Description

List of 3 large life science real estate investors in Europe

The “life science” asset class, which includes laboratory and research buildings, is becoming increasingly popular. More and more investors are including laboratory real estate in their investment profiles. Below we present three leading European investors in life science properties.

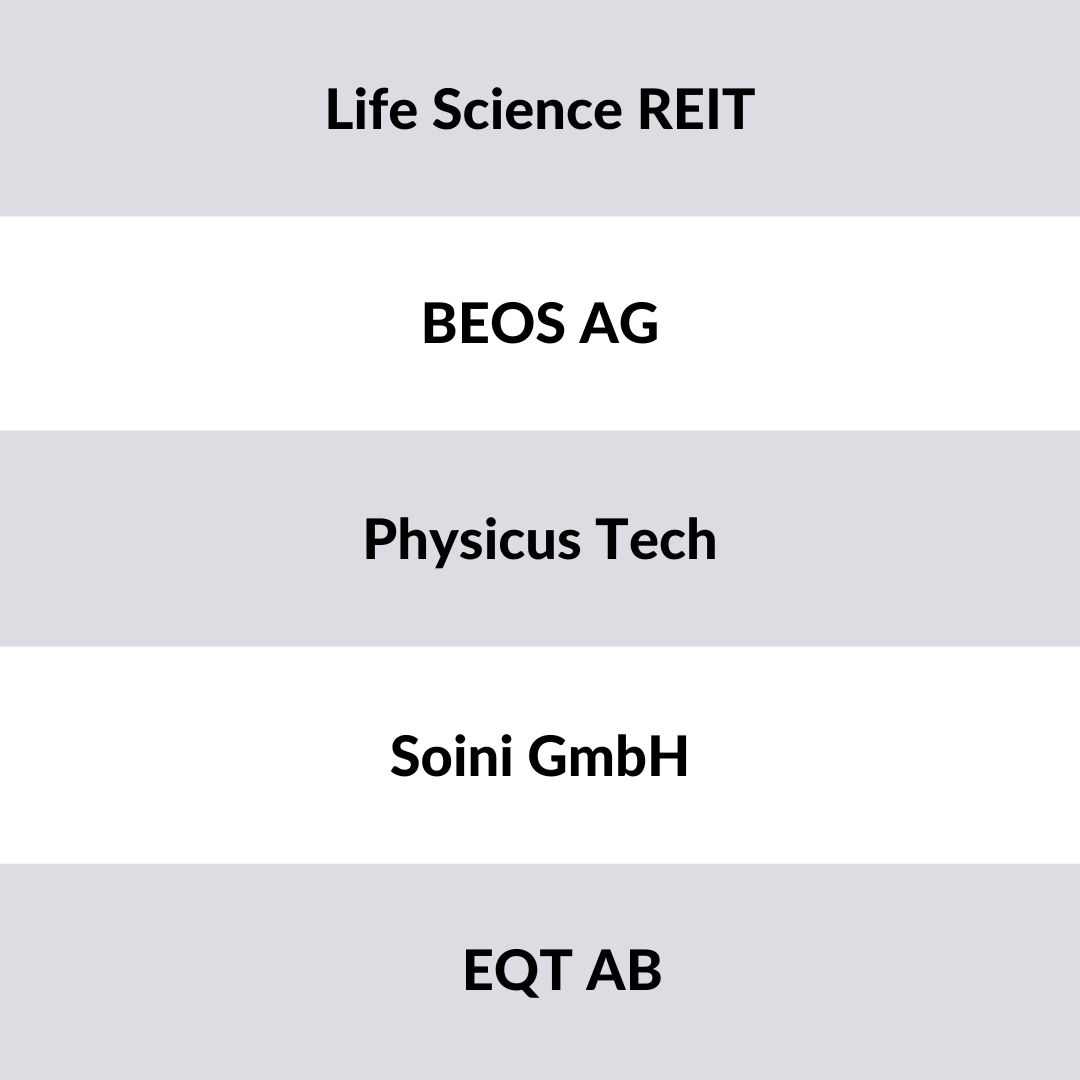

1. Life Science REIT (UK)

The London-based Life Science REIT focuses on life science buildings in the UK. The investment vehicle comprises 6 buildings with a valuation of over GBP380M. Portfolio properties are located in Cambridge, Oxford and London. Examples of tenants include the Novartis subsidiary Gyroscope and Nanna Therapeutics.

Update 2024: Life Science REIT has recently finalized the sale of the Lumen House (Oxford) asset to Harwell Science and Innovation Campus for £7.65 million. The sale price represents a net initial yield of 5.6%.

2. BEOS AG (Germany)

Berlin-based BEOS AG, a subsidiary of Swiss Life Asset Managers, has proven with a recent investment that it is one of the top investors in life science real estate in Europe. A property in Berlin was acquired from SCIENION GmbH for €21M in a sale-and-lease-back transaction. The property comprises office, laboratory and warehouse space. BEOS also owns other life science properties in the Adlershof Technology Park.

3. Physicus Tech (Netherlands)

Physicus is an Amsterdam-based investment manager specializing in life science real estate. The vehicle was created as a joint venture between TPG Real Estate and Base Investments. Portfolio properties are located in the Netherlands, Belgium and Germany. An exemplary portfolio property is the “Beagle” property in Leiden, which offers combined laboratory and office space.

Picture source: Sieuwert Otterloo via Unsplash (11.07.2023).

Focus on investors for laboratory properties and research buildings

The coronavirus pandemic has shown that healthcare is a growing economic factor. At the same time, demographic change, which is accompanied by an ageing population, is driving innovation in this sector as a whole. There is also a worldwide increase in lifestyle diseases. There are therefore positive long-term earnings prospects for life science companies as and when healthcare expenditure increases. The overall trend in the market is bound to have an impact on real estate marketing. In addition, the yields in the asset class appear promising – according to Cushman & Wakefield, there is a net prime yield of 4 to 4.5 percent for so-called lab offices in Germany, based on the top cities of Berlin, Düsseldorf, Frankfurt, Hamburg and Munich. This “German” development could also increasingly take shape in Europe with countless MedTech cities and specialized biopharma companies.

Picture source: Yassine Khalfalli via Unsplash (11.07.2023)

These investor types are included in the list:

- Investment managers

- Real estate companies

- Project developers with portfolio acquisition

- Private equity investors

- REITs

- Pension funds

- Foundations

These property types are purchased:

- Laboratory real estate

- Research buildings

- Life science properties

- LabOffices

Investors in the list are interested in:

- Core Real Estate

- Value add real estate

- Sales-and-Leaseback

- Trophy real estate

- Distressed Assets

- Project developments and forward deals

Included columns in our directory

- Company data (name, legal form, country of origin)

- Contact details (address, URL, e-mail, telephone number, management)

- Form of address of the management suitable for serial letters (e.g. “Dear Dr. Müller”)

- Investor type (investment manager, REIT, pension fund, private equity, etc.)

- Investment focus (asset classes, ranking from A to E, (global) investment volume / assets under management, detailed geographical focus)

- Special investment focus (debt, parking, forward deals, etc.)

- Link to the acquisition profile of the companies and contact details of an acquisition manager (if indicated on the investors’ website)

Any questions? Get in touch!

Leo Semmelmann, Founder

contact [at] researchgermany.com

+49 (0) 89 92927741

We are looking forward to help you in case of any questions, remarks and individual requests. Feel free to get in touch via email, live chat or phone. We can also offer you package prices and can create individual lists.

Includes institutional investors, investment managers, project developers, real estate companies, REITs and pension funds that actively acquire life science real estate in Europe. This list is based on our

Includes institutional investors, investment managers, project developers, real estate companies, REITs and pension funds that actively acquire life science real estate in Europe. This list is based on our

Reviews

There are no reviews yet.