Description

List of 3 real estate investors in UK

To give you a better idea of our list, we briefly introduce three companies that are included in our address database of the largest UK real estate buyers. Our team deals intensively with the respective markets and analyses the most important players in detail before we prepare our lists. In this way we ensure that the most relevant companies are really included in our overviews and that you don’t acquire outdated data.

1. Savills Investment Management (London) – diversified portfolio

The Savills Investment Management company is an independent subsidiary of the Savills group. Since 30 years the now international operating real estate investor has a diversified portfolio: investments in Europe, in Asia-Pacific as well as in Japan are included in the investment strategy. With a mixed approach of indirect and direct investments, Savills Investment Management invests in multiple assets: Residential, Office Buildings or Infrastructure Investments are just some of the interests of the investor.

Update 2023: Despite the current real estate crisis, SIM continues to show a willingness to buy on the German market. In this context, a light industrial park in Essen was acquired most recently. Savills IM manages logistics properties worth more than 6 billion euros worldwide for various funds and mandates – around 1 billion of the logistics AuM’s are located in Germany.

2. Columbia Threadneedle Investments Real Estate (formerly BMO Real Estate Partners) (London)

BMO Real Estate Partners is part of BMO Global Asset Management and, as of September 2020, has £6.4 billion assets under Management. The real estate investor mainly focuses on residential buldings or offices as well as some retail investments. One commonly known investment in their portfolio is the st. Christophers Place in London which has 150 lettable units which accommodate retail space, offices and apartments.

Update 2024: BMO Real Estate Partners has been operating under the name Columbia Threadneedle Investments Real Estate Partners for some time now. Under the new umbrella, the focus is still on the retail and residential asset classes and in particular on mixed-use properties in A and B cities.

3. Pembroke (London) – focus on offices in Europe and Asia-Pacific

Pembroke is an international real estate investor with 7 offices around the globe. All in all, the real estate investor has 41 assets in 14 markets including Boston, London, Melbourne, Munich, Stockholm, Seattle, Tokyo, San Francisco and Washington, DC. Pembroke, founded 1997, has an asset class focus on offices and a regional focus on Europe and the Asia-Pacific region.

Picture sources: Unsplash(Benjamin Davies), Unsplash(Robin Canfield), Unsplash(Bastian Pudill)

These investor types are included in the list:

- Investment managers

- Real estate companies

- Project developers with portfolio acquisition

- Private equity investors

- REITs

- Pension funds

- Foundations

These property types are purchased:

- Residential real estate

- Office properties

- Retail real estate

- Logistics real estate

- Light industrial real estate

- Hotel real estate

- Data center

- Parking garages

- Nursing homes

Investors in the list are interested in:

- Core Real Estate

- Value add real estate

- Sales-and-Leaseback

- Trophy real estate

- Distressed Assets

- Project developments and forward deals

- Debt investments

Included columns in the list

- Company data (name, legal form, country of origin)

- Contact details (address, URL, e-mail, telephone number, management)

- Form of address of the management suitable for serial letters (e.g. “Dear Dr. Müller”)

- Investor type (investment manager, REIT, pension fund, private equity, etc.)

- Investment focus (asset classes, ranking from A to E, (global) investment volume / assets under management, detailed geographical focus)

- Special investment focus (debt, parking, forward deals, etc.)

- Link to the acquisition profile of the companies and contact details of an acquisition manager (if indicated on the investors’ website)

Where are the headquarters?

The United Kingdom is consistent of the countries England, Scotland, Northern Ireland, and Wales. Naturally most of the UK’s real estate investors have their headquarter in one of these countries. Especially the financial centre London has an abundance of property investors. Additionally many international investors from all over the world are investing in the United Kingdom’s real estate market.

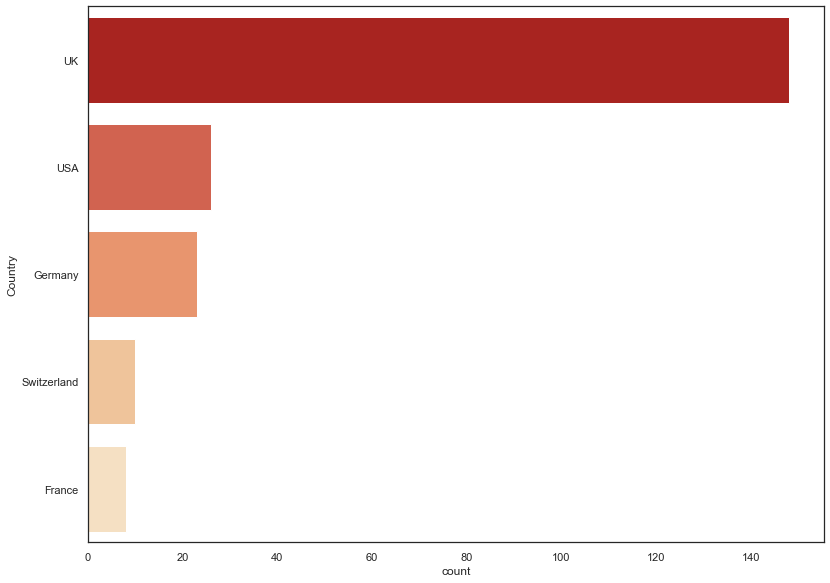

Countries of origin

Most real estate investors in the United Kingdom come – as expected – from England. However, numerous international investors are also active in the United Kingdom, for example from the United States, Germany, or Switzerland.

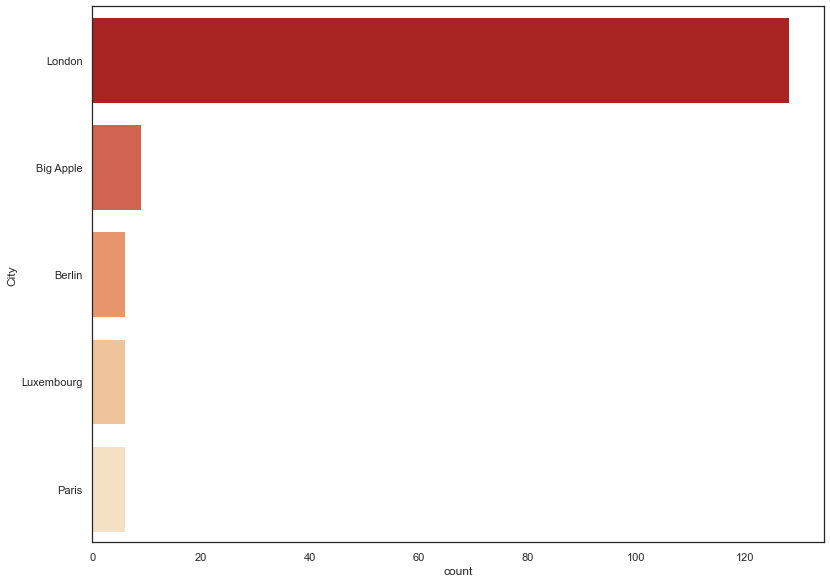

Cities of investors

Most real estate investors in the UK are headquartered in London, followed by New York, Paris, and Berlin.

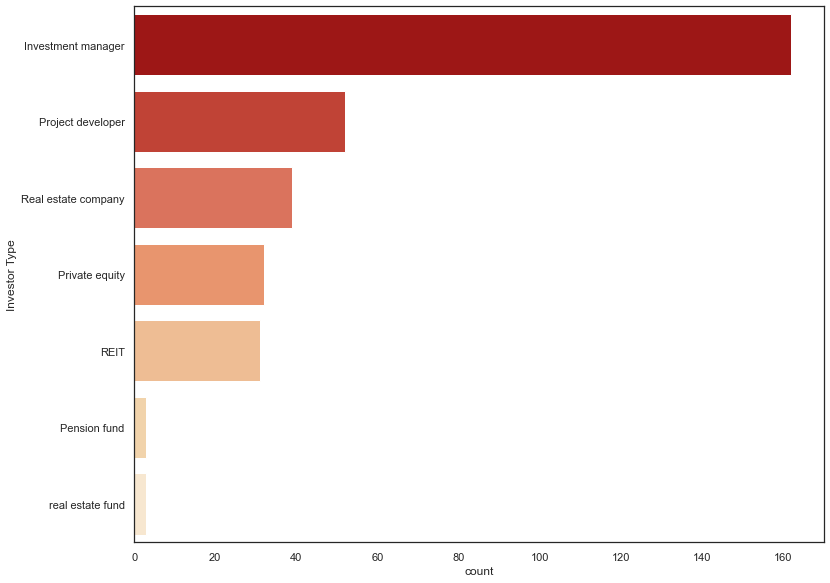

Investor types

Over 160 of the Real Estate Investors active in the UK are categorized by us as “Investment Managers”. Over 50 of the real estate investors are categorized as project developers and over 30 as real estate companies. In addition, numerous private equity players and REITs are active in the UK.

Different asset classes: Residential real estate, office real estate, retail, hotel, logistics, light industrial, care, debt

The investors on our list are active throughout the UK, from London to Edinburgh. There are differences in the asset classes in which investments are made. The most widely spread asset classes are particularly sought after: residential and office. But here too, the investment focus varies from investor to investor. Some are only looking for skyscrapers with office space in London, while others are looking for commercial office buildings in B and C locations. Some of the investors only buy top residential properties in A-locations, while others are interested in portfolios in rural areas. Retail and hotel properties are also sought-after asset classes. Rather new asset classes that have recently become more popular are logistics and light industrial real estate. In times of an aging population, nursing and health care properties also play a greater role.

Any questions? Get in touch!

Leo Semmelmann, Founder

contact [at] researchgermany.com

+49 (0) 89 92927741

We are looking forward to help you in case of any questions, remarks and individual requests. Feel free to get in touch via email, live chat or phone. We can also offer you package prices and can create individual lists.

Includes institutional investors, investment managers, project developers, real estate companies, REITs and pension funds that actively acquire real estate in England, Wales and Scotland. This list is based on our

Includes institutional investors, investment managers, project developers, real estate companies, REITs and pension funds that actively acquire real estate in England, Wales and Scotland. This list is based on our

Reviews

There are no reviews yet.