Description

List of the 5 largest trading companies in Germany

Trade is one of the central economic sectors in Germany. Trading companies contribute about 16 percent of the gross domestic product and provide a good 3 million jobs. These are the 5 largest trading companies in the Federal Republic of Germany:

1. REWE Deutscher Supermarkt AG & Co. KGaA, Cologne

With around 3,600 stores, REWE is the number 2 in German food retailing and at the same time Germany’s second largest trading company. Originally organised as a cooperative, Rewe has long since formed a group of companies. The current structure has been in place since 2006, when various supermarket chains of the Group were merged under the REWE brand. The discounter Penny also belongs to REWE.

Update 2022: The 2021 financial year was extremely successful for Rewe, with sales growth of 2 billion euros and total external sales of 76.5 billion euros. The DIY sector is served by toom Baumärkte, the Lekkerland Group generates sales in the convenience sector, and PENNY is active as a discounter throughout Europe.

Update 2024: Now that Real has slipped into insolvency, REWE is coming into play. The food retailer is planning to take over a total of 15 Real stores from the ailing chain.

2. EDEKA ZENTRALE AG & Co. KG, Hamburg

EDEKA is the largest German food retailer. The group and the decentralised cooperative organisation enter into a unique symbiosis. The EDEKA headquarters is the umbrella for 7 regional companies. Around 4,500 independent EDEKA retailers form the basis. The network includes, among others, the discounter Netto, various bakery chains, beverage retailers and self-service department stores.

3. METRO AG, Düsseldorf

METRO AG was created in 2017 from the split-up of the old Metro Group and combined the retail chains Metro Cash & Carry and Real. The Real stores were sold to an investor group in February 2020. What remained is essentially Metro Cash & Carry – an international wholesale chain with a total of 760 self-service wholesale stores in 25 countries.

Update 2023: In February 2023, the Group announced that the Management Board of Metro Germany would be expanded. Martin Schumacher, a long-time Metro manager with international experience, was appointed CEO.

4. PHOENIX Pharmahandel GmbH & Co KG, Mannheim

PHOENIX Pharmahandel is the number 1 pharmaceutical wholesaler in Germany and a leading European healthcare provider. The company belongs to the Merckle Group – a conglomerate with a focus on pharmaceuticals. PHOENIX Pharmahandel supplies 56,000 pharmacies in 27 countries with pharmaceuticals and healthcare products.

5. CECONOMY AG, Düsseldorf

Like METRO AG, CECONOMY was created in 2017 from the split-up of the old Metro Group. Since then the consumer electronics chains Mediamarkt and Saturn have been operating under the new name. In operational terms, the stores are organized under the umbrella of the MediaMarktSaturn Retail Group in Ingolstadt. The individual stores are legally independent units and each is majority-owned by the MediaMarktSaturn Retail Group.

Part of our list: Retailers, wholesalers, e-commerce companies

The retail sector reflects the German economy in its variety. Many retailers specialise in specific sectors and are market leaders in their respective industries. With our list of the largest retailers in Germany, we cover all areas and make this difficult-to-understand industry transparent. You can use the database to identify specific retailers, wholesalers or e-commerce companies. Thanks to our categorization and segmentation you can see at a glance in which industries the respective companies are active. Thus, our list offers much more than just an address database.

This information is included

- Company name

- General contact data (address, e-mail address, telephone number, URL)

- Name of the management

- Serial letter suitable for addressing the management (e.g. “Dear Dr. Müller”)

- Sales figures for the years 2021, 2020, 2019, 2018, 2017, 2016 and 2015 (taken from the annual and consolidated financial statements)

- Employee figures for the years 2021, 2020, 2019 and 2018 (taken from the annual and consolidated financial statements)

- Field of activity

- Classification by industry (see below)

- Own stationary trade (yes/no)

- Own online trade (yes/no)

Note: If the sales and employee figures are not included in a company’s own financial statements but in the parent company’s consolidated financial statements, the data from the respective consolidated financial statements are provided.

Picture source: CHUTTERSNAP via Unsplash (04.07.2023)

German trade industry: Covered segments

In order to give you an impression of the scope of our database, we list below some industries that are covered by the database. Our research team has developed a field of activity for each company, combining the necessary granularity with a meaningful segmentation and categorization.

Wholesale Trade:

- Electrical wholesale (e.g. UNI ELEKTRO Fachgroßhandel GmbH & Co. KG)

- Industrial trade (e.g. Klöckner & Co SE)

- Chemical trade (e.g. Brenntag AG)

- Pharmaceutical trade (e.g. GEHE Pharma Handel GmbH)

- Construction trade (e.g. EUROBAUSTOFF Handelsgesellschaft mbH & Co. KG)

- Sanitary trade (e.g. Richter + Frenzel GmbH & Co. KG)

- etc.

Retail:

- Food retail trade (LEH) (e.g. EDEKA ZENTRALE AG & Co KG)

- Wine trade (e.g. Hanseatisches Wein- und Sekt-Kontor Hawesko GmbH)

- Fashion and textile trade (e.g. Peek & Cloppenburg KG)

- Mail order business (e.g. Otto GmbH & Co KG)

- Vehicle trade (e.g. Mahag Automobilhandel und Service GmbH & Co. OHG)

- Furniture trade (e.g. POCO Einrichtungsmärkte GmbH)

- Book trade (e.g. H. Hugendubel GmbH & Co. KG)

- etc.

Online Trade / E-Commerce:

- Online fashion trade (e.g. Zalando SE, mytheresa.com GmbH)

- Online furniture trade (e.g. home24 SE)

- Online trade in children’s products (e.g. windeln.de SE, babymarkt.de GmbH)

- Online music store (e.g. Thomann GmbH)

- Online wine trade (e.g. Vicampo.de GmbH)

- etc.

Picture source: Joey Kyber via Unsplash (04.07.2023)

Statistics based on the ResearchGermany database

The ResearchGermany database of the German retail industry covers all segments of retail throughout the Federal Republic. Thanks to the extensive data set, we are able to publish interesting statistics. In the following, we present the distribution of the trading companies from our list by federal state and city in clear graphs. On request we are also able to prepare individual analyses.

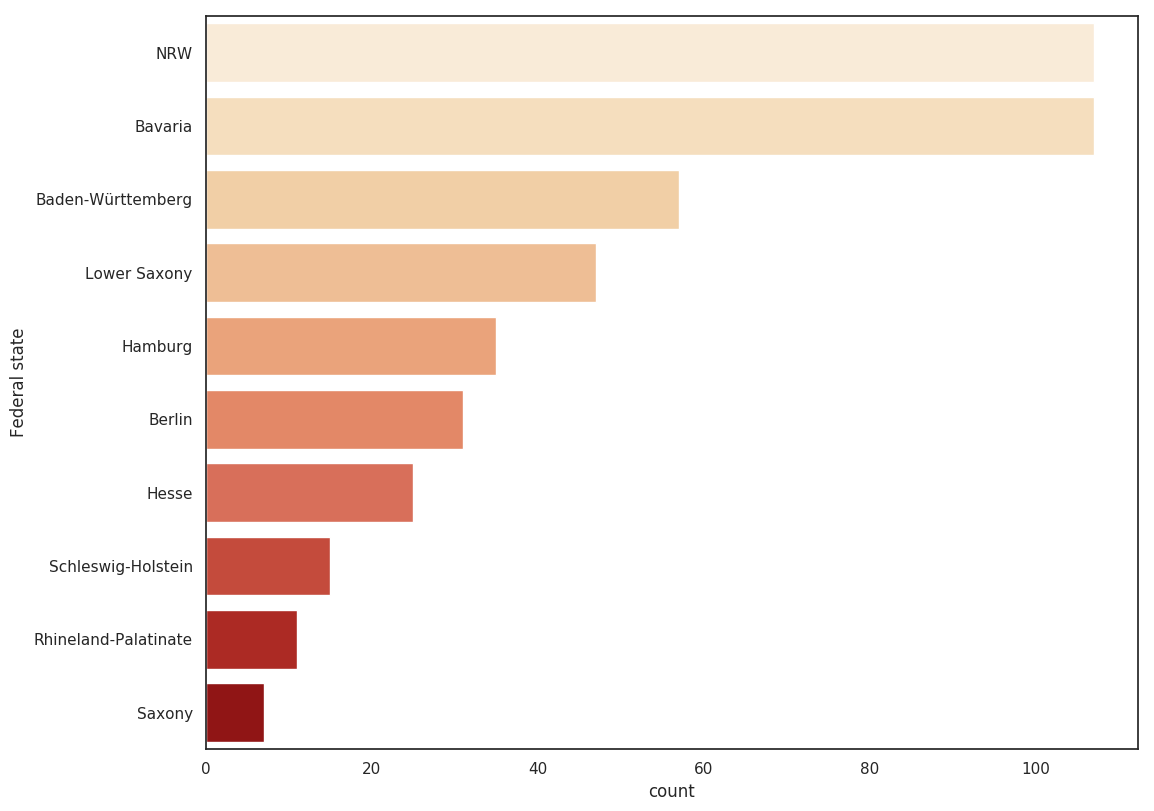

Distribution of the headquarters by federal state

Most German trading companies are based in Bavaria or North Rhine-Westphalia. Both states are home to more than 100 of the largest German trading companies in the wholesale, retail and online trade sectors. In general, the distribution by federal state roughly corresponds to the general distribution of the largest companies in Germany (see here).

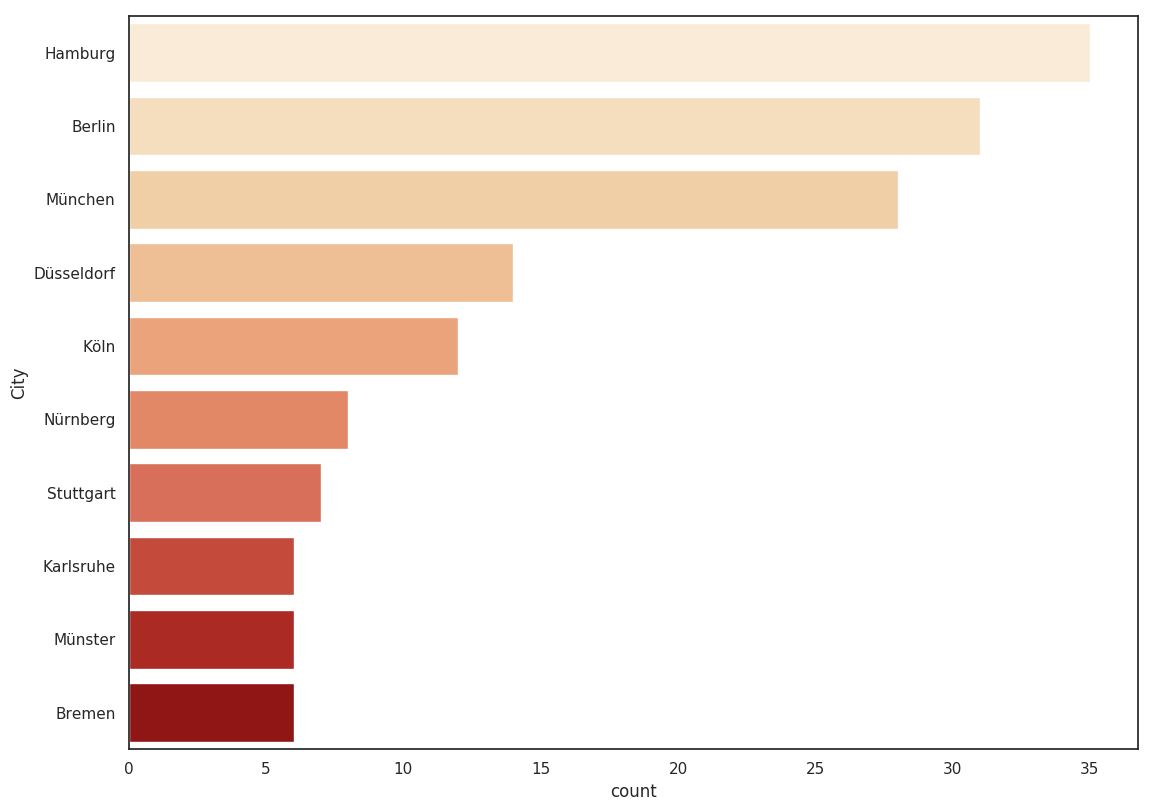

Distribution of the headquarters by city

Most of the largest trading companies in Germany are located in economically strong regions or in the cities with the most inhabitants. However, the distribution of headquarters by city shows that there are some interesting exceptions. This is particularly related to regional industrial clusters, which are also reflected in the retail sector.

The German retail industry: Statistics and facts

The retail sector is the interface between producers of goods and consumers. Retailers procure the products in demand from manufacturers and offer them “locally”. A distinction is made between wholesale and retail trade. Wholesalers sell their goods to commercial customers – including retailers – and to bulk buyers. The retail trade, on the other hand, offers its goods to private end users. Within the framework of this distinction, there are several dozen retail sectors.

According to the Federal Statistical Office, the German wholesale and retail trade represents an annual turnover of 2.19 trillion Euros and 6.4 million employees. There are about 150,000 wholesalers and about 300,000 retailers. In 2019 the retail trade achieved sales of almost 550 billion euros. One of the most important retail sectors is food retailing. It accounts for about 20 percent of retail sales. Internet trading has become increasingly important in recent years. It has developed into a serious competitor for stationary trade. Almost every eighth euro in retail is now generated in online stores. This share is likely to increase even further in future.

The retail sector is characterized by strong market concentration overall. In many retail sectors – for example in food retailing – the market is dominated by a few large chains. By contrast, the wholesale sector is less highly concentrated. Here, medium-sized companies are typical. Around one-fifth of those employed in retail work for wholesalers, while 80 percent are employed in the retail sector.

Any questions? Get in touch!

Leo Semmelmann, Founder

contact [at] researchgermany.com

+49 (0) 89 92927741

We are looking forward to help you in case of any questions, remarks and individual requests. Feel free to get in touch via email, live chat or phone. We can also offer you package prices and can create individual lists.

Contains the 500 largest trading companies from Germany in the wholesale, retail and e-commerce sectors. The list is an excerpt from our

Contains the 500 largest trading companies from Germany in the wholesale, retail and e-commerce sectors. The list is an excerpt from our

Marcus Flinn (verified owner) –

This is exactly the kind of database we were looking for. We use the list to approach the MDs via LinkedIn and are satisfied with the data quality.

Bastian Collins (verified owner) –

This list provides all necessary information on companies in the retail market in Germany. I’m very happy with the high quality data.