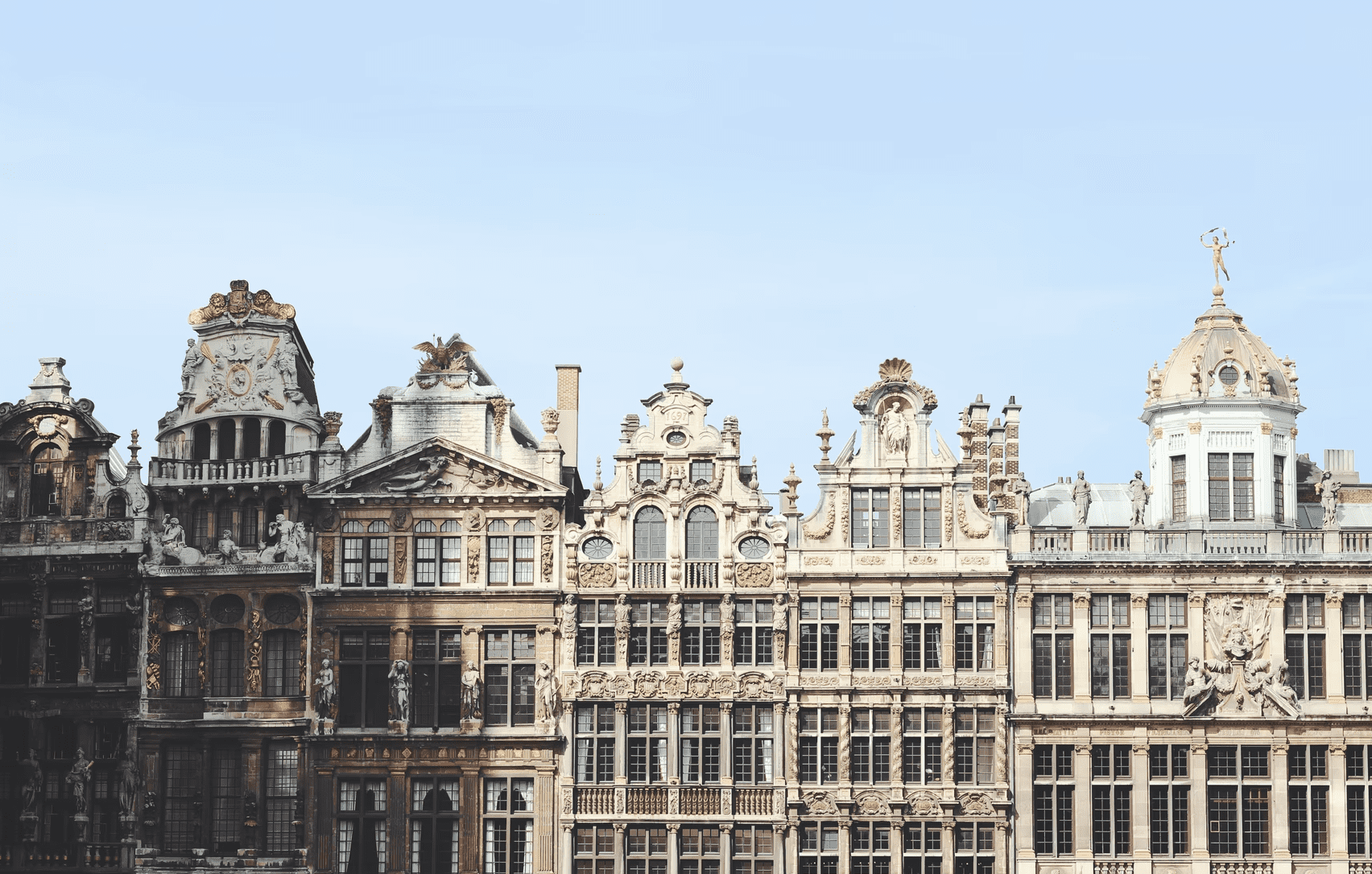

Brussels is the capital of Belgium and one of the seats of the European Parliament. The city has over 190,000 inhabitants and as part of the Benelux countries is an important and interesting location for real estate investors.

The real estate investors listed below are all part of our List of the 200 largest real estate investors in the Benelux Union

-

Rated 5.00 out of 5€349,99 Incl. VAT

- Includes institutional investors, investment managers, project developers, real estate companies, REITs and pension funds that actively acquire real estate in the Benelux Union.

- Excellent depth of detail: purchase profile (asset classes and regional focus), link to purchase profile and assets under management if available, contact details, management board, etc.

- Free preview available on request via contact [at] researchgermany.com or live chat.

1. AG real estate

AG real estate is the real estate investment company of AG Insurance. The company acts as a real estate investor as well as a project developer. AG real estate is active in Belgium, France, Luxembourg, and other European markets. The company’s real estate portfolio has a value of 6.8 billion euros and consists of direct investments in office, retail, residential and healthcare properties as well as parking management and indirect investments in real estate funds and club deals.

2. Fidentia Real Estate Investement

Fidentia is an independent real estate fund founded in 2006 that invests in sustainable and responsible real estate. The company invests primarily in individual properties and portfolios for institutional investors. The focus of the fund management is on green buildings and a value-add strategy. The firm has offices in Belgium and Luxembourg. An exemplary investment is Buzzcity in Luxembourg, acquired in 2019, with 16,810 square meters of space.

3. Eaglestone Services SA.

Eaglestone is a real estate investor and project developer founded in 2010 and active in Belgium, France, and Luxembourg. The company invests in residential, office, and retail properties, with 51% of its investments in residential, 45% in office, and 4% in retail. The portfolio has an asset value of 1.5 billion euros. In Belgium as well as in Luxembourg the company operates as Eaglestone and in France as Interconstruction Group. One exemplary investment is located at 74 Avenue Prince de Liège in Jambes and is an office property.

Picture Source: Marius Badstuber

-

€699,99 Incl. VAT

-

Rated 5.00 out of 5€349,99 Incl. VAT

-

€349,99 Incl. VAT

-

Rated 5.00 out of 5€599,99 Incl. VAT