Description

List of 3 large healthcare real estate investors in Europe

Care for the elderly and the sick will become increasingly important in the coming decades. In the EU alone, there are currently over 25 million people over the age of 80. This number is expected to increase by 130% between 2018 and 2050. Therefore, the interest in healthcare real estate is increasing and since governments have limited budgets, private investors and companies in the care sector have recently gained in importance. Here we present three companies active in the healthcare sector.

1. Aedifica SA (Brussels/Belgium)

Brussels-based Aedifica SA is a listed company specializing in healthcare and nursing real estate in the European market. Aedifica’s portfolio is currently valued at 4.6 billion euros. The company operates in the European countries of Belgium, Germany, Finland, Sweden, Ireland, the United Kingdom and the Netherlands and owns over 570 healthcare properties. Aedifica leases the before-mentioned properties to over 110 different professional care providers.

Update 2023: Belgian company Aedifica is entering the Spanish market for senior real estate with a residence in Seville. The company, which specializes in the development of healthcare real estate, will invest thirteen million euros in the construction of a 160-place nursing home in the municipality of Tomares, to be operated by Neurocare and commissioned in early 2024.

2. Quandriga (Hamburg/Germany)

Quandriga GmbH is a Hamburg-based investment and asset management company. Quandriga is active in several asset classes and provides both direct and indirect investments and certain fund services. The company invests in office, retail, hotel and residential real estate.

Update 2024: Quandriga continues to see great potential for the care real estate sector – and not just in Germany. However, based on data from the Federal Statistical Office and calculations by the Federal Institute for Population Research, the number of people in need of care – in Germany alone – will rise to more than 4.1 million in 2030 and to more than 5.3 million in 2050.

3. Target Healthcare REIT (Stirling/Scotland)

Target Healthcare is a REIT focused on real estate in the healthcare sector in the United Kingdom. The company invests exclusively in modern purpose-built properties. An exemplary property is the “Balhousie St Ronan’s Care Home” for assisted living in Dundee, Scotland.

Picture source: Mihály Köles via Unsplash 22.08.2023

Focus on investors for senior living and care properties

The healthcare real estate asset class has grown strongly in recent years. The reason for this is the current demographic trend: by 2050, it is expected that there are more than 6 million people in need of care in Germany. Special nursing care properties are becoming particularly relevant in this context. These are often combined with “assisted living”, which promises seniors a mix of freedom and support. Healthcare properties are mostly operator properties. This means that a tenant takes over the business operations and pays rent for it. In our list we represent the largest and most important healthcare real estate investors in Europe. They buy a wide variety of properties in the “healthcare” segment.

Picture source: Vlad Sargu via Unsplash (22.08.2023)

These investor types are included in the list:

- Investment managers

- Real estate companies

- Project developers with portfolio acquisition

- Private equity investors

- REITs

- Pension funds

- Foundations

These property types are purchased:

- Nursing homes

- Assisted living

- Mixed-Use care properties

- Senior residences

- Care operator real estate

- Senior living

Investors in the list are interested in:

- Core Real Estate

- Value add real estate

- Sales-and-Leaseback

- Trophy real estate

- Distressed Assets

- Project developments and forward deals

Included columns in our directory

- Company data (name, legal form, country of origin)

- Contact details (address, URL, e-mail, telephone number, management)

- Form of address of the management suitable for serial letters (e.g. “Dear Dr. Müller”)

- Investor type (investment manager, REIT, pension fund, private equity, etc.)

- Investment focus (asset classes, ranking from A to E, (global) investment volume / assets under management, detailed geographical focus)

- Special investment focus (debt, parking, forward deals, etc.)

- Link to the acquisition profile of the companies and contact details of an acquisition manager (if indicated on the investors’ website)

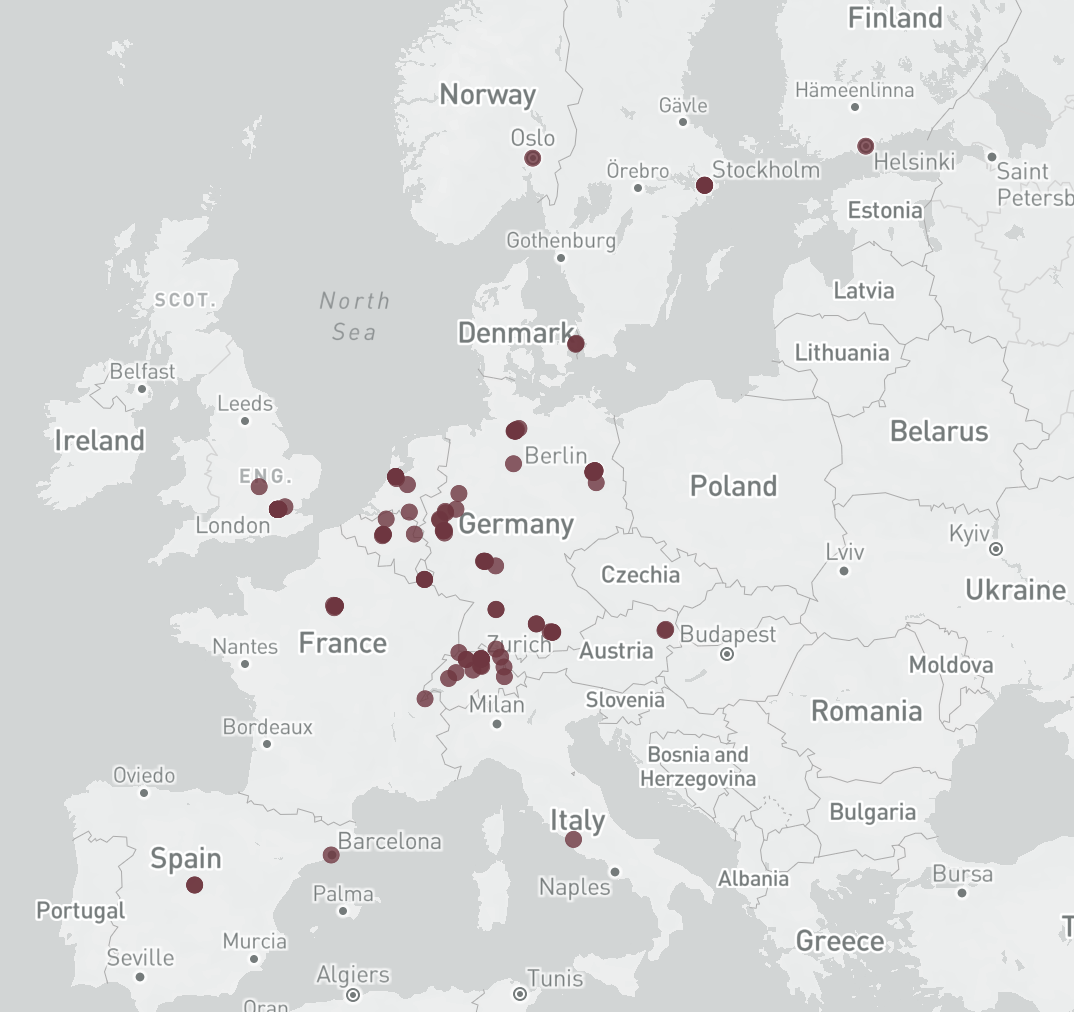

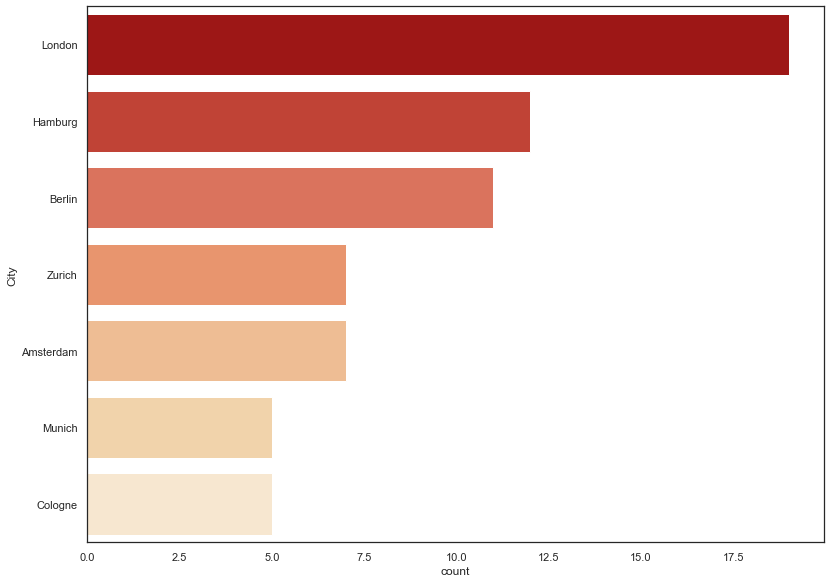

Where are the investors in Europe located?

Europe’s population on average is getting older. Therefore healthcare facilities like nursing homes and senior care are becoming more important. Several real estate investors are currently active in the sector. Healthcare real estate investors can be found in any European country. The focus is hereby on the Benelux Union, Switzerland, the UK, and France.

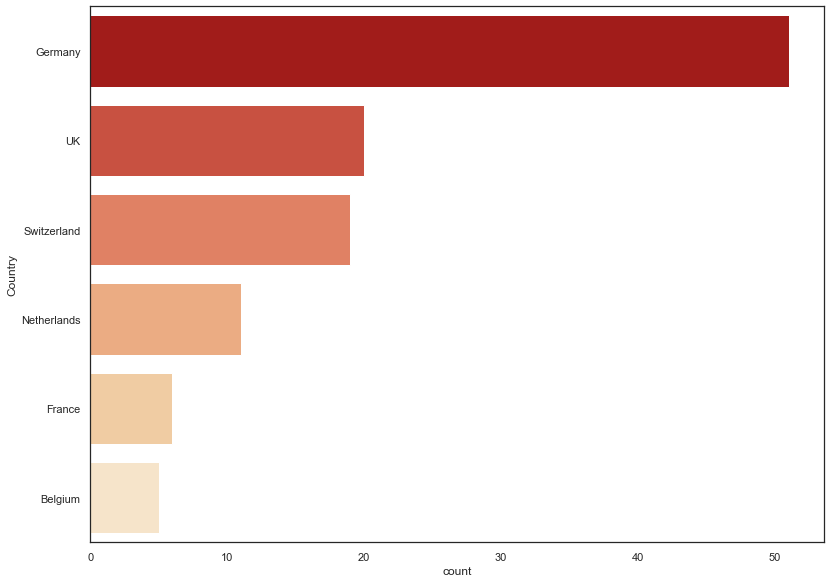

Countries of origin

Most of the healthcare real estate investors in our list are from Germany. This is followed by the United Kingdom, Switzerland and the Netherlands. Also active are investors from the countries France and Belgium.

Any questions? Get in touch!

Leo Semmelmann, Founder

contact [at] researchgermany.com

+49 (0) 89 92927741

We are looking forward to help you in case of any questions, remarks and individual requests. Feel free to get in touch via email, live chat or phone. We can also offer you package prices and can create individual lists.

Includes institutional investors, investment managers, project developers, real estate companies, REITs and pension funds that actively acquire healthcare real estate in Europe. This list is based on our

Includes institutional investors, investment managers, project developers, real estate companies, REITs and pension funds that actively acquire healthcare real estate in Europe. This list is based on our

Reviews

There are no reviews yet.