Description

List of 3 large retail real estate investors in Europe

European real estate investors are in shopping centers, malls as well as food retail and local retail properties. We are highlighting three exciting investors from our list.

1. ECE Group GmbH & Co. KG (Hamburg/Germany)

ECE is a real estate investor wholly owned by the Otto family. The company is specialized in the investment in shopping center and also manages 200 shopping centres across Europe. The centres have a total sales area of over 7,000,000m² and generate over 22 billion euros in retail sales. The Group operates some of the largest shopping centres in Germany. An exemplary example is the “Europa Passage Hamburg” with a sales area of 30,000m² and 120 stores.

Update 2023: ECE is currently expanding the G3 Shopping Resort Gerasdorf in Austria, thereby diversifying not only the tenant mix but also the range of leisure and sports facilities. The shopping center near Vienna will ultimately thus be complemented by the idea of a shopping “resort” with a focus on sports and outdoor. Construction work started at the beginning of the year; the facility is scheduled for completion by mid-2023. The investment costs amount to approximately EUR 12 million. The final realization will be an indoor sports retail area of 5000m² and an outdoor sports facility of 3000m² – with a coordinated retail offering by theme-related retailers such as Snipes or Intersport.

Also in 2023, ECE stays active. Together with Generali, the firm acquired the Pep shopping mall in Munich.

2. METRO PROPERTIES (Düsseldorf/Germany)

METRO PROPERTIES is the real estate arm of the METRO AG. The company owns 436 wholesale properties in Europe, 103 of them in Germany and 130 wholesale properties in Asia. METRO PROPERTIES manages real estate in 17 European countries and also engages in project development. In Asia, the company also relies on mixed-use concepts for the redevelopment of METRO Cash&Carry properties. These concepts include retail, residential, hotels, office and entertainment facilities.

Update 2024: The Metro retail group is still active on the real estate market. Part of the Düsseldorf campus site has been sold to the Swiss asset management company Swiss Life Asset Managers.

3. ImocomPartners (Paris/France)

ImocomPartners is a real estate investor in the retail sector from France. The company manages assets of 610 million euros and owns 30 retail parks in France with a total area of 363,000m². An exemplary investment is “Saint-Orens” in Toulouse with a total area of 53,000m².

Picture source: Heidi Fin

Focus on a diverse asset class

Hardly any asset class is as diverse as retail real estate. Store premises and high-street retail properties in major cities are just as much a part of this as supermarkets and retail parks. Shopping centers and outlet centers can also be found in the purchase profiles of the important investors in this real estate class. The importance of the individual property types differs greatly in some cases between different countries in Europe. In Austria, for example, retail parks play a comparatively important role, in metropolises such as Paris and London, high-street retail properties are of great importance, and factory outlet centers are mainly found in the UK and Italy.

These investor types are included in the list:

- Investment managers

- Real estate companies

- Project developers with portfolio acquisition

- Private equity investors

- REITs

- Pension funds

- Foundations

These property types are purchased:

- Commercial Real Estate

- Mixed-use retail real estate

- High-street retail real estate

- Retail parks

- Supermarkets

- Shopping centers

- Local shopping centers

- Food retail real estate

Investors in the list are interested in:

- Core Real Estate

- Value add real estate

- Sales-and-Leaseback

- Trophy real estate

- Distressed Assets

- Project developments and forward deals

Included columns in our directory

- Company data (name, legal form, country of origin)

- Contact details (address, URL, e-mail, telephone number, management)

- Form of address of the management suitable for serial letters (e.g. “Dear Dr. Müller”)

- Investor type (investment manager, REIT, pension fund, private equity, etc.)

- Investment focus (asset classes, ranking from A to E, (global) investment volume / assets under management, detailed geographical focus)

- Special investment focus (debt, parking, forward deals, etc.)

- Link to the acquisition profile of the companies and contact details of an acquisition manager (if indicated on the investors’ website)

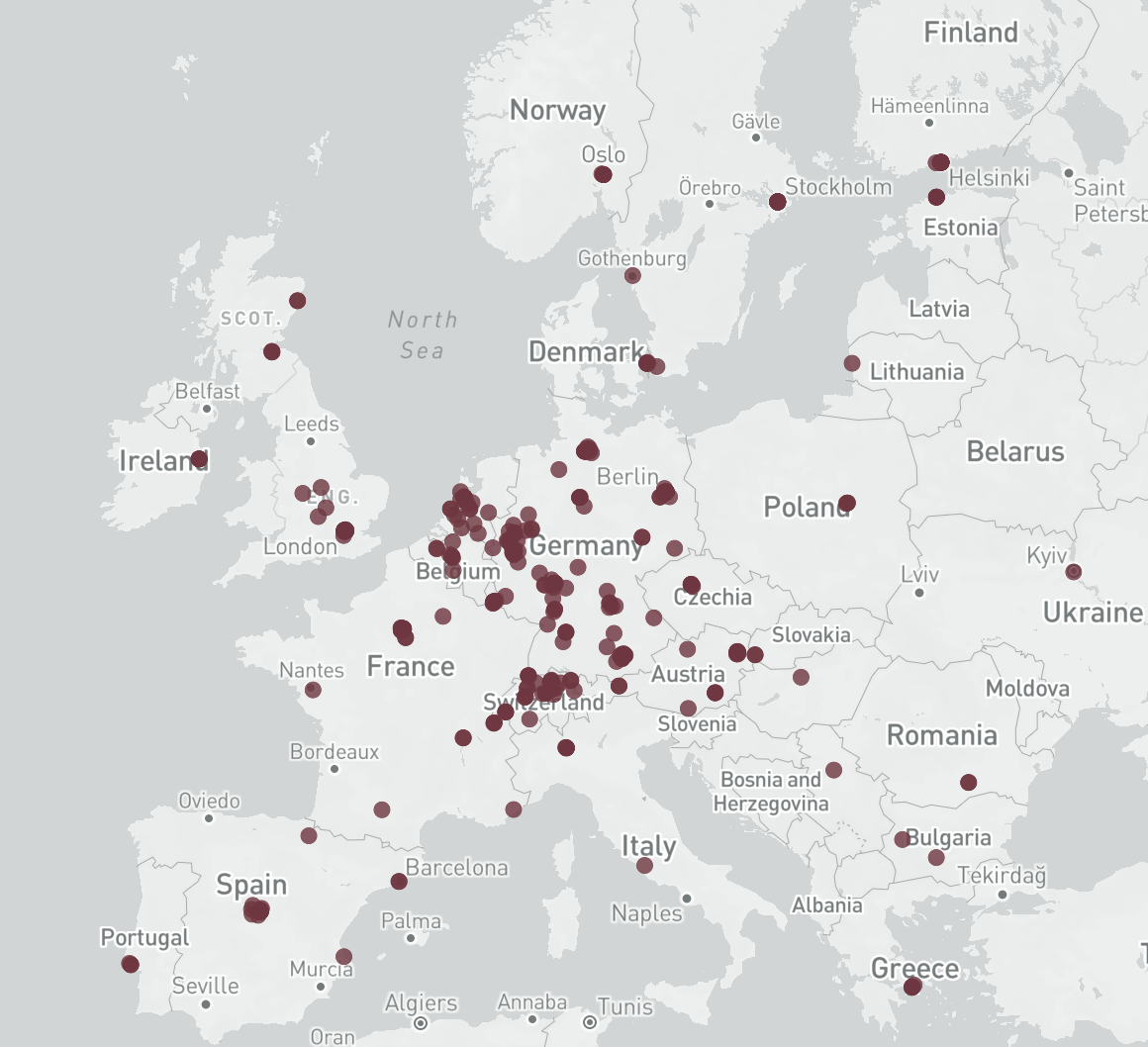

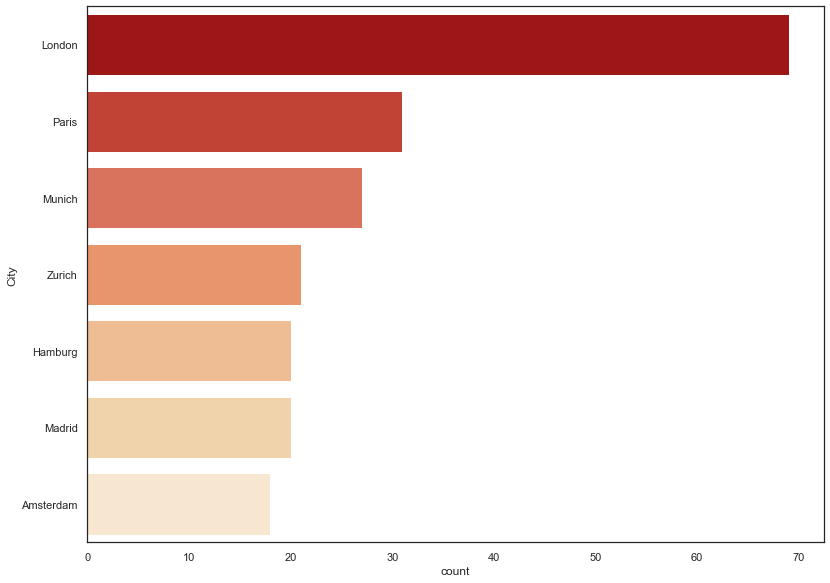

Where are they based?

Even though the COVID-19 pandemic has put a damper on the retail sector, demand for retail real estate in Europe remains strong. The map of Europe shows the regional distribution of retail real estate investors in Europe and reveals a broad spread across the entire continent. A particularly large number of investors are based in Germany, the UK, France and Switzerland.

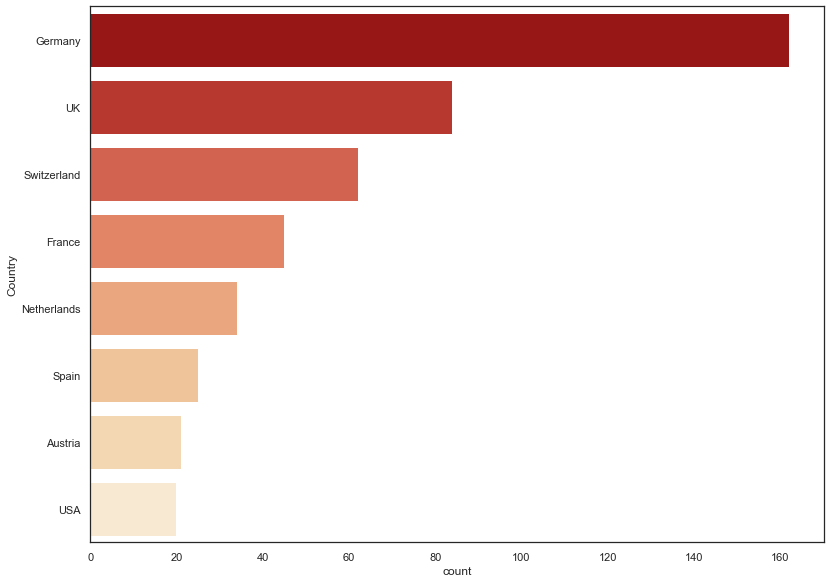

Countries of origin

Most retail real estate investors in our list come from Germany. This is followed by the United Kingdom, Switzerland and France. Active investors also come from the Netherlands, Spain, and Austria.

Picture Source: Unsplash (Christian Wiediger), Xianjuan HU via Unsplash (23.08.2023)

Any questions? Get in touch!

Leo Semmelmann, Founder

contact [at] researchgermany.com

+49 (0) 89 92927741

We are looking forward to help you in case of any questions, remarks and individual requests. Feel free to get in touch via email, live chat or phone. We can also offer you package prices and can create individual lists.

Includes institutional investors, investment managers, project developers, real estate companies, REITs and pension funds that actively acquire retail real estate in Europe. This list is based on our

Includes institutional investors, investment managers, project developers, real estate companies, REITs and pension funds that actively acquire retail real estate in Europe. This list is based on our

Reviews

There are no reviews yet.