Description

Lists of real estate investors in Scandinavia & Northern Europe

To give you a better idea of our list, we briefly introduce three companies that are included in our address database of the largest Nothern Europe real estate buyers. Our team deals intensively with the respective markets and analyses the most important players in detail before we prepare our lists. In this way we ensure that the most relevant companies are really included in our overviews and that you don’t acquire outdated data.

List of 3 large real estate investors in Sweden

1. STENA FASTIGHETER AB (Göteborg)

STENA FASTIGHETER AB is one of the largest privately owned real estate investors in Sweden. The investor’s geographical focus is within Sweden, largely in the cities of Gothenburg, Stockholm, Malmö, Uppsala, Landskrona and Lund. In addition to this, there is Stena Realty investing internationally – in the Netherlands, France, the UK, Germany, Hungary and the US. At the end of 2020, STENA FASTIGHETER AB made its first real estate acquisition in Central and Eastern Europe with an office complex in Warsaw.

Update 2023: The real estate investor from Gothenburg recently ordered six energy storage systems from specialist BatteryLoop. Among other things, this will ensure the storage of solar energy generated on property roofs. In addition, the charging infrastructure for e-vehicles is also supported and, moreover, electricity peaks are reduced. Overall, it should thus be possible for properties to supply and maintain themselves with energy.

2. AMF Fastigheter (Stockholm)

AMF Fastigheter is one of Sweden’s largest real estate investors – the real estate investor is 100% owned by the Swedish pension fund AMF. The Swedish real estate investor is highly innovative up-to-date: one of AMF Fastigheter’s biggest and latest projects is “The Lobby” a joint project with streaming provider Bambuser – where customers can store digitally via live video.

Update 2024: AMF has now leased around 11,000 square meters of space in Stockholm’s Urban Escape district to Söderberg & Partners. The new tenant is taking over the entire property, which was previously occupied by WeWork.

3. Genesta (Stockholm)

Genesta is an independent real estate investor with a geographic focus on Northern Europe – the Swedish real estate investor’s offices are also spread across these regions: in Sweden, Finland, Denmark and Luxembourg. Genesta is interested in office and commercial real estate as well as infrastructure and logistics properties. For example, the Swedish real estate investor recently signed a contract with one of Sweden’s largest fitness chains and will open a gym at Arninge Centrum in Täby in early 2022.

List of 3 large real estate investors in Finland

1. CapMan Real Estate (Helsinki)

CapMan Real Estate is a real estate investor from Finland with offices in Helsinki, Stockholm and Copenhagen – the geographic focus is similar, namely Northern Europe: Sweden, Finland, Denmark and Norway. The Finnish real estate investor has approximately €2.5 billion in assets under management with their over 200 properties. The company is broadly diversified and invests, for example, in residential and office properties but also in commercial properties and hotels.

2. Varma Real Estate (Helsinki)

Varma Real Estate is a Finnish real estate investor based in Helsinki. Varma’s portfolio is divided into two divisions, firstly the investor invests in commercial properties and secondly in residential properties – around 60% of which are located in the Finnish capital Helsinki. As of June 2019, Varma has made real estate investments worth >4 million euros.

3. Vicus Capital Advisors (Helsinki)

Vicus Capital Advisors, a Finnish real estate investor has been operating in the Finnish, Baltic, Russian and Ukrainian real estate markets since 2005, and in Central and Eastern Europe since 2016. Vicus Capital Advisors has a diversified portfolio and invests in residential real estate and office properties as well as commercial real estate and infrastructure/logistics properties.

List of 3 large real estate investors in Denmark

1. Northern Horizon Capital A/S (Copenhagen)

Northern Horizon Capital A/S is a Danish real estate investor based in Copenhagen. The investor is partly owned by Evli Bank Plc, and partly by the founders. Northern Horizon Capital is active in 6 countries and 5 segments, 4 funds are available for this purpose. One of the segments in which the real estate investor from Denmark invests is real estate in the care, health & social sector – for example, Northern Horizon Capital has acquired a high quality aged care facilities in Finland with its Nordic Age Care Fund.

2. Nordic Real Estate Partners (Copenhagen)

The Danish real estate investor Nordic Real Estate Partners – NREP for short – is headquartered in Copenhagen. With over 300 real estate investments, NREP has approximately 5 billion euros in assets under management. The portfolio of the investor from Denmark is diversified, as there is interest in investing in residential or office properties as well as in commercial properties or logistics objects. For example, NREP is developing one of the largest and most modern logistics warehouses in Europe – in Bålsta, near Stockholm. In 2022, the 126,000 square meter logistics center, on the roof of which solar panels will be installed, is expected to be finalized.

3. Jeudan A / S (Copenhagen)

Jeudan A / S is also in real estate investor based in Copenhagen. Jeudan is the largest listed real estate investor in Denmark and has now acquired over 200 investments worth a total of DKK 28 billion. The investor invests mainly in residential, office and commercial properties – as it did at the end of 2020: in August, Jeudan acquired six properties. The properties, which are largely used for office purposes, have a floor area of around 15,000 m2 and were priced at around DKK 400 million. kr.

List of 3 large real estate investors in Norway

1. Olav Thon Gruppen (Oslo)

Olav Thon Gruppen is a real estate investor from Norway based in Oslo and is part of the Olav Thon Foundation. The real estate investor invests in two divisions: commercial real estate and hotel real estate. In the commercial property segment, Olav Thon Gruppen has approximately 90 shopping centers and 500 commercial properties in its portfolio; within the hotel segment, the Thon Hotels are market leaders: approximately 80 hotels are spread across Brussels, Norway and Rotterdam, along restaurants and pubs.

2. Asset Buyout Partners AS (Oslo)

Asset Buyout Partners AS is also a real estate investor from Oslo. The investor owns and manages about 1.75 million square meters of land and infrastructure, plus about 245,000 square meters of industry properties and quays as well as undeveloped land. The focus of the asset classes is therefore clearly on office/industrial real estate and logistics/infrastructure properties. Geographically, the Norwegian real estate investor focuses on Northern Europe.

3. Indigo Invest (Lysaker)

Indigo Invest is a Norwegian real estate investor based in Lysaker. Since 1992 the investor also invests in real estate, the second main pillar are car parks. Accordingly, the focus of real estate investments is also on infrastructure or logistics objects, such as parking garages in major Norwegian cities.

Picture source: Ava Coploff via Unsplash (21.08.2023)

These investor types are included in the list:

- Investment managers

- Real estate companies

- Project developers with portfolio acquisition

- Private equity investors

- REITs

- Pension funds

- Foundations

These property types are purchased:

- Residential real estate

- Office properties

- Retail real estate

- Logistics real estate

- Light industrial real estate

- Hotel real estate

- Data center

- Parking garages

- Nursing homes

Investors in the list are interested in:

- Core Real Estate

- Value add real estate

- Sales-and-Leaseback

- Trophy real estate

- Distressed Assets

- Project developments and forward deals

- Debt investments

Included columns in our directory

- Company data (name, legal form, country of origin)

- Contact details (address, URL, e-mail, telephone number, management)

- Form of address of the management suitable for serial letters (e.g. “Dear Dr. Müller”)

- Investor type (investment manager, REIT, pension fund, private equity, etc.)

- Investment focus (asset classes, ranking from A to E, (global) investment volume / assets under management, detailed geographical focus)

- Special investment focus (debt, parking, forward deals, etc.)

- Link to the acquisition profile of the companies and contact details of an acquisition manager (if indicated on the investors’ website)

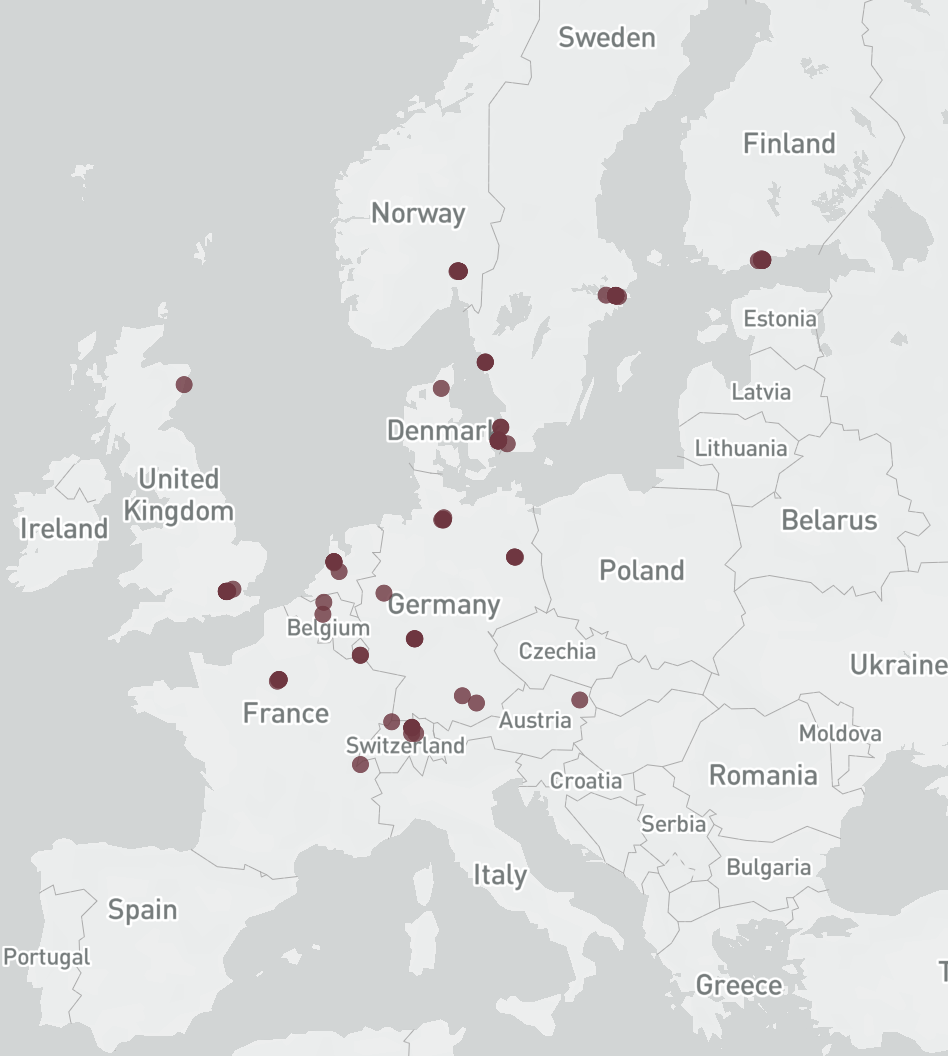

Where are their primary location ?

Naturally most of the property investors that invest in Scandinavia are from the Scandinavian countries Denmark, Norway, Sweden, and Finland. International real estate buyers also invest in Northern Europe. Most of the international real estate investors in our list are from Germany, UK, and Switzerland.

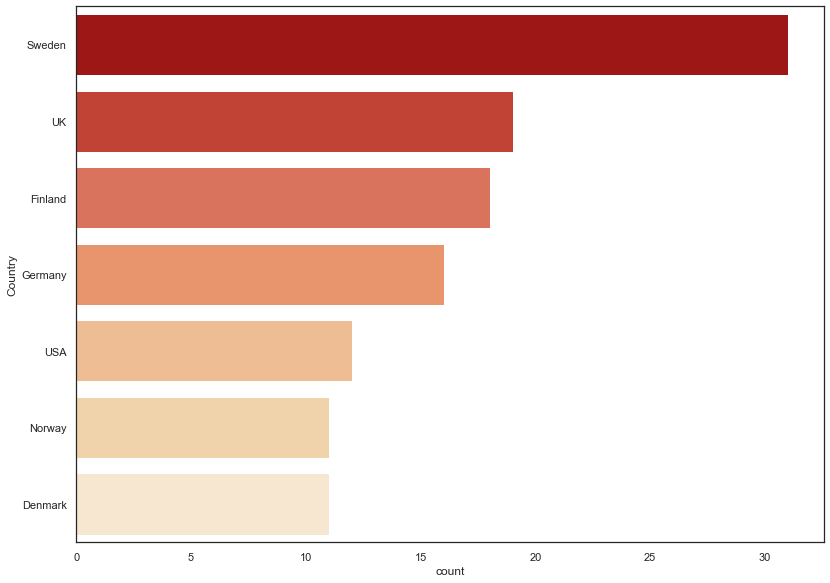

Countries of origin in Scandinavia

Most real estate investors in Scandinavia come from Sweden. Many investors also come from the other Northern European countries Finland, Denmark and Norway. Many investors from other European countries are active in Scandinavia, for example from the United Kingdom, and Germany, many investors also come from the United States.

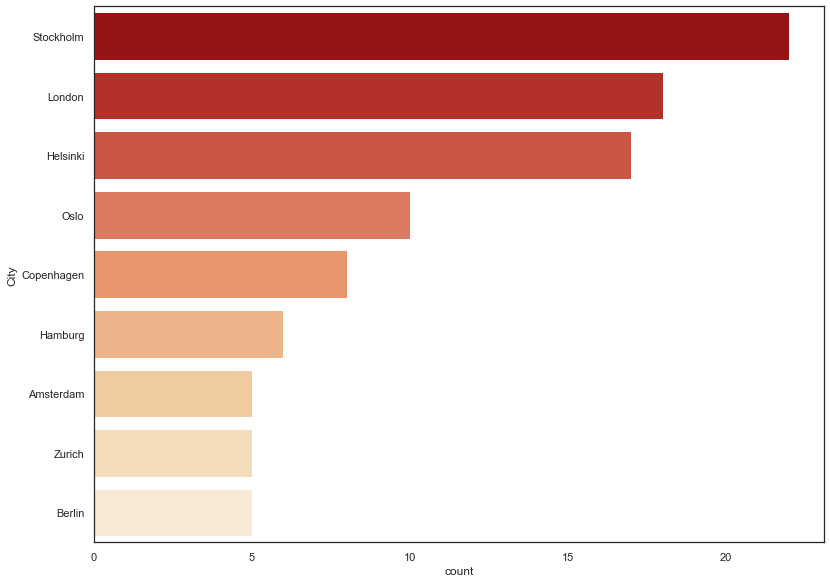

Northern Europe real estate market

Scandinavia, or the northern European countries Sweden, Finland, Norway and Denmark, have been characterised by a stable political and economic environment for years. The standard of living and quality of education is also rated very high. The majority of the populations in the Nordic countries are found in the major cities – Stockholm, Helsinki, Oslo and Copenhagen. Helsinki, for example, is home to around 30% of Finland’s population – accordingly, the real estate markets are strongly fixated on the major cities, especially with regard to office, retail or logistics properties. Furthermore, Sweden, Norway, Finland and Denmark have a relatively high share of homeowners: between 60%-70%. For comparison: the share of homeowners in Germany is around 50%.

Covered asset classes: residential, office, retail, logistics, care, hospitality, light industrial, debt

The real estate market can be divided into different asset classes, which are characterised by very different structures and characteristics. The team of Research Germany knows that specialized investors operate in the individual segments. To help you easily identify the right real estate buyer for your project, our overview contains several columns that show all relevant asset classes. With just one click you can filter by investment companies that invest in residential real estate, office real estate, retail and shopping centers, logistics or light industrial real estate, hotels and vacation properties or care properties. The largest companies are often active in several segments, while smaller companies often focus on individual areas.

Picture source: Unsplash(Jaakko Kemppainen), Unsplash(Flobrant), Unsplash(Dylag)

Any questions? Get in touch!

Leo Semmelmann, Founder

contact [at] researchgermany.com

+49 (0) 89 92927741

We are looking forward to help you in case of any questions, remarks and individual requests. Feel free to get in touch via email, live chat or phone. We can also offer you package prices and can create individual lists.

Includes institutional investors, investment managers, project developers, real estate companies, REITs and pension funds that actively acquire real estate in Scandinavia & Northern Europe (Sweden, Denmark, Norway, Finland). This list is based on our

Includes institutional investors, investment managers, project developers, real estate companies, REITs and pension funds that actively acquire real estate in Scandinavia & Northern Europe (Sweden, Denmark, Norway, Finland). This list is based on our

Anna Turrini (verified owner) –

The data in the list is of very high quality. I could download the Excel list immediately after ordering. Top service, thank you!