Description

List of 3 real estate investors in Portugal

We have several real estate investors that are active in Portugal in our Database. To give you an idea what to expect from this list, we curated a list of 3 property investors that invest in Portugal.

1. SILVIP S.A. (Lisbon)

SILVIP – Sociedade Gestora de Organismos de Investimento Coletivo – is a Lisbon based real estate fund manager. The company was established in 1987. The company manages multiple funds. SILVIP’s oldest fund is the Fund VIP. It is an open real estate investment fund that distributes income every three months. The minimum subscription amount is around EUR 50,000. An exemplary investment of the fund is the “Rua Júlio Dinis” in Porto.

Update 2024: Patron Capital has completed the sale of BdB, a 3,600m² office building on Avenida Barbosa du Bocage (Lisbon) to Fundo VIP. The real estate investor Silvip managed the Portuguese open-ended real estate fund in this context.

2. Optylon Krea (Lisbon)

Optylon Krea is a real estate investment management and development firm that focuses on mediterainian real estate markets. The company has four active funds that are currently open to subscription. One of these funds is the Prima Europe Fund that invests in prime residential investments. The fund is primarily active in Portugal but also in cities like Madrid, Milan or Athens. The company also owns and develops individual projects.

Update 2023: Optylon Krea continues to show strength in the real estate market. A good EUR 400 million gross has been invested in Lisbon in recent years, including more than 200 residential units and an aparthotel.

3. Temprano Capital (Madrid)

Temprano Capital is a real estate investor and developer headquartered in Madrid. The company currently has over USD 1 billion in assets under management and has a strong focus on the Iberian peninsula. Temprano has multiple portuguese residential properties in their portfolio. These are located in several Portuguese cities like Porto and Lisbon. An exemplary residential building is the “Livensa living Porto Boavista”.

These investor types are included in the list:

- Investment managers

- Real estate companies

- Project developers with portfolio acquisition

- Private equity investors

- REITs

- Pension funds

- Foundations

These property types are purchased:

- Residential real estate

- Office properties

- Retail real estate

- Logistics real estate

- Light industrial real estate

- Hotel real estate

- Data center

- Parking garages

- Nursing homes

Investors in the list are interested in:

- Core Real Estate

- Value add real estate

- Sales-and-Leaseback

- Trophy real estate

- Distressed Assets

- Project developments and forward deals

- Debt investments

Included columns in our directory

- Company data (name, legal form, country of origin)

- Contact details (address, URL, e-mail, telephone number, management)

- Form of address of the management suitable for serial letters (e.g. “Dear Dr. Müller”)

- Investor type (investment manager, REIT, pension fund, private equity, etc.)

- Investment focus (asset classes, ranking from A to E, (global) investment volume / assets under management, detailed geographical focus)

- Special investment focus (debt, parking, forward deals, etc.)

- Link to the acquisition profile of the companies and contact details of an acquisition manager (if indicated on the investors’ website)

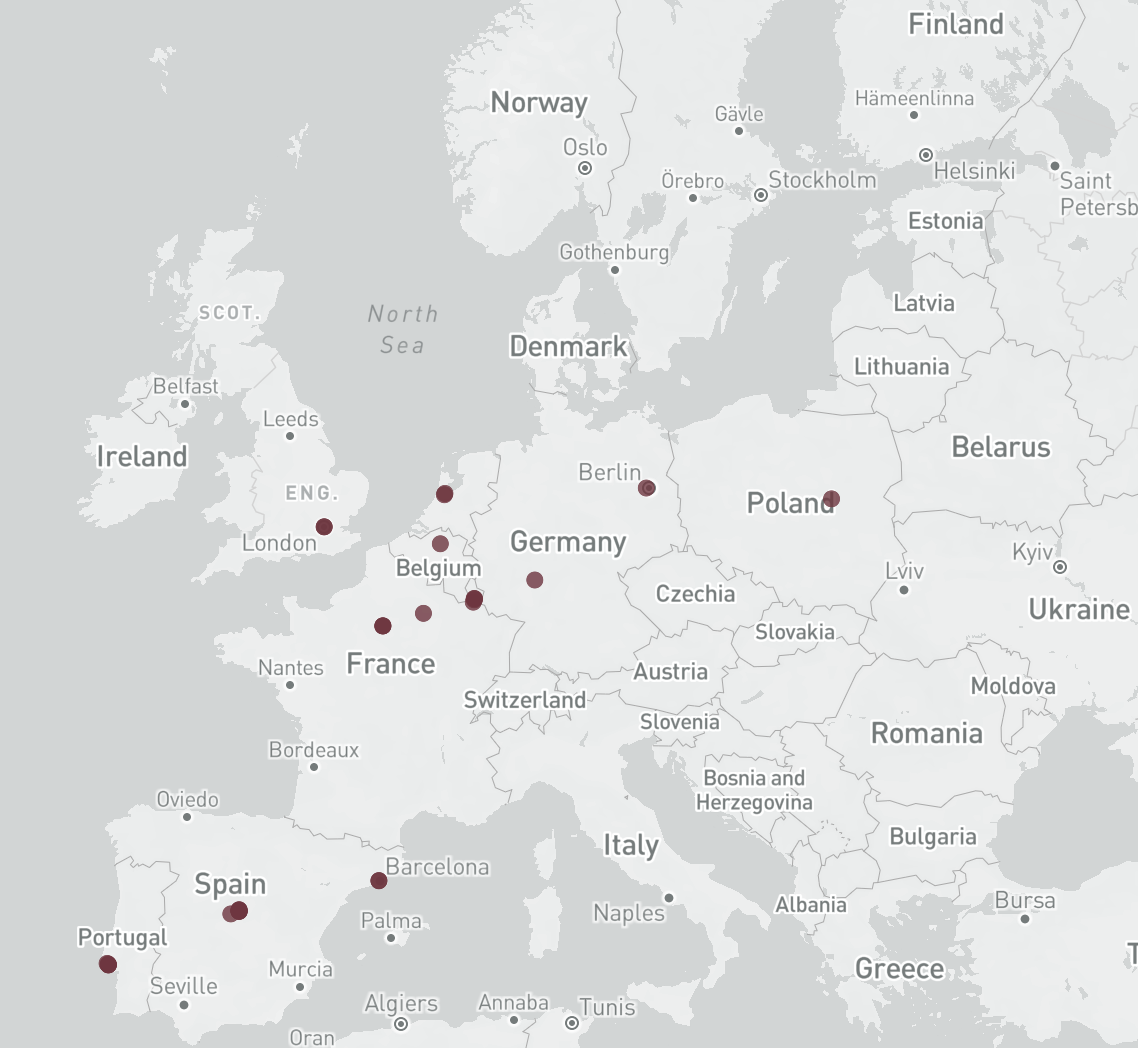

Where are the investors from?

Domestic real estate investors in Portugal are all located in the country’s largest city and capital Lisbon. The city is Portugal’s main economic centre and financial hub. Foreign real estate investors often come from other European nations like Germany, France or the neighbouring Spain.

Investment companies with international origins

Portugal is one of the largest economies in the EU and has been attracting increasing numbers of investors from all over the world in recent years. For this reason, our database of the most important real estate buyers contains not only companies from Portugal, but from many other countries. For example, professional real estate investors from the UK, Germany, France, Singapore, USA, China or Switzerland are included in the overview. Many of the companies listed are active throughout the country, with Lisbon, Porto, Vila Nova de Gaia, and Amadora being particularly popular with many buyers. Especially investors for hotels, resorts and holiday properties are highly interested in coastal regions like the Algarve, and islands like Madeira and the Azores.

Asset classes in our list: residential, office, logistics, retail, care, hospitality

The real estate market can be divided into different asset classes, which are characterised by very different structures and characteristics. The team of Research Germany knows that specialized investors operate in the individual segments. To help you easily identify the right real estate buyer for your project, our overview contains several columns that show all relevant asset classes. With just one click you can filter by investment companies that invest in residential real estate, office real estate, retail and shopping centers, logistics or light industrial real estate, hotels and vacation properties or care properties. The largest companies are often active in several segments, while smaller companies often focus on individual areas.

Picture source: Unsplash(Filiz Elaerts), Unsplash(Vita Marija Murenaite), Unsplash(Everaldo Coelho), Hugo Sousa via Unsplash (22.08.2023)

Any questions? Get in touch!

Leo Semmelmann, Founder

contact [at] researchgermany.com

+49 (0) 89 92927741

We are looking forward to help you in case of any questions, remarks and individual requests. Feel free to get in touch via email, live chat or phone. We can also offer you package prices and can create individual lists.

Includes institutional investors, investment managers, project developers, real estate companies, REITs and pension funds that actively acquire real estate in Portugal. This list is based on our

Includes institutional investors, investment managers, project developers, real estate companies, REITs and pension funds that actively acquire real estate in Portugal. This list is based on our

Reviews

There are no reviews yet.