Description

List of 3 large M&A and corporate finance consultancies in Germany

Corporate transactions and the acquisition of shareholdings are complex processes in which a large number of economic, financial and legal issues need to be clarified. M&A and corporate finance consultancies specialize in this area. The companies we have written news about are part of our list of the largest M&A and corporate finance consultancies in Germany.

1. Clairfield International: Düsseldorf/Frankfurt/Stuttgart

Clairfield International is a globally operating group of M&A and corporate finance advisors. In total, the consultancy has 34 offices in 22 countries, three of which are in Germany. In the last five years, 650 transactions and corporate finance projects with a total volume of 25 billion euros have been supported. Clairfield International’s target group is larger medium-sized companies, in particular family businesses. The firm advises on transactions up to approximately €500 million. The consulting focus is on mergers and acquisitions, capital market consulting, business valuation and strategic consulting. One transaction Clairfield International advised on in Germany was the sale of DRK-Kliniken Nordhessen to Helios in 2021.

2. Houlihan Lokey: Frankfurt/Munich

Houlihan Lokey Inc. is an American investment bank founded in 1972 and headquartered in Los Angeles with over 1,300 employees worldwide. The bank specializes in advising companies and other institutions on insolvency and restructuring. The institute is considered a global leader in this field. This also applies to the advisory fields of Debt Advisory – debt advice to avert impending insolvency – and Creditor Advisory. In the USA, Houlihan Lokey’s best-known creditor advisory services included the Enron, General Motors Corporation and Lehman Brothers cases. In Germany, Houlihan Lokey has advised creditors of Jack Wolfskin Ausrüstung, Rickmers Reederei and Wirecard, among others.

3. goetz partners: Munich

goetz partners was founded in 1991 by Stephan Goetz and Stefan Sanktjohanser. In addition to Munich, the consultancy also has offices in Düsseldorf and Frankfurt/Main. Further offices are located in London, Madrid, Milan, Moscow, New York, Paris, Prague, Shanghai and Zurich. In total, goetz partners employs more than 250 consultants. The consulting focus is on strategy consulting, M&A consulting as well as on the support of transformation processes in companies (organization, personnel, restructuring). An example of a transaction supported by goetz partners is the acquisition of a majority stake in the North Hessian furniture manufacturer Thonet GmbH by the family office Benner Beteiligungsgesellschaft at the turn of the year 2021/22.

Update 2023: In March 2023 goetzpartners supported the Irish investment fund 4D Global Energy in the sale of Rosehope Limited, an Irish holding company.

Picture source: Hunters Race via Unsplash (26.09.2023)

Mergers & Acquisitions consultants: our directory

Our database of the most important M&A and corporate finance consultancies in Germany is the perfect product if you want to analyze the German M&A market and contact relevant consulting firms. The list can be downloaded directly after purchase as a clearly arranged Excel file and edited according to your wishes and requirements. You have unlimited access to the list and can use the overview optimally as an introduction to the scene. We not only provide you with contact details of the firms, but also with valuable information that allows you to directly classify the M&A consultancies. You can filter by consulting focus, use the ranking and get an overview of some references of the consultants. Save yourself hours of research work and rely on our in-depth experience in market research in the German and European investment industry.

Lead generation for buyers, sellers, owners and other advisors in the investor environment

Corporate finance consultancies and M&A consultancies are essential partners in the context of company acquisitions and sales. We assist numerous client groups in finding the right consulting firm for their project. These include managing directors and shareholders who want or need to dispose of their company. We have also been able to support numerous private equity professionals in comprehensively analyzing the German market for M&A consultancies and in establishing new contacts. Thanks to the clear presentation of the Excel file, the perfect consultancies can be easily identified by using the ranking (from A to E) or by specifying the consulting focus.

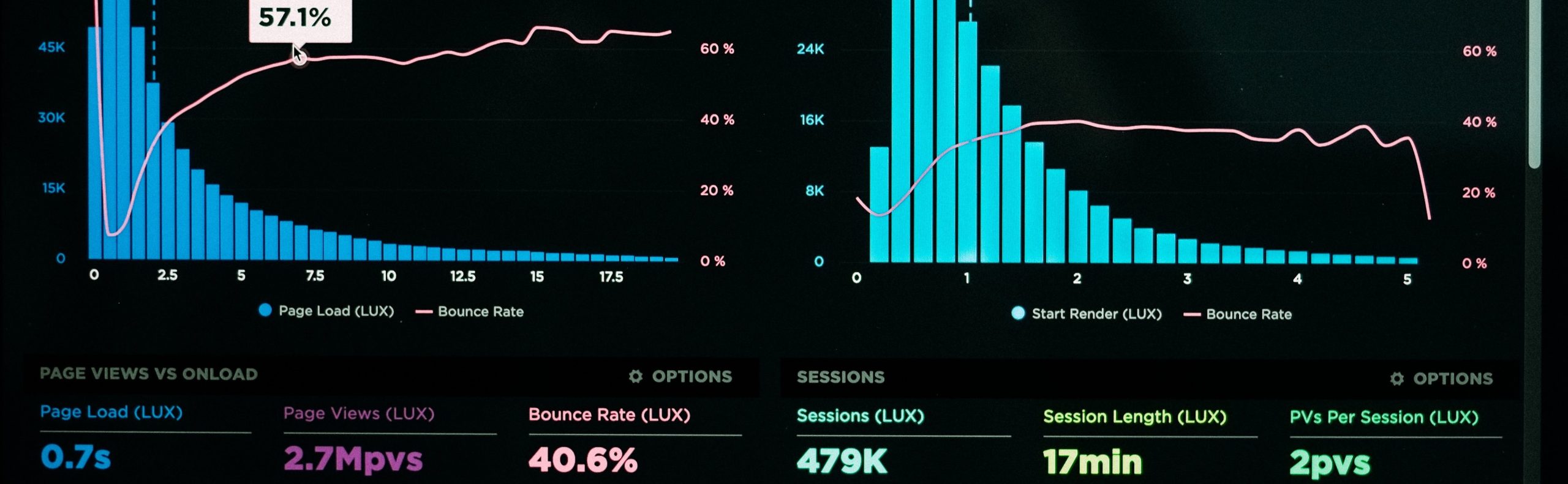

Picture source: Luke Chesser via Unsplash (26.09.2023)

This information is included in the database

- Company name

- General contact data (address, e-mail address, telephone number, URL)

- Name of the management

- Serial letter suitable for addressing the management (e.g. “Sehr geehrter Herr Dr. Müller”)

- Information on the consulting focus (M&A, corporate finance, capital raising, restructuring, CFO services, company valuation, distressed M&A, etc.)

- Country of origin and locations in Germany and abroad

- Ranking by size and relevance from A to E

- Mention of references and clients

Corporate Finance boutiques, Mid Cap, M&A Advisory firms

Corporate finance consultancies assist with corporate sales and acquisitions (M&A), capital raising, debt advisory and also restructuring plans. While the largest deals are supported by well-known consultancies such as McKinsey and BCG, many smaller consultancies such as Hübner Schlösser Cie (HSC) or Oaklins are also active in the mid-market. For example, HSC supported Heraeus Holding in the purchase of the worldwide dental business of Bayer AG. Due to the importance of hidden champions and mid-sized companies for the German economy, M&A boutiques and mid cap consultancies play a particularly important role. However, identifying the smaller consulting firms is not always easy, as they often specialize in certain regions and/or industries. We facilitate access to M&A consultants of all sizes by analyzing the entire German landscape and presenting it in a concise list.

Picture source: Adeolu Eletu via Unsplash (26.09.2023)

Any questions? Get in touch!

Leo Semmelmann, Founder

contact [at] researchgermany.com

+49 (0) 89 38466606

We are looking forward to help you in case of any questions, remarks and individual requests. Feel free to get in touch via email, live chat or phone. We can also offer you package prices and can create individual lists.

Contains the 200 largest M&A/Corporate Finance boutiques in Germany.

Contains the 200 largest M&A/Corporate Finance boutiques in Germany.

Reviews

There are no reviews yet.