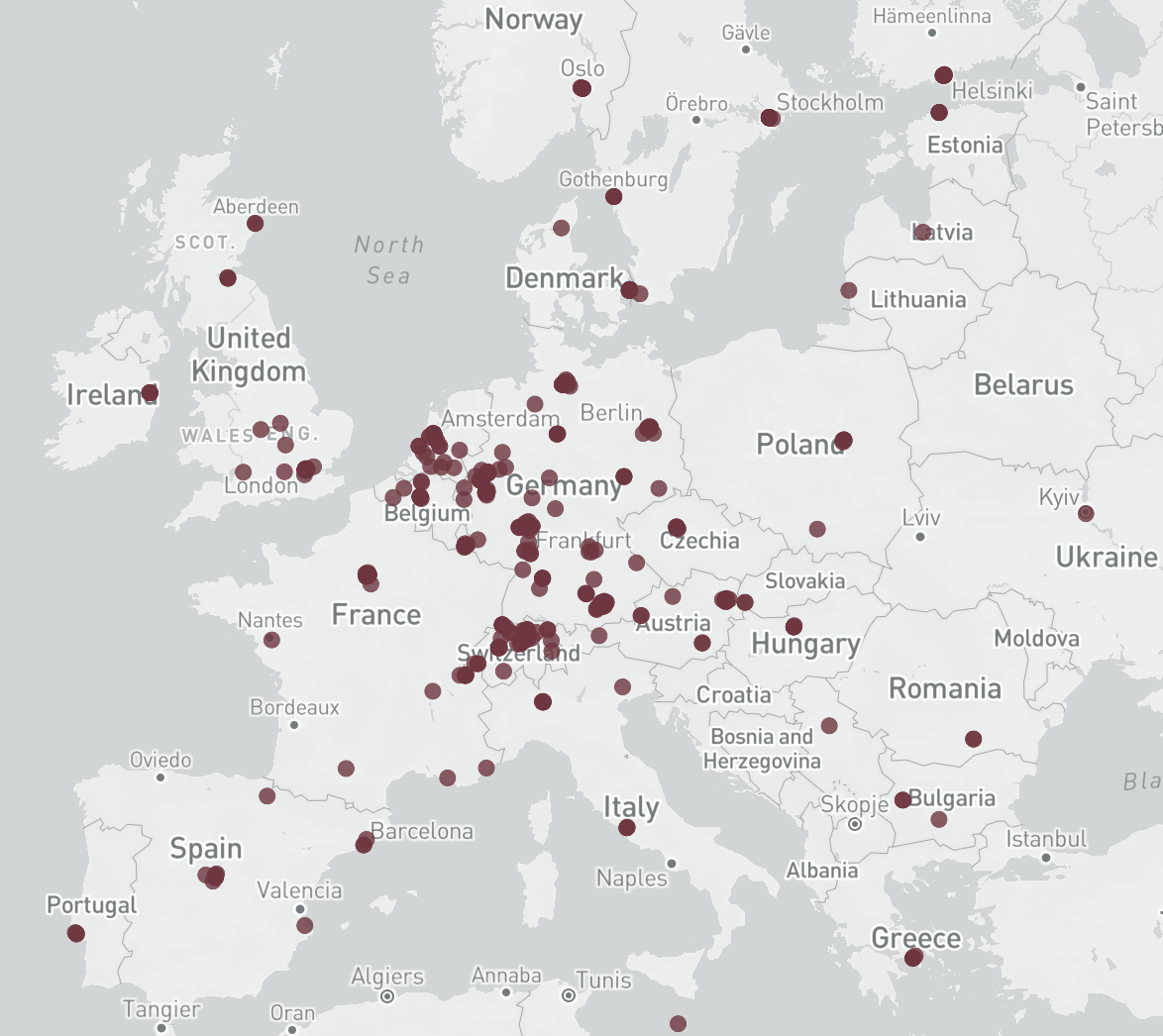

Where are the investors located?

The largest European office real estate investors are distributed throughout Europe according to the size and attractiveness of the national real estate markets. A particularly large number of investors are located in Germany, Benelux, Switzerland and the UK. However, relevant buyers of office complexes are also based in Northern Europe, Eastern Europe and Southern Europe. A large number of investors operates on an international level.

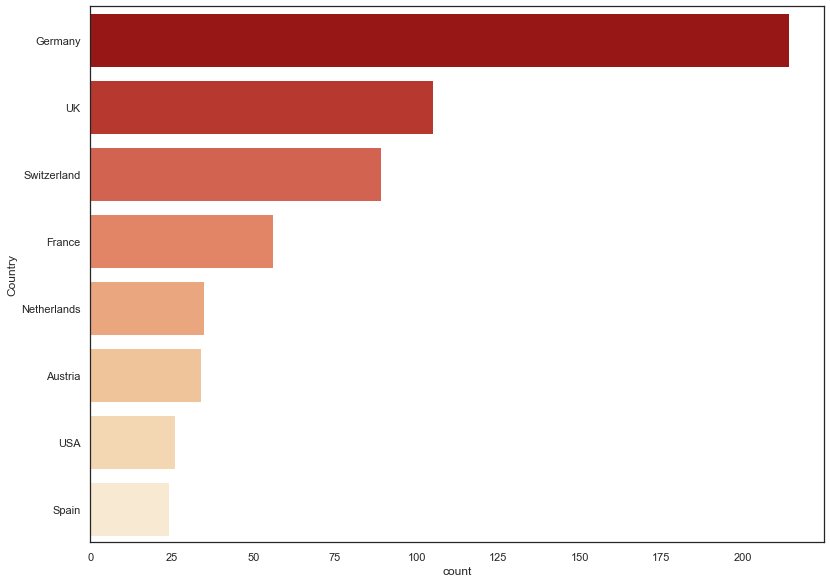

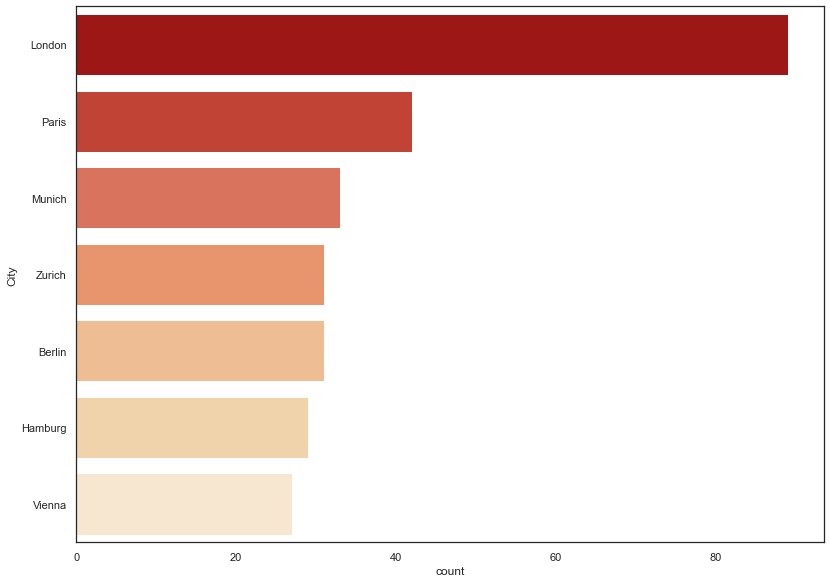

Countries of origin

Most of the office real estate investors in our list come from Germany. This is followed by the United Kingdom, Switzerland and France. Investors from the Netherlands, Austria and the USA are also active office real estate investors in Europe.

Office property in focus: buildings, parks and portfolios

The asset class of office real estate has a firm place in the investment landscape. Long-term leases and solvent tenants make office buildings popular investment properties, not least because they are easy to plan. A distinction must be made between pure office buildings, mixed-use office properties and office parks. While office parks are often found in the suburbs of large cities and metropolitan areas, office properties in central city locations are often characterized by a mixed-use component. The investors included in our list are very broadly positioned and are interested in all types of office buildings. In particular, international investors active on a supra-regional scale are always on the lookout for entire office portfolios.

Picture Source: Unsplash(Abbe Sublett), Erin Doering via Unsplash (23.08.2023)

Any questions? Get in touch!

Leo Semmelmann, Founder

contact [at] researchgermany.com

+49 (0) 89 92927741

We are looking forward to help you in case of any questions, remarks and individual requests. Feel free to get in touch via email, live chat or phone. We can also offer you package prices and can create individual lists.

Includes institutional investors, investment managers, project developers, real estate companies, REITs and pension funds that actively acquire office real estate in Europe. This list is based on our

Includes institutional investors, investment managers, project developers, real estate companies, REITs and pension funds that actively acquire office real estate in Europe. This list is based on our

Reviews

There are no reviews yet.