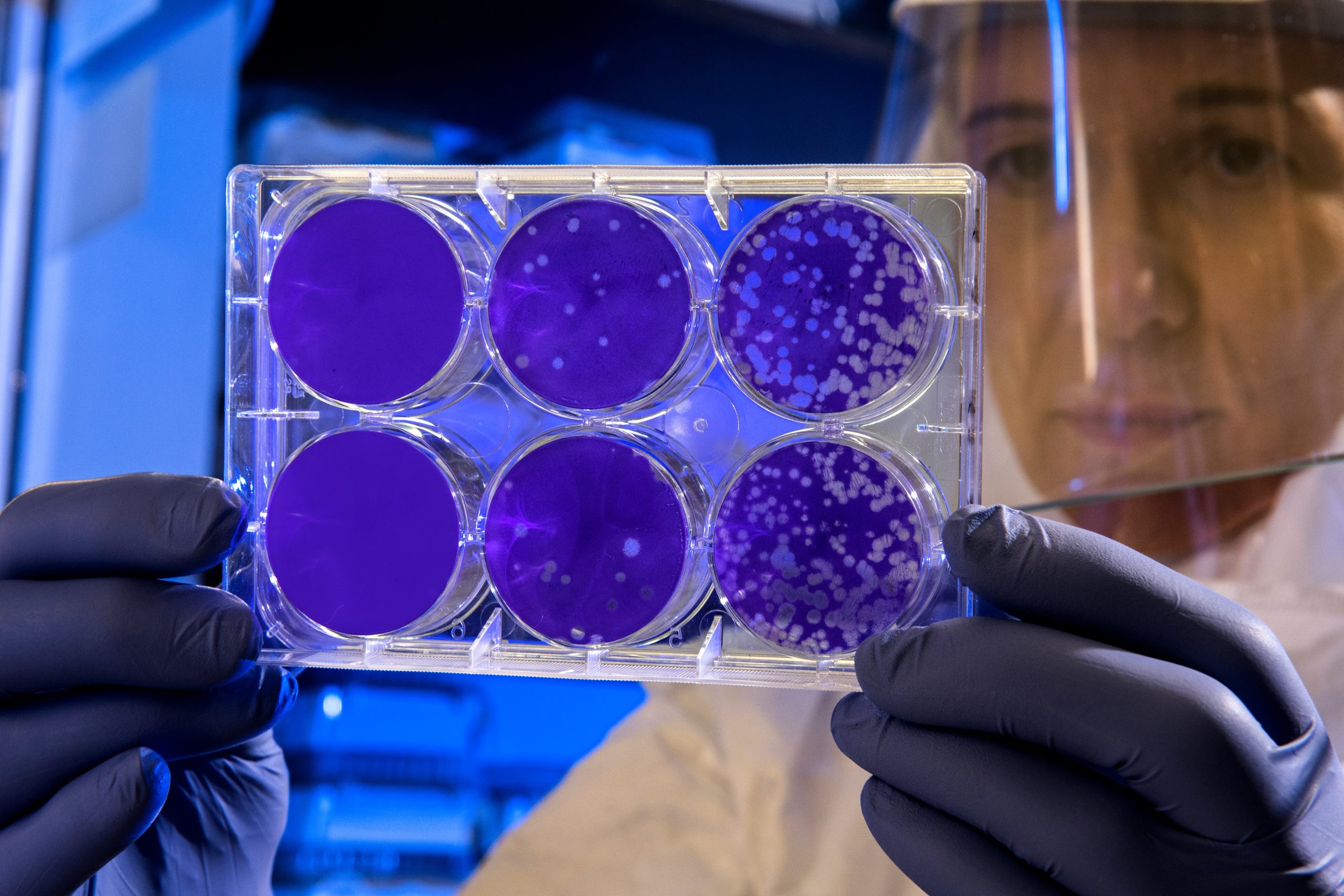

American venture capital funds as essential financing partners for international biotech start-ups

Start-up companies in the biotech and pharmaceutical sectors are dependent on solvent capital providers to support them, especially in the early stages. The costs for the highly qualified team as well as for clinical studies and years of research are so high that large financing rounds are regularly concluded. For biotech start-ups, investors are very important not only because of the capital they provide, but also because of their expertise and networking within the scene. American VCs, which have been participating in many of the largest rounds for many years, play a particularly important role here (in addition to venture capital funds from Switzerland). Our comprehensive database of the 250 largest venture capital funds from the USA includes a breakdown by investment focus. Of the companies listed, a total of 152 VCs are active in the life science/healthcare sector. In this article we would like to introduce some of these investment companies. This article is based on the unique List of the 250 most important venture capital investors in America.

-

€199,99 Incl. VAT

- Exclusive database of the largest venture capital funds in the USA

- Uncomplicated download as Excel list via online shop

- List contains contact details, contact persons and detailed information about the investment focus

- Perfectly suited to identify suitable venture capitalists for start-ups

- Regular updates and enhancements ensure up-to-dateness

- Free preview file available on request

#1: OrbiMed (New York City, NY): Internationally active investor for the health care industry

OrbiMed is one of the world’s most important and largest investors for companies in the healthcare sector. In addition to biotech companies, it also supports companies in the fields of medical technology, healthcare services and healthcare IT. With locations in the USA, China and India, OrbiMed invests around the world and has already supported hundreds of companies in their growth ambitions. OrbiMed is not a classic venture capital investor, as it also finances established and listed companies. Nevertheless, the company is a highly relevant contact point for young life science and healthcare companies from the USA and beyond.

#2: RA Capital (Boston, MA): Life science investor with a strong network and a wealth of experience

For young companies in the healthcare industry, contacts with relevant players in the scene are particularly important. This applies not only to the acquisition of business partners, but also and especially to the recruitment of personnel. The investor RA Capital knows this and positions itself quite clearly as a partner that provides much more than “just” capital. RA Capital’s investments include numerous successful companies from the life science industry, some of which have made the step to IPO in recent years. The most well-known companies among the exits are certainly Moderna Therpeutics and Novavax. Among the American biotech VCs, RA Capital is one of the companies with the largest and most steady deal flow.

#3: Atlas Venture (Cambridge, MA): Early-stage investor for biotech start-ups with more than $3 billion AUM

The third venture capital investor in our selection is also based in Massachusetts. The selection does not present a distorted picture, as many of the most relevant life science companies are spin-offs of the renowned universities on the east coast of the USA. It is therefore only logical that numerous early-stage investors for this segment are also based here. Altas Venture is a good example of this. With assets under management totaling more than $3 billion, the company is one of the larger in the United States. The VC prefers to participate in seed and early stage investment rounds and is certainly involved in larger rounds in the three-digit million range. The funded start-ups come from very different areas of the biotech world and are mainly based in the USA. The regional focus is on the east coast.

Picture source: Unsplash