Description

List of investors in the Benelux Union

To give you a better idea of our list, we briefly introduce three companies that are included in our address database of the largest Benelux real estate buyers. Our team deals intensively with the respective markets and analyses the most important players in detail before we prepare our lists. In this way we ensure that the most relevant companies are really included in our overviews and that you don’t acquire outdated data.

List of 3 large real estate investors in Belgium

1. Ascencio SCA (Gosselies)

Founded in 2006, this Belgian real estate investor is headquartered in Gosselies, Belgium. Ascencio’s focus is on commercial properties in peri-urban areas, and the investor now has 106 such properties in its portfolio – together these have an estimated value of around 700 million euros. The geographical is in Belgium, France and Spain – recently (early 2020) Ascencio acquired 5 shopping centers in the southeast of France.

Update 2023: The real estate buyer Ascencio continues to be active in the domestic market. Most recently, it acquired the Bellefleur retail park in Couillet (near Charleroi, Belgium) from Mestdagh. Mestdagh SA operates a network of grocery stores and supplies customers throughout the country. The purchase price was 6.4 million euros.

2. Whitewood (Antwerp)

In 2007 the foundations were laid for the current Belgian real estate investor Whitewood; in 2015 the joint venture with Dutch real estate investor AllFixed Property Management established a second pillar in the Netherlands. Whitewood invests in commercial real estate, residential real estate and also office real estate – together with DW Partners, Whitewood acquired a 174 million euro office portfolio from Propertize in 2016 – with offices in Utrecht, Rotterdam, Amsterdam and Den Haage.

Update 2024: Surprising deal in Brussels’ northern district: a real estate fund led by the Federal Holding and Investment Company (SFPI) and insurer Ethias is acquiring two office towers on Simon Bolivarlaan for almost 400 million euros. This is confirmed by the Antwerp-based fund manager Whitewood.

3. Nextensa (Brussels)

Nextensa is a Belgian real estate investor based in Antwerp with a regional focus on Belgium, Switzerland, Luxemburg and Austria. More than 50% of its investments are made in Luxembourg, which makes Nextensa one of the most important real estate investors in Luxembourg. Nextensa is also diversified in terms of investor asset classes and invests in office properties as well as commercial properties and also logistics properties.

List of 3 large real estate investors in the Netherlands

1. a.s.r. real estate (Utrecht)

a.s.r. real estate is a Dutch real estate investor belonging to one of the largest insurers in the Netherlands: a.s.r. The Utrecht-based real estate investor’s portfolio is diversified and includes not only residential properties but also retail, office, science park and rural properties – as a result, a.s.r. real estate has approximately 6.4 billion euros in assets under management. In mid-2020, the investor acquired 220 rental apartments of a residential building for the ASR Dutch Core Residential Fund, which is to be built on the former site of the Winston Churchill Tower in Rijswijk (South Holland) in 2022.

Update 2023: The real estate division of insurer ARS has received its first capital from Germany. The so-called “ASR Dutch Mobility Office Fund” was able to collect the equivalent of almost 60 million euros from an undisclosed institutional investor. The fund focuses on high-quality office buildings in the immediate vicinity of mobility hubs in the five largest office markets in the Netherlands.

2. Amvest (Amsterdam)

Amvest was established as a joint venture back in 1997, formerly with a focus on managing rental housing. However, since 2005, Amvest has also been active as an investor, distinctly in the area of residential real estate. In the meantime, the real estate investor from the Netherlands manages around 21,000 homes, which are divided into four portfolios. The most important fund for the company is the Amvest Residential Core Fund (ARC Fund), which specializes in sustainable single-person homes in the mid-price segment in economically strong regions in the Netherlands. Recently, as of mid-2019, the investor, which is also a project developer, has completed 151 rental apartments in Arnhem.

3. Daelmans Vastgoed (Maastricht)

The Dutch real estate investor Daelmans Vastgoed, headquartered in Maastricht, was founded back in 1982 and is still family-run. Daelmans Vastgoed focuses geographically on the Netherlands, Belgium and Germany. The company is interested in the residential properties, as well as retail- and office properties. In mid-2020, the real estate investor acquired a €91 million residential portfolio from Syntrus Achmea Real Estate & Finance, which includes a total of 399 properties.

These investor types are included in the list:

- Investment managers

- Real estate companies

- Project developers with portfolio acquisition

- Private equity investors

- REITs

- Pension funds

- Foundations

These property types are purchased:

- Residential real estate

- Office properties

- Retail real estate

- Logistics real estate

- Light industrial real estate

- Hotel real estate

- Data center

- Parking garages

- Nursing homes

Investors in the list are interested in:

- Core Real Estate

- Value add real estate

- Sales-and-Leaseback

- Trophy real estate

- Distressed Assets

- Project developments and forward deals

- Debt investments

Included columns in our directory

- Company data (name, legal form, country of origin)

- Contact details (address, URL, e-mail, telephone number, management)

- Form of address of the management suitable for serial letters (e.g. “Dear Dr. Müller”)

- Investor type (investment manager, REIT, pension fund, private equity, etc.)

- Investment focus (asset classes, ranking from A to E, (global) investment volume / assets under management, detailed geographical focus)

- Special investment focus (debt, parking, forward deals, etc.)

- Link to the acquisition profile of the companies and contact details of an acquisition manager (if indicated on the investors’ website)

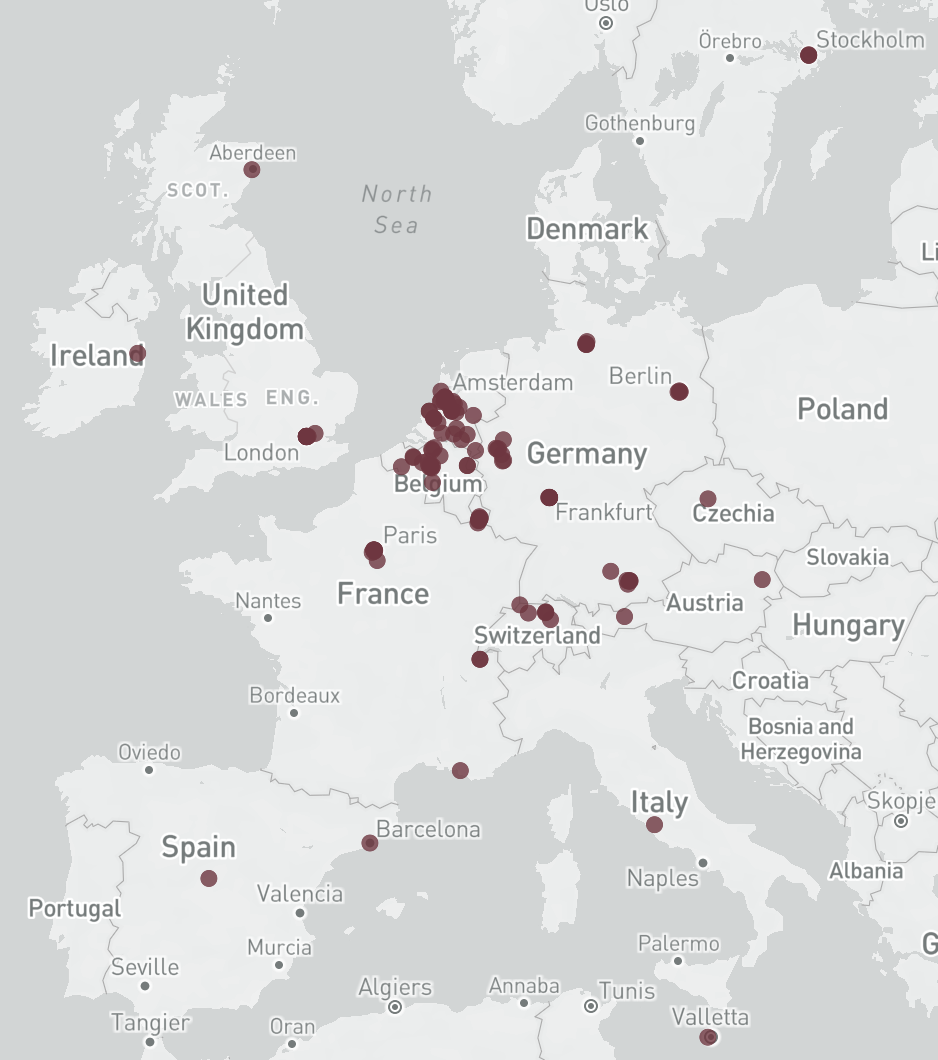

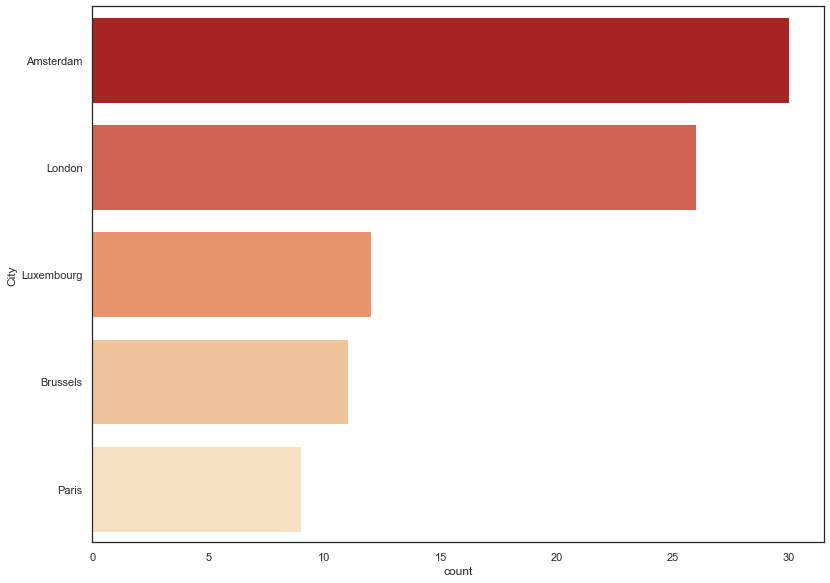

Where are investors located?

The Benelux Union is an association of the Western European countries Belgium, Netherlands, and Luxembourg. Correspondingly many domestic real estate investors are located in cities like Amsterdam, The Hague, Brussels, and Luxembourg. Multiple foreign investors, especially from other European countries like the neighbouring France and Germany are also active in the region.

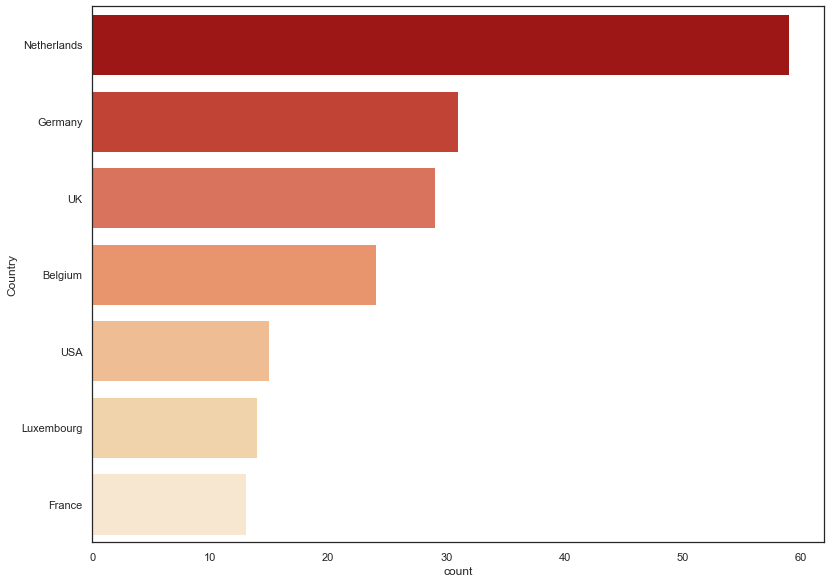

Countries of origin

Most real estate investors in Benelux come from the Netherlands. In addition, there are also many investors from the countries of Belgium and Luxembourg. But there are also many international investors active in Benelux, for example investors from Switzerland, the United Kingdom or the USA.

Benelux real estate market: highly promising

The Benelux Union was formed in 1944 and describes a Union between the neighbour states Belgium, Netherlands and Luxembourg. Today, Benelux is more commonly known for the geographical, economical und cultural grouping of named countries. The Benelux are an economically important region which is characterised by their high population density as well as their dynamic economic system. Even though the Benelux states only account for roughly 5.5% of the European Population, their contribution to the joint EU GDP is nearly 8%. This strong economy makes the Benelux an investment friendly environment: The Benelux accounted for 7.8% of all European investment volumes. Investments in office real estate are particularly promising, as the Benelux is expected to see overproportional growth in office-based work – 50% of investments in 2018 were in office real estate.

Covered asset classes: residential, office, retail, light industrial, etc.

The real estate market can be divided into different asset classes, which are characterised by very different structures and characteristics. The team of Research Germany knows that specialized investors operate in the individual segments. To help you easily identify the right real estate buyer for your project, our overview includes several columns that show all relevant asset classes. With just one click you can filter by investment companies that invest in residential real estate, office real estate, retail and shopping centers, logistics or light industrial real estate, hotels and vacation properties or care properties. The largest companies are often active in several segments, while smaller companies often focus on individual areas.

Any questions? Get in touch!

Leo Semmelmann, Founder

contact [at] researchgermany.com

+49 (0) 89 92927741

We are looking forward to help you in case of any questions, remarks and individual requests. Feel free to get in touch via email, live chat or phone. We can also offer you package prices and can create individual lists.

Includes institutional investors, investment managers, project developers, real estate companies, REITs and pension funds that actively acquire real estate in the Benelux Union. This list is based on our

Includes institutional investors, investment managers, project developers, real estate companies, REITs and pension funds that actively acquire real estate in the Benelux Union. This list is based on our

Alex Maron (verified owner) –

I have been looking for such a collection for a long time. With its information, the list fully meets my expectations.