Description

List of 3 light-industrial real estate investors in Europe

“Light-industrial” refers to real estate that is well located and has a flexible action concept. They are generally industrial halls or production areas that also have office space.

1. INBRIGHT Investment GmbH (Berlin/Germany)

INBRIGHT is a private company that acts as project developer and real estate investment manager. As an investment manager, the company provides institutional investors with access to light-industrial real estate through funds or other investment vehicles. In addition to light-industrial, the firm focuses on office buildings.

Update 2023: The investment manager continues to be very active and has started the construction of a 25,000 m² light industrial and logistics space in Hamburg-Billbrook. For the new site in the Hanseatic city, INBRIGHT is investing around 35 million euros. The project is scheduled for completion by the end of 2023 and already has two well-known and liquid tenants in Rofin Sinar Laser GmbH and Franke + Pahl GmbH.

2. DIVAM Capital Partners (Bremen/Germany)

DIVAM is an investment company focusing on light-industrial and other types of logistics and industrial real estate in Germany. The company invests on behalf of institutional investors as well as HNWI and family offices. Investments are made through individual solutions or through funds. DIVAM invests in properties located in locations with more than 100,000 inhabitants or close to the highway. The investment volume is between 2 and 20 million euros.

Update 2024: Managing Partner is still Dr. Frank F. Ebner, who has been successfully steering the fortunes of the investment boutique for many years.

3. VGP Group (Antwerp/Belgium)

VGP is a real estate investor and project developer specializing in logistics and commercial real estate. The company is active in 13 European markets, including Germany, Portugal and Spain. VGP owns huge industrial parks such as VGP Park Berlin, which has 216,250 square meters of leasable space.

Picture source: Robert Haverly via Unsplash (23.08.2023)

An industry in focus: production-related buildings and entrepreneurial real estate

The light-industrial asset class has gained strong significance in recent years. While corporate real estate and production real estate used to be mostly held by the resident company itself, they are now increasingly being sold to investors via so-called “sale-and-leaseback” deals, which we cover via our list. Buildings in the light- industrial asset class are mostly production-related properties. These can also be production areas mixed with office space. Another focus of this list: industrial parks and industrial estates. We cover the ever increasing number of European light-industrial investors with our list.

These investor types are included in the list:

- Investment managers

- Real estate companies

- Project developers with portfolio acquisition

- Private equity investors

- REITs

- Pension funds

- Foundations

These property types are purchased:

- Light industrial real estate

- Corporate real estate

- Production real estate

- Industrial parks

- Industrial estates

Investors in the list are interested in:

- Core Real Estate

- Value add real estate

- Sales-and-Leaseback

- Trophy real estate

- Distressed Assets

- Project developments and forward deals

- Debt investments

Included columns in our directory

- Company data (name, legal form, country of origin)

- Contact details (address, URL, e-mail, telephone number, management)

- Form of address of the management suitable for serial letters (e.g. “Dear Dr. Müller”)

- Investor type (investment manager, REIT, pension fund, private equity, etc.)

- Investment focus (asset classes, ranking from A to E, (global) investment volume / assets under management, detailed geographical focus)

- Special investment focus (debt, parking, forward deals, etc.)

- Link to the acquisition profile of the companies and contact details of an acquisition manager (if indicated on the investors’ website)

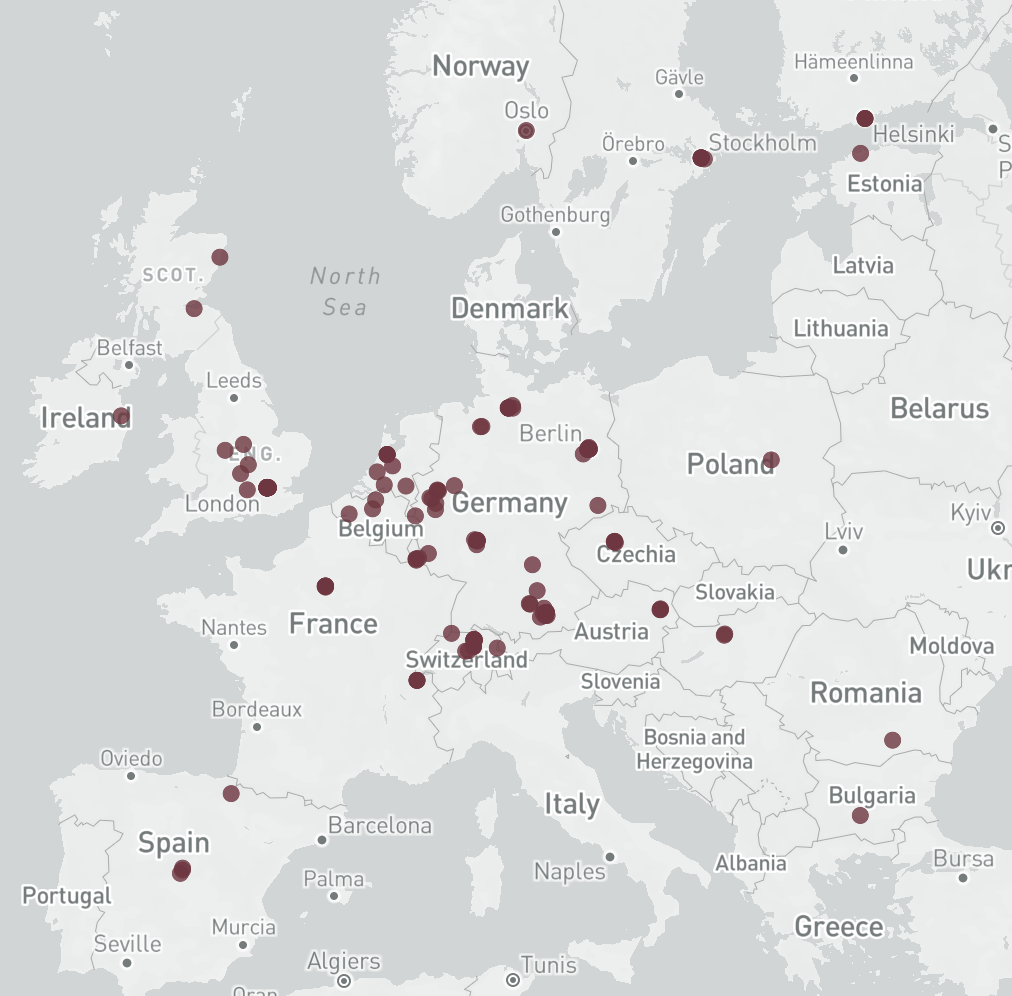

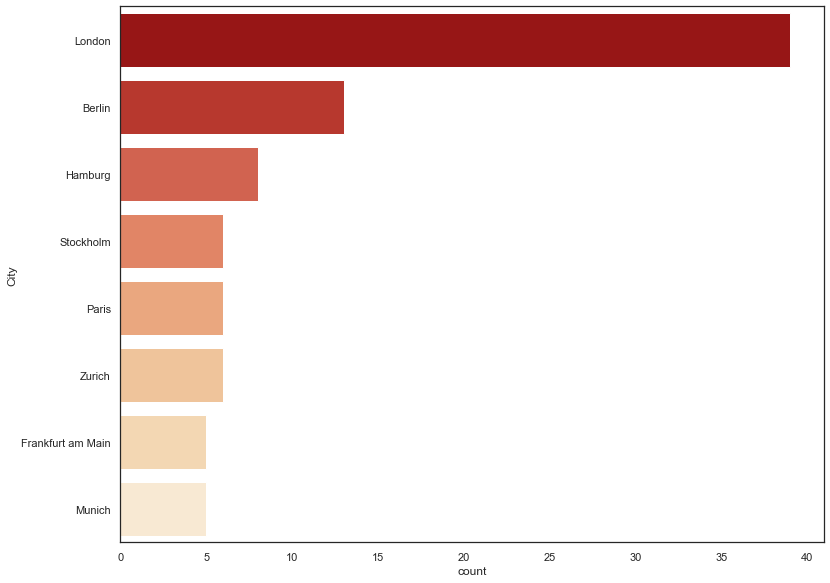

Where are they based?

Real estate investors that invest in light-industrial properties are practically in every European country. In detail they focus on production halls, corporate real estate and industrial properties. A large number of these investors are based in Germany. Other countries include France, the Benelux Union, and the UK.

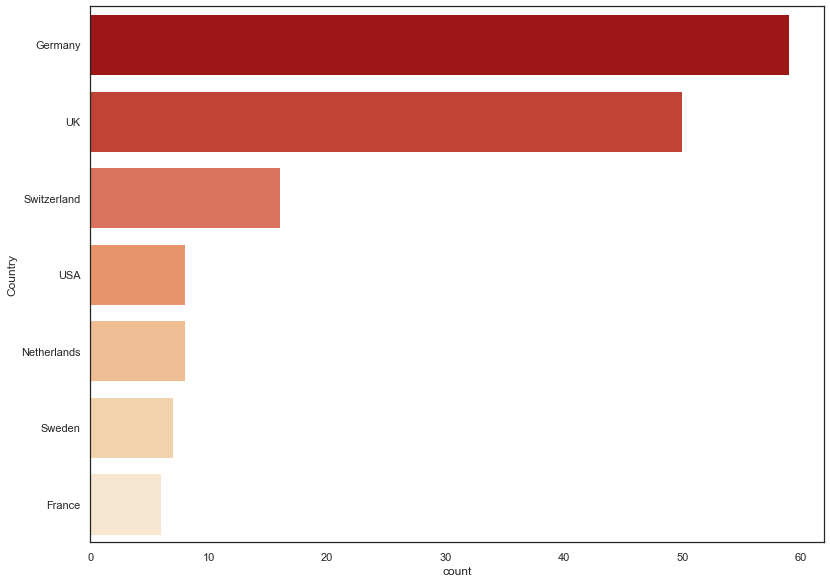

Countries of origin

Most of the light industrial real estate investors in our European list are from Germany. This is followed by the United Kingdom, Switzerland and the Netherlands. Also active are investors from the USA, Sweden and France.

Picture source: Unsplash (Marcin Jozwiak), Raphael Roth via Unsplash (23.08.2023)

Any questions? Get in touch!

Leo Semmelmann, Founder

contact [at] researchgermany.com

+49 (0) 89 92927741

We are looking forward to help you in case of any questions, remarks and individual requests. Feel free to get in touch via email, live chat or phone. We can also offer you package prices and can create individual lists.

Includes institutional investors, investment managers, project developers, real estate companies, REITs and pension funds that actively acquire light-industrial real estate in Europe. This list is based on our

Includes institutional investors, investment managers, project developers, real estate companies, REITs and pension funds that actively acquire light-industrial real estate in Europe. This list is based on our

Reviews

There are no reviews yet.