Description

List of 3 Private Equity Real Estate Investors in Europe

European private equity investors in the real estate business are characterized by their broad investment profile and rather high risk profile. In the following we introduce three relevant investors from our list.

1. EQT (Stockholm)

The Swedish private equity investor EQT invests through its EQT Exeter division. The focus of this is on value-add investments. These can be in the areas of logistics, light industrial, offices, life science and residential. An example is, for example, the “Concept” project in France or the acquisition of Stendörren, which invests in urban logistics properties and light industrial properties in the Stockholm area.

Update 2023: A new logistics center for Aldi is being built in Paderborn, where EQT Exeter is acting as project developer and will be responsible for the construction – the regional company Aldi Nord will be the tenant. The site, which covers an area of around 50,000 square meters, has enough space for a cold and dry storage facility and a transshipment hall for frozen goods. In addition, office and administrative space is part of the arrangement on Halberstädter Straße.

2. AURELIUS Real Estate Opportunities (Grünwald/Munich)

The real estate arm of the Munich-based private equity investor AURELIUS Real Estate Opportunities invests in residential, light industrial and corporate real estate. In PE style, the focus is on special situations. A “manage-to-core” approach is used to achieve improvement potential. Properties are purchased in European markets from a purchase price of EUR 3 million.

Update 2024: AURELIUS has acquired the Lindemann hotel group as part of a buy and build strategy. The portfolio comprises four boutique hotels in Berlin and offers growth potential. The deal also clarifies the succession solution for the Lindemann family’s life’s work.

3. Heitman (Chicago/Frankfurt)

The US private equity investor Heitman LLC manages over USD 46 billion. In the real estate sector, investments are made in three areas: Private Equity (privately held real estate), Debt (loans) and Public Equity (shares in listed companies). In private equity, the focus is on core, value-add and opportunistic strategies.

What distinguishes these PE-investors?

In general, “private equity” refers to privately held investment vehicles that are not listed on a stock exchange. Private equity funds have established themselves specifically in the corporate investment world. In recent years, these private equity funds have also become increasingly active in the real estate markets with their own property investment teams. These investors differ from ordinary investors in so far that riskier deals are made, they often have a broader investment spectrum and distressed assets are also relevant.

These investor types are included in the list:

- Private equity investors

These property types are purchased:

- Residential real estate

- Office properties

- Retail real estate

- Logistics real estate

- Light industrial real estate

- Hotel real estate

- Data center

- Parking garages

- Nursing homes

Investors in the list are interested in:

- Core Real Estate

- Value add real estate

- Sales-and-Leaseback

- Trophy real estate

- Distressed Assets

- Project developments and forward deals

- Debt investments

Included columns in our directory

- Company data (name, legal form, country of origin)

- Contact details (address, URL, e-mail, telephone number, management)

- Form of address of the management suitable for serial letters (e.g. “Dear Dr. Müller”)

- Investor type (investment manager, REIT, pension fund, private equity, etc.)

- Investment focus (asset classes, ranking from A to E, (global) investment volume / assets under management, detailed geographical focus)

- Special investment focus (debt, parking, forward deals, etc.)

- Link to the acquisition profile of the companies and contact details of an acquisition manager (if indicated on the investors’ website)

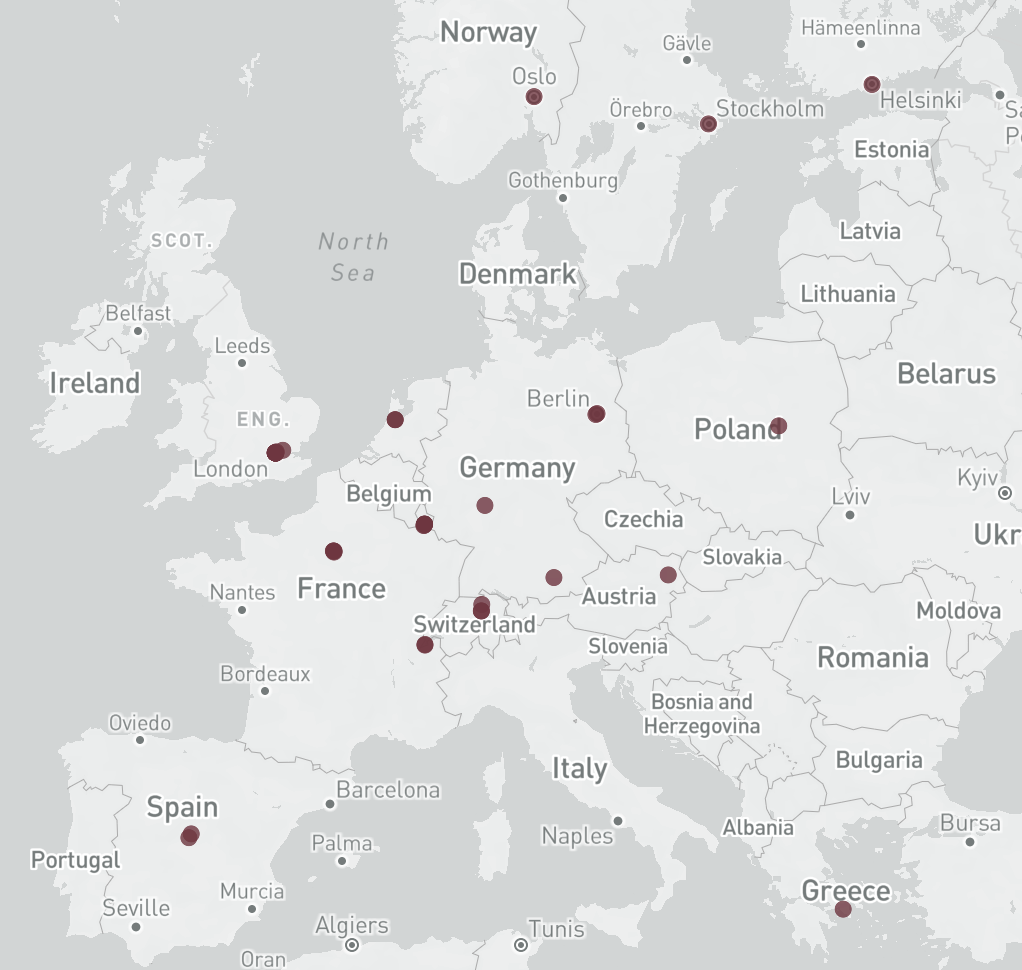

Where are investors in Europe located?

European private equity real estate investors heavily focus on certain regions to invest. They often have their headquarters in the UK (especially London), Luxembourg or German cities like Berlin or Munich. Many US-based private equity investors are active in the European real estate market.

Picture Source: Unsplash (Felicia Varzari), Nastuh Abootalebi via Unsplash (23.08.2023)

Any questions? Get in touch!

Leo Semmelmann, Founder

contact [at] researchgermany.com

+49 (0) 89 92927741

We are looking forward to help you in case of any questions, remarks and individual requests. Feel free to get in touch via email, live chat or phone. We can also offer you package prices and can create individual lists.

Includes private equity investors actively buying real estate in Europe. This list is based on our

Includes private equity investors actively buying real estate in Europe. This list is based on our

Reviews

There are no reviews yet.