Description

List of the 3 largest insurance companies in Germany

Insurance companies are among the most financially powerful players in the economic cycle and – in addition to their core competencies such as property insurance, life insurance or reinsurance – often have a wide range of other business activities. These include, for example, real estate and property or asset management. In the following, we present three examples from our extensive list in more detail.

1. Allianz SE, Munich

The insurance group has been operating on the market since 1890 and is now one of the global heavyweights in the industry. The company was founded in Berlin by Carl von Thieme, then director of the Munich Reinsurance Company, and Wilhelm von Finck, then co-owner of Merck Finck & Co. At the beginning of its more than 130-year history, the company offered accident and transport insurance – and only regionally at that – but has since developed into a global insurer and relevant asset manager. The company is characterized by its steady rise, but also takes a critical look at its role under National Socialism. In this context, CEO Oliver Bäte also emphasizes the importance of the past in shaping the future of Allianz. Over the course of time, the headquarters have moved from Berlin to Munich and the Allianz Arena at home has ensured that the company is known far beyond the borders of Bavaria. In 2022, total assets amounted to a whopping 1,022 billion euros and the Group employed over 159,000 people.

2. Munich Reinsurance Company Ltd, Munich

The reinsurance expert Munich Re started out in 1880 as a four-man operation and, as with Allianz, Carl Thieme played a key role in its foundation. The company’s focus was international right from the start, and this was and still is one of the key success factors of the company. Other important cornerstones are independence from primary insurers, broad risk diversification, efficient contract management, innovative insurance concepts and, of course, partnership-based cooperation with its customers. Today, the Group is one of the world’s leading risk carriers and is constantly competing with Swiss RE (Swiss Reinsurance Company) for the position of the world’s largest reinsurance company. With total assets of just under 300 billion euros and gross premiums written of around 67 billion euros in the same year (2022), Munich Re underpins its claim to the top spot.

3. Talanx AG, Hanover

The history of Talanx AG is closely interwoven with HDI – the Haftpflichtverband der Deutschen Industrie – and thus goes back to 1903. Although it is not possible to go into every detail of the history here, the first important milestone was exactly 50 years after the company was founded: This was when the company began to open up to private customers – and thus also to mass business. It was not until many years later (1998) that the company was finally renamed Talanx AG to avoid confusion with the HDI brand, and from the turn of the millennium the company expanded increasingly in Central and Eastern Europe, with start-ups, takeovers and cooperations in countries such as Bulgaria, Poland and Hungary. Today, the Hanover-based insurance group is also active in Latin America and, with total assets of around 193 billion euros (2022), is the third-largest insurer in Germany. Some of the best-known brands, including Hannover Re, are united under the Talanx umbrella.

This information is included in our database

- Company name

- General contact data (address, e-mail address, telephone number, URL)

- Name of the management

- Serial letter suitable for addressing the management (e.g. “Dear Dr. Müller”)

- Total assets and gross premiums written for the years 2020, 2019, 2018, 2017, 2016, 2015 (taken from the annual and consolidated financial statements)

- Employee figures for the years 2021, 2020, 2019, 2018 (taken from the annual and consolidated financial statements)

- Highlighting of direct insurance policies

- Field of activity

Note: If the sales and employee figures are not included in a company’s own financial statements but in the parent company’s consolidated financial statements, the data from the respective consolidated financial statements are provided.

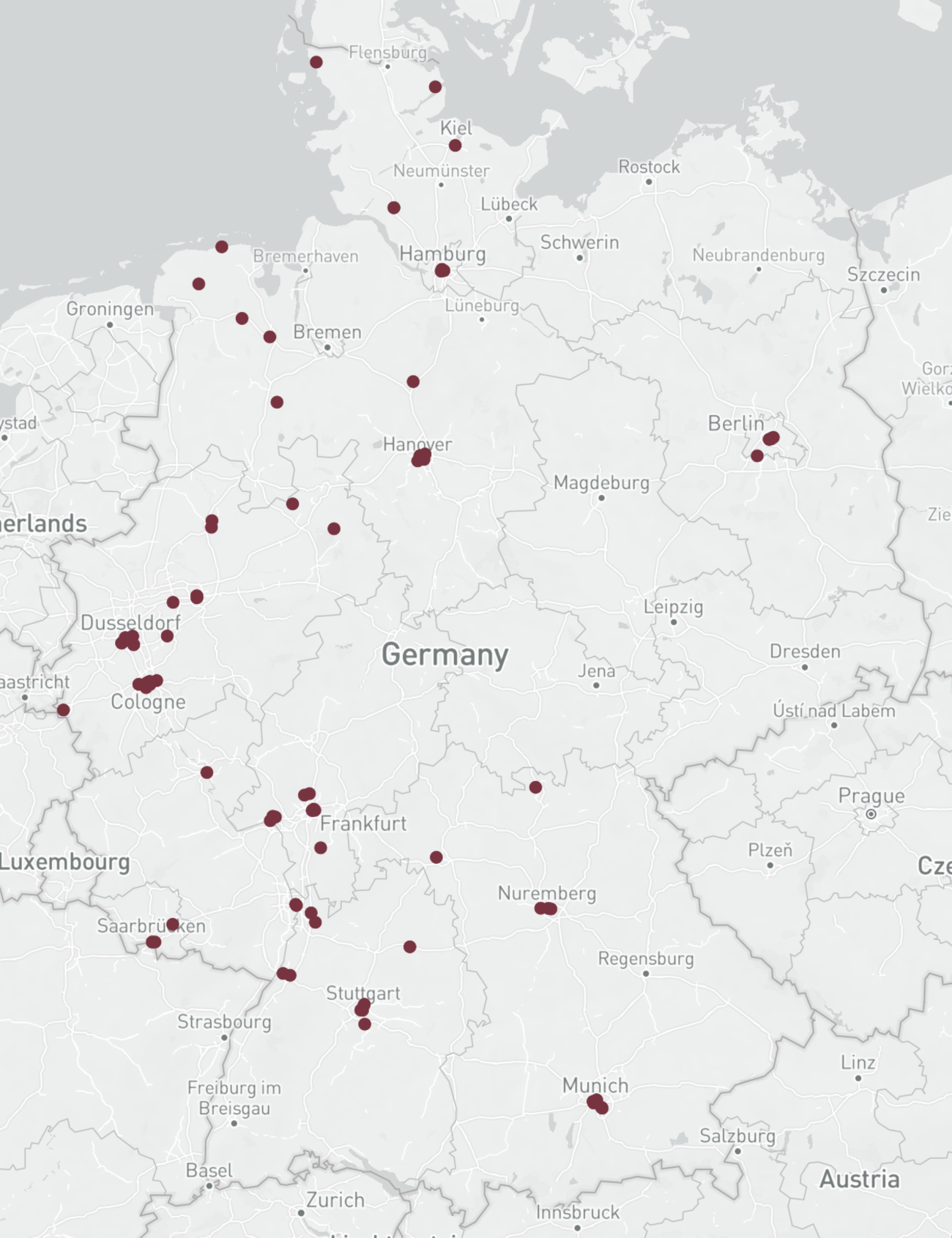

Map: Headquarters of insurance corporations

Assekurance sector as relevant real estate investors

The research team of ResearchGermany is specialized in the analysis of industries that are difficult to understand. Our industry and investor lists are particularly in demand in the real estate industry, which is characterized by a high degree of intransparency. In our online store we offer, for example, the list of the largest real estate investors in Germany or the list of the most important real estate investors in Europe. Our customers include brokers, investors, asset managers, consultants and other real estate professionals who use our databases to generate leads. The largest German insurance companies also play an important role here. Institutional investors not only invest in real estate funds, but also make some purchases on their own. Thus, you can use our list of the largest German insurance companies ideally to address potential buyers in the real estate sector.

Balance sums and gross premiums written

Many providers of address databases not only offer obsolete data, but also comparatively little information about the companies in the respective lists. The team of ResearchGermany attaches great importance to the fact that our databases provide real added value. In the case of the list of Germany’s largest insurance companies, this means that we have identified relevant KPIs from recent years. We have analyzed the annual balance sheet for the years 2015 to 2020 in order to be able to offer you both total assets and gross premiums written.

Picture source: Guilherme Rossi

Statistics based on our list

The ResearchGermany database of the German insurance industry covers all segments of the industry in the entire Federal Republic (property insurance, life insurance, health insurance, direct insurers, etc.) Thanks to the extensive data set, we are able to publish interesting statistics. In the following, we present the distribution of the insurance companies from our list by state and city in clearly arranged graphs. On request we are also able to prepare individual evaluations.

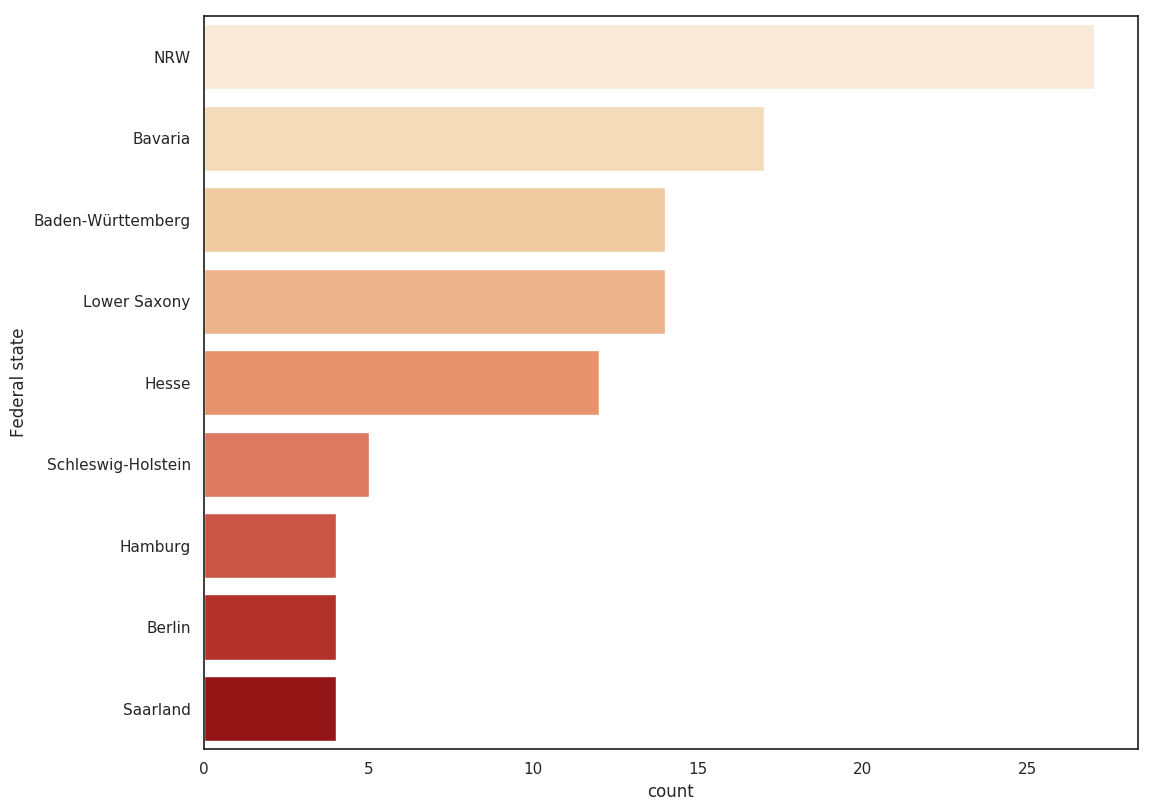

Distribution by federal state

North Rhine-Westphalia leads the German insurance industry in terms of the number of insurance companies headquartered in the federal state. Bavaria and Lower Saxony are in the following places, with this being mainly determined by the respective state capitals (see following graph).

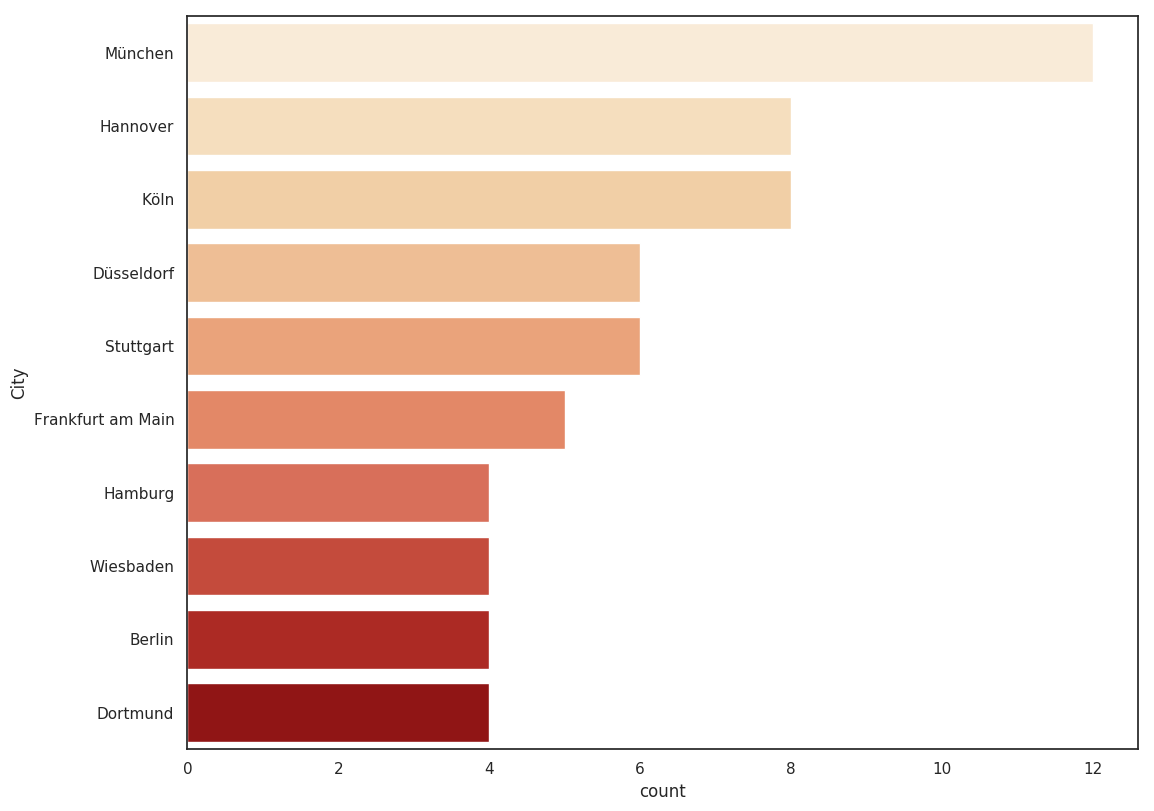

Distribution by city

The absolute number of insurance companies per city shows that the insurance industry is relatively evenly distributed across Germany. Only Munich is home to more than ten insurance companies and can therefore claim a leading role for itself. The detailed data in our list provides further interesting information regarding the geographical distribution.

The German insurance industry: Statistics and facts

The German insurance industry is an important branch of the service sector. According to the central association GdV, in 2019 German insurance companies employed a total of 209,200 people. In addition, there are 201,600 self-employed insurance agents and brokers. On average, each German citizen spends 2,450 euros on insurance per year.

The larger insurance companies are supervised by the Federal Financial Supervisory Authority (BaFin). These are 85 life insurers, 46 health insurers, 199 property and accident insurers and 29 reinsurers. They share about 90 percent of the German insurance market. On a regional level, there are also a few hundred smaller insurance companies. The insurance industry also includes institutions for company pension schemes (136 pension funds and 33 pension funds) and 33 death funds. In addition, various foreign providers are active in the German market.

This picture of great diversity and number is put into perspective when one considers that many insurers are subsidiaries of larger insurance groups. The major players in the market operate as universal insurers. This means that they cover the entire range of insurance business through subsidiaries. By far the German market leader is the Allianz Group, one of the world’s largest insurers, followed by the Munich Re Group, which also stands for the world’s largest reinsurance business. In third to fifth place are Talanx, R+V Versicherung and Generali Deutschland. The largest private health insurer is Debeka.

Any questions? Get in touch!

Leo Semmelmann, Founder

contact [at] researchgermany.com

+49 (0) 89 92927741

We are looking forward to help you in case of any questions, remarks and individual requests. Feel free to get in touch via email, live chat or phone. We can also offer you package prices and can create individual lists.

Contains the 100 largest insurance companies from Germany from various sectors such as life insurance, property insurance, annuity insurance, health insurance, reinsurance. The list is an excerpt from our

Contains the 100 largest insurance companies from Germany from various sectors such as life insurance, property insurance, annuity insurance, health insurance, reinsurance. The list is an excerpt from our

Martin Richard (verified owner) –

Great product with many valuable entries