Description

List of 3 logistics real estate investors in Europe

Many European real estate investors are actively investing in logistics properties. Especially through the rise of e-commerce, there is a constant need for logistics real estate, such as warehouses or distribution centers. In the following, we are highlighting three interesting European logistics real estate investors.

1. Goodman (Sydney, Australia)

Goodman is an Australian real estate investor and developer specializing in logistics properties. The company buys both undeveloped greenfield properties and developed brownfield properties. Goodman develops industrial parks, warehouses, distribution centers and business parks. Together with partners, such as the Goodman Australia Industrial Partnership (GAIP), the company invests in and manages large logistics centers.

Update 2023: In April 2023, the firm had globally €50.6bn assets under management, managing 435 properties for over 1,700 customers globally.

2. Catena AB (Helsingborg, Sweden)

Catena is a Helsingborg-based project developer and property manager specializing in logistics properties. The company covers the metropolitan regions of Scandinavia with its 125 strategically located sites. In addition, it develops new logistics centers on so-called greenfields in many Swedish locations.

Update 2023: In December 2022, Catena announced the acquisition of two logistics properties from ICA Fastigheter for SEK500M. The two modern cold storage facilities are located in Arendal and Upplandsbro. The cold storage building in Arendal comes with an BREEAM Outstanding certification.

3. Aurelis Real Estate GmbH (Eschborn, Germany)

Aurelis is a German real estate investor and project developer. The company’s focus is on value-add or manage-to-core real estate and specifically the purchase of industrial parks, warehouses, factory sites and brownfields, which are then renovated. Aurelis is looking for properties with a size of 15,000 m² or more, which can be developed or undeveloped and have a volume of 5 million euros or more. In addition to asset deals and individual or portfolio transactions, the company also offers sale-and-leaseback.

Update 2024: Despite the crisis, Aurelis continues to be a highly active investor. An entire site in Duisburg is currently being converted into a business park. All office and warehouse space is already fully let eleven months after the start of construction.

Picture source: Barret Ward

Logistics in focus: warehouses, logistics hubs etc.

The market for logistics real estate has become increasingly important in recent years. Some current trends are responsible for this. For just-in-time deliveries, logistics companies need suitable warehouses and transshipment stations. E-commerce companies depend on a modern distribution network. Global players such as Amazon have an unprecedented demand for large logistics properties, for which developed and undeveloped land is sought in suitable locations. All these developments have attracted numerous logistics real estate investors active in Europe. Our list provides a unique overview of the investment scene and helps buyers and sellers alike to find potential leads.

These investor types are included in the list:

- Investment managers

- Real estate companies

- Project developers with portfolio acquisition

- Private equity investors

- REITs

- Pension funds

- Foundations

These property types are purchased:

- Logistics real estate

- Warehouses

- Production buildings

- Distribution centres

- Logistics halls

- Industrial parks

- Green and brownfield areas

Investors in the list are interested in:

- Core Real Estate

- Value add real estate

- Sales-and-Leaseback

- Trophy real estate

- Distressed Assets

- Project developments and forward deals

- Debt investments

Included columns in our directory

- Company data (name, legal form, country of origin)

- Contact details (address, URL, e-mail, telephone number, management)

- Form of address of the management suitable for serial letters (e.g. “Dear Dr. Müller”)

- Investor type (investment manager, REIT, pension fund, private equity, etc.)

- Investment focus (asset classes, ranking from A to E, (global) investment volume / assets under management, detailed geographical focus)

- Special investment focus (debt, parking, forward deals, etc.)

- Link to the acquisition profile of the companies and contact details of an acquisition manager (if indicated on the investors’ website)

Where are the the largest financiers from?

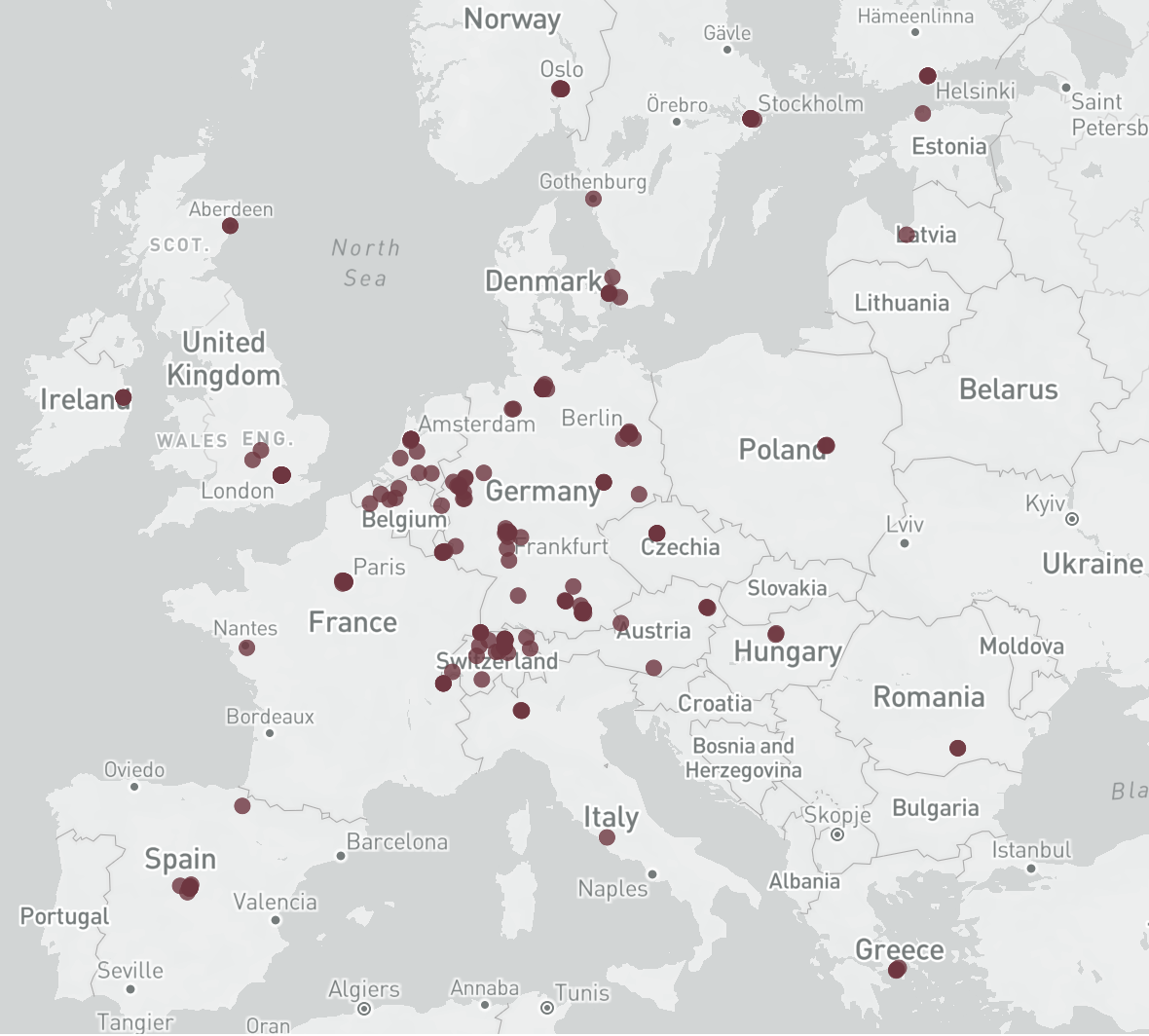

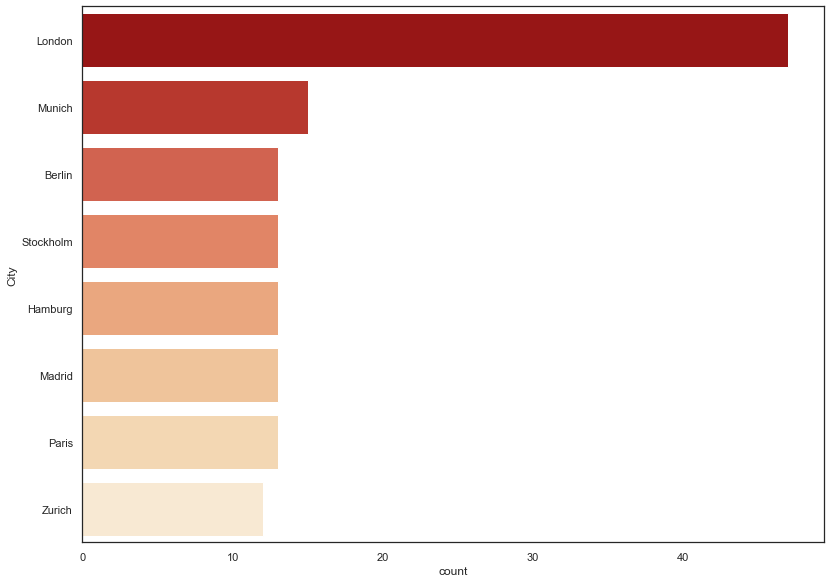

Investors in logistics real estate can be found in virtually every European country. Many of the investment companies are active across countries and have a pan-European portfolio. They invest in buildings such as distribution centers and warehouses as well as in greenfield and brownfield properties. A large proportion of the investors in our list come from Germany. Other countries frequently represented include France, the Benelux Union and the UK.

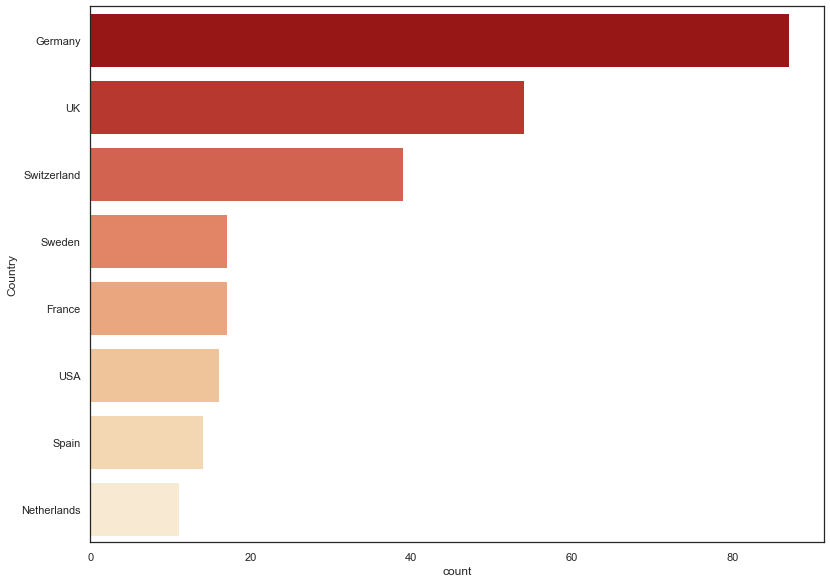

Countries of origin

Most of the logistics real estate investors in our list come from Germany. This is followed by the United Kingdom, Switzerland and France. Investors from Sweden, the USA and Spain are also active.

Picture Source: Unsplash (Julian Schultz), Robson Hatsukami Morgan via Unsplash (23.08.2023)

Any questions? Get in touch!

Leo Semmelmann, Founder

contact [at] researchgermany.com

+49 (0) 89 92927741

We are looking forward to help you in case of any questions, remarks and individual requests. Feel free to get in touch via email, live chat or phone. We can also offer you package prices and can create individual lists.

Includes institutional investors, investment managers, project developers, real estate companies, REITs and pension funds that actively acquire logistics real estate in Europe. This list is based on our

Includes institutional investors, investment managers, project developers, real estate companies, REITs and pension funds that actively acquire logistics real estate in Europe. This list is based on our

Reviews

There are no reviews yet.